Algorithmic cryptocurrency trading, also known as “algo-trading,” is a method where traders use pre-programmed software to execute trades based on predefined criteria, market conditions, or technical indicators. This trading approach allows for automated, fast, and often more efficient trades compared to manual methods. Given the volatility and 24/7 nature of cryptocurrency markets, algorithmic trading has become particularly popular among both professional and retail traders.

In this article, we’ll explore the basics of algorithmic cryptocurrency trading, the steps to develop and implement a trading algorithm, common strategies, and the tools necessary for success.

What is Algorithmic Trading?

Algorithmic trading involves the use of computer programs and algorithms to automate the trading process. Instead of manually placing orders on an exchange, an algorithm can execute trades based on predefined rules, such as price, volume, or other technical indicators. These algorithms can monitor market conditions, analyze vast amounts of data, and execute trades at high speeds, often leading to better opportunities and minimized human error.

Algorithmic trading in cryptocurrency markets is especially advantageous due to the market’s 24-hour availability, extreme volatility, and the need for quick decision-making.

Key Components of Algorithmic Trading

Before diving into the development and implementation process, it’s essential to understand the fundamental components of algorithmic trading systems:

- Data Feed: Reliable access to market data, including price movements, order books, trading volumes, and historical data, is crucial for an algorithm to make informed decisions. High-quality data feeds ensure that your algorithm can react quickly and accurately to changes in market conditions.

- Trading Strategy: The core of any algorithmic trading system is the strategy it follows. A trading strategy consists of rules that define when to buy, sell, or hold an asset. These rules are usually based on technical indicators, market trends, or arbitrage opportunities.

- Execution: Once a trade decision is made, the algorithm must execute the trade efficiently and at the best possible price. Execution involves interacting with exchanges via APIs to place buy/sell orders automatically.

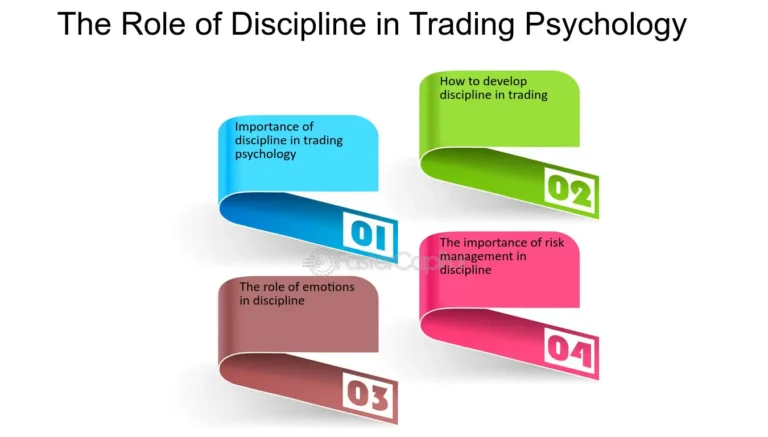

- Risk Management: Risk management ensures that the algorithm doesn’t expose the trader to excessive risk, whether through stop-loss orders, position sizing, or portfolio diversification. Proper risk management protects against potential large losses due to market volatility or unforeseen events.

- Backtesting: Before deploying a trading algorithm, it’s important to test its effectiveness on historical data. Backtesting allows you to see how the strategy would have performed in the past and helps identify potential flaws or areas for improvement.

- Monitoring and Optimization: Once the algorithm is live, continuous monitoring is required to ensure it’s functioning as expected. Additionally, optimization may be needed as market conditions change or new data becomes available.

Steps to Develop and Implement a Trading Algorithm

1. Define Your Trading Strategy

The first step in developing a trading algorithm is to decide on a strategy. Your strategy should be based on market analysis, and it should outline specific rules for entering and exiting trades. Some common types of strategies include:

- Market-making: Involves placing buy and sell orders at both sides of the order book to capture the spread between bid and ask prices. The goal is to profit from small price fluctuations by providing liquidity to the market.

- Arbitrage: Exploits price differences between different exchanges or markets by simultaneously buying low on one platform and selling high on another.

- Trend-following: Based on the idea that “the trend is your friend,” this strategy follows the momentum of the market. If the price is rising, the algorithm buys, and if the price is falling, it sells.

- Mean reversion: Assumes that prices will eventually revert to their mean or average over time. When prices deviate significantly from the mean, the algorithm executes trades expecting a reversion.

- High-frequency trading (HFT): Executes thousands of trades within seconds, aiming to profit from very short-term price fluctuations. This approach requires ultra-fast execution and is used primarily by institutional traders.

Once you’ve chosen a strategy, clearly define the rules that the algorithm will follow. For example, a trend-following strategy might buy when the 50-day moving average crosses above the 200-day moving average (a common bullish signal) and sell when the reverse occurs.

2. Choose a Programming Language and Platform

To build your trading algorithm, you’ll need to choose a programming language and a development platform. Some popular languages for algorithmic trading include:

- Python: Python is one of the most widely used languages for algorithmic trading due to its simplicity and the availability of numerous financial libraries. Libraries such as

pandas(for data analysis),NumPy(for mathematical operations), andTA-Lib(for technical analysis) make it easy to implement complex strategies. - C++: Known for its speed, C++ is often used for high-frequency trading algorithms where latency and execution speed are critical.

- JavaScript: While not as common as Python or C++, JavaScript can be used to build web-based trading bots or integrate with exchange APIs.

- Java: Java is robust and has good performance, making it suitable for building scalable trading systems.

Several platforms and tools can also simplify the development process. These include:

- QuantConnect: A cloud-based platform that allows you to write, test, and deploy algorithmic trading strategies in Python and C#. It provides access to historical data and integrates with multiple exchanges.

- Trality: A platform that offers a code editor and drag-and-drop bot creation, designed for traders who want to build and deploy algorithms without extensive coding knowledge.

- MetaTrader: Popular in forex and traditional asset markets, MetaTrader also supports algorithmic trading for cryptocurrencies. It allows for the development of automated trading bots (Expert Advisors) using MQL5 (its proprietary language).

3. Obtain Market Data

Market data is the lifeblood of any algorithmic trading system. Reliable and timely access to data is essential for accurate trade execution. You’ll need two types of data:

- Historical Data: For backtesting your strategy and assessing how it would have performed in the past.

- Real-Time Data: For executing trades based on current market conditions.

Most exchanges provide APIs that allow traders to access both historical and real-time data. Popular cryptocurrency exchanges such as Binance, Coinbase Pro, and Kraken offer APIs that you can integrate with your trading algorithm to receive market data and execute trades.

4. Implement the Algorithm

With your strategy and platform in place, the next step is to code the algorithm. Depending on the strategy, your algorithm may:

- Monitor price movements or technical indicators.

- Execute trades when predefined conditions are met (e.g., when the price breaks a certain resistance level).

- Use APIs to communicate with the exchange, submitting buy and sell orders automatically.

It’s important to ensure that the code is optimized for performance, especially in high-frequency trading scenarios where speed is crucial. For example, algorithms used for market-making or arbitrage must be able to respond to market changes in milliseconds.

5. Backtest the Algorithm

Backtesting is a crucial step in the development process, allowing you to test your algorithm on historical data to assess its performance. This helps you understand how the strategy would have performed in different market conditions and allows you to fine-tune the rules to optimize results.

When backtesting, you should pay attention to:

- Profitability: Does the strategy generate consistent profits over time?

- Drawdown: What is the maximum loss experienced during a bad trading period? A high drawdown can signal that the strategy carries too much risk.

- Transaction Costs: Consider the impact of transaction fees on your strategy, especially if it involves frequent trading.

- Slippage: Slippage occurs when the price at which an order is executed differs from the expected price due to market volatility. This can significantly affect your algorithm’s profitability, particularly in fast-moving markets.

6. Implement Risk Management

Risk management is essential to protect your portfolio from excessive losses. Some key risk management techniques include:

- Stop-Loss Orders: These orders automatically sell an asset when its price drops below a certain threshold, limiting your potential losses.

- Position Sizing: Limiting the size of each trade based on a percentage of your total capital can help reduce risk. For example, a 1% risk rule means that no single trade can lose more than 1% of your total portfolio value.

- Diversification: Trading multiple cryptocurrencies or assets can spread risk across your portfolio, reducing the impact of a significant loss in one market.

7. Deploy the Algorithm

Once your algorithm has been backtested and optimized, the next step is to deploy it in a live trading environment. It’s advisable to start with a small portion of your capital to ensure the algorithm performs well in real-world conditions before scaling up.

Most platforms allow you to deploy your algorithm in a “paper trading” or demo mode, where it executes trades with virtual money. This allows you to test how it reacts to real-time data without risking actual capital.

8. Monitor and Optimize the Algorithm

Even after your algorithm is live, continuous monitoring is necessary to ensure it’s working as expected. Market conditions can change, and what worked in the past may not always be effective in the future. Regularly review the algorithm’s performance and make adjustments as needed to keep it profitable.

Common Algorithmic Trading Strategies

Here are some of the most popular algorithmic trading strategies in cryptocurrency markets:

- Momentum Trading: This strategy follows trends, buying into assets when prices are rising and selling when they begin to fall. Momentum traders use technical indicators such as moving averages and the Relative Strength Index (RSI) to identify potential trends.

- Mean Reversion: This strategy assumes that prices will revert to their mean over time. When an asset is significantly above or below its average price, the algorithm initiates a trade expecting the price to revert to its historical average.

- Arbitrage: Arbitrage strategies take advantage of price differences between different exchanges or markets. The algorithm buys an asset on the exchange where it is cheaper and simultaneously sells it on the exchange where it is more expensive, capturing the price difference.

- Market Making: Market makers provide liquidity to the market by placing buy and sell orders around the current market price. They profit from the spread between the bid and ask prices.

- Statistical Arbitrage: This involves trading based on statistical models that identify asset price deviations from historical patterns. Pairs trading is a common form of statistical arbitrage, where two correlated assets are traded against each other.

Conclusion

Algorithmic cryptocurrency trading offers numerous benefits, including the ability to execute trades faster, reduce human error, and take advantage of complex market conditions. Developing and implementing a trading algorithm requires a combination of programming skills, market knowledge, and careful planning. By following a structured approach—defining a strategy, backtesting, implementing risk management, and optimizing based on performance—traders can build robust algorithms that thrive in the fast-paced world of cryptocurrency trading.

However, while algorithmic trading can be profitable, it also carries risks. Continuous monitoring and adaptation to market conditions are key to maintaining long-term success.