Introduction

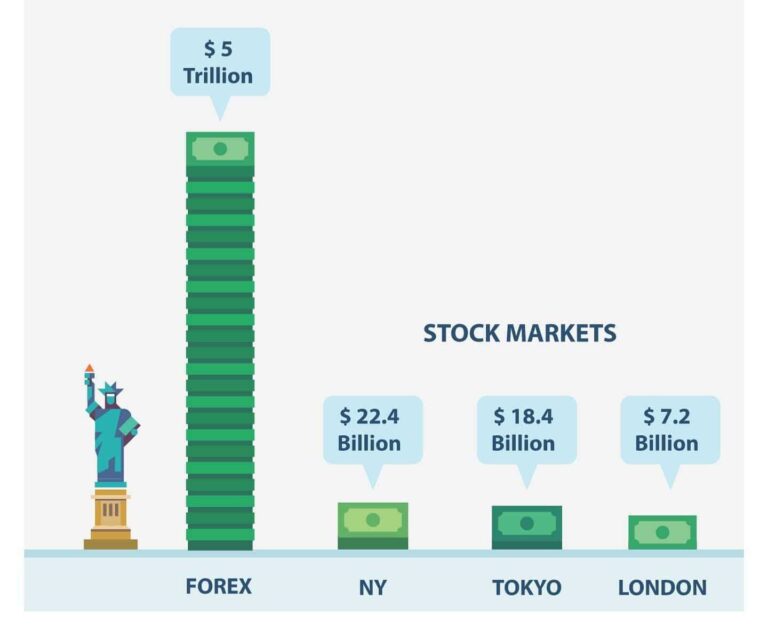

The foreign exchange market, or forex, is the largest financial market globally, with daily trading volumes exceeding $5 trillion. It offers a vast array of opportunities for traders of all levels. If you’re considering entering the forex market, this comprehensive guide will provide you with the essential knowledge and steps to get started.

Understanding the Forex Market

Before diving into trading, it’s crucial to grasp the fundamental concepts of the forex market:

- Currency Pairs: Forex trading involves the simultaneous buying and selling of different currencies. These are typically represented as currency pairs, such as EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), or USD/JPY (US Dollar/Japanese Yen).

- Bid and Ask Prices: When you want to buy a currency pair, you pay the ask price. When you want to sell, you receive the bid price. The difference between these prices is known as the spread.

- Leverage: Forex brokers often offer leverage, which allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses.

- Pips: A pip (percentage in point) is the smallest unit of measurement in forex trading. It’s typically the last decimal place in a currency pair. For example, a pip in EUR/USD is 0.0001.

- Long and Short Positions: A long position is when you buy a currency pair with the expectation that its value will increase. A short position is when you sell a currency pair with the expectation that its value will decrease.

Choosing a Forex Broker

Selecting a reputable forex broker is essential for a successful trading experience. Consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable financial authority. This provides a layer of protection for your funds.

- Trading Platforms: Evaluate the user-friendliness, features, and performance of the broker’s trading platform.

- Spreads and Commissions: Compare the fees charged by different brokers. Lower spreads and commissions can significantly impact your profitability.

- Customer Support: Look for a broker that offers reliable and responsive customer support.

- Educational Resources: Some brokers provide valuable educational materials, such as webinars, tutorials, and market analysis.

Developing a Trading Plan

A well-defined trading plan is crucial for success in the forex market. Your plan should include:

- Risk Management: Establish clear risk management strategies, such as stop-loss orders and position sizing, to protect your capital.

- Trading Strategy: Determine your preferred trading style (e.g., day trading, swing trading, position trading) and develop a strategy that aligns with your goals and risk tolerance.

- Entry and Exit Criteria: Define specific rules for entering and exiting trades based on technical and/or fundamental analysis.

- Record Keeping: Maintain a trading journal to track your performance, identify areas for improvement, and learn from your mistakes.

Essential Tools and Resources

To succeed in forex trading, you’ll need the right tools and resources:

- Trading Platform: A reliable trading platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), is essential for executing trades and analyzing market data.

- Economic Calendar: Stay informed about important economic events that can influence currency prices.

- Charting Software: Use charting software to visualize price movements, identify patterns, and apply technical indicators.

- Fundamental Analysis Tools: Access financial news, economic data, and central bank statements to assess market sentiment and economic conditions.

Learning and Education

Continuous learning is vital for forex trading. Consider the following options:

- Online Courses: Enroll in online courses or tutorials to gain a deeper understanding of forex concepts and strategies.

- Books: Read books written by experienced traders to learn from their insights and experiences.

- Webinars and Seminars: Attend webinars and seminars hosted by brokers, financial institutions, or industry experts.

- Practice Account: Use a practice account to test your strategies and gain hands-on experience without risking real money.

Risk Management

Effective risk management is paramount in forex trading. Here are some key strategies:

- Stop-Loss Orders: Set stop-loss orders to automatically close a position when the price reaches a predetermined level, limiting potential losses.

- Take-Profit Orders: Use take-profit orders to secure profits when a trade reaches a target price.

- Position Sizing: Determine the appropriate size for each trade based on your risk tolerance and account balance.

- Diversification: Spread your trades across multiple currency pairs to reduce risk.

- Emotional Control: Avoid making impulsive decisions driven by emotions. Stick to your trading plan and maintain discipline.

Conclusion

Starting your forex trading journey requires careful planning, education, and a commitment to continuous learning. By understanding the fundamentals, developing a sound trading plan, and managing risk effectively, you can increase your chances of success in this dynamic market. Remember, forex trading involves risks, and there’s no guarantee of profits.