Introduction

Forex trading presents exciting opportunities for profit but also significant challenges, especially for beginners. New traders often grapple with emotions that can cloud their judgment and lead to costly mistakes. This article explores the most common mistakes made by novice Forex traders and emphasizes the importance of emotion control in developing a successful trading strategy.

Understanding Forex Trading

What is Forex Trading?

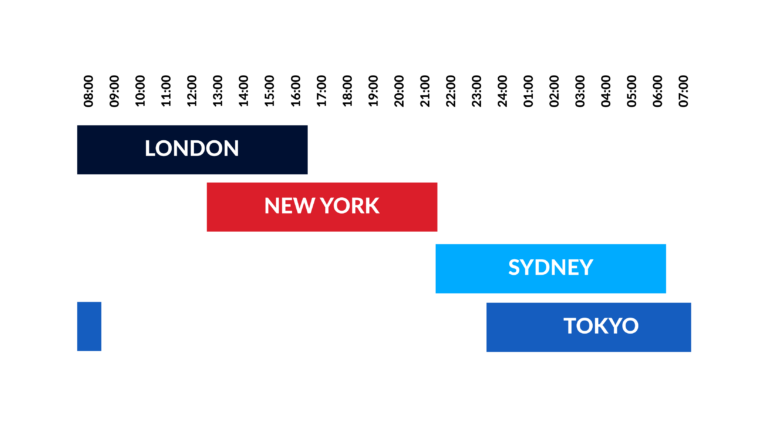

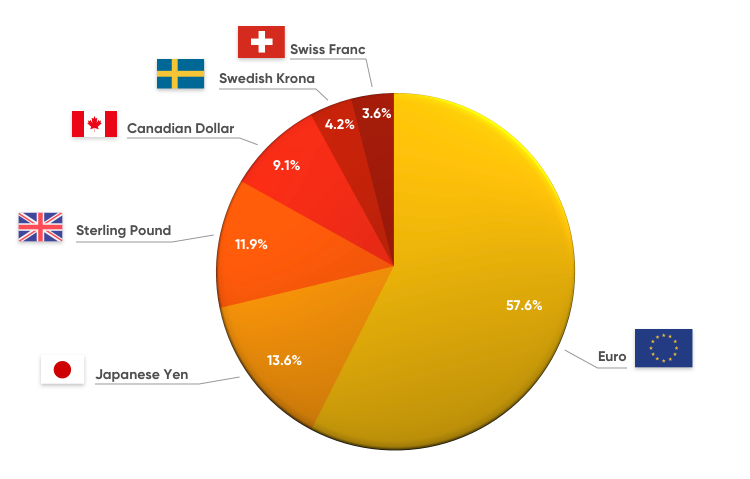

The Forex market, or foreign exchange market, is the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. It involves the exchange of currencies, where traders speculate on the price movements of currency pairs, such as EUR/USD or GBP/JPY.

The Role of Emotions in Trading

Trading is not merely a mathematical exercise; it is deeply psychological. Emotions like fear, greed, and hope can significantly impact decision-making. A solid grasp of these emotions and how they influence trading behavior is essential for long-term success in Forex.

Common Mistakes Made by Beginner Forex Traders

1. Lack of a Trading Plan

The Mistake

One of the most significant mistakes that beginner Forex traders make is entering the market without a well-defined trading plan. A trading plan outlines your strategy, including entry and exit points, risk management rules, and profit targets.

The Emotional Impact

Without a trading plan, traders often rely on impulse, which can lead to emotional decision-making. This can result in overtrading, revenge trading after losses, or failing to stick to a profitable strategy.

How to Avoid It

- Develop a Comprehensive Trading Plan: Outline your strategy, including your goals, risk tolerance, and trading style. Your plan should be a living document that you adjust as you gain experience.

- Backtest Your Strategy: Use historical data to test your trading strategy and refine it based on the results. This can build confidence and help you adhere to your plan.

2. Overleveraging

The Mistake

Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases risk. Many beginners misuse leverage, leading to significant losses.

The Emotional Impact

Overleveraging can lead to a false sense of security, encouraging traders to take risks they wouldn’t normally take. When losses occur, the emotional toll can lead to panic selling or chasing losses.

How to Avoid It

- Understand Leverage: Learn how leverage works and its implications on your trading. Use leverage conservatively, keeping in mind that higher leverage increases risk.

- Set Leverage Limits: Determine the maximum leverage you will use and stick to it, regardless of market conditions.

3. Ignoring Risk Management

The Mistake

Many beginner traders overlook the importance of risk management. They might take larger positions than their account can handle or fail to set stop-loss orders, exposing themselves to substantial losses.

The Emotional Impact

Ignoring risk management can lead to emotional turmoil during losing trades. As losses accumulate, fear can cause traders to make irrational decisions, further exacerbating their financial situation.

How to Avoid It

- Implement Stop-Loss Orders: Always use stop-loss orders to protect your capital. This ensures that you exit a losing trade before it erodes a significant portion of your account.

- Risk Only a Small Percentage: A common rule is to risk no more than 1-2% of your trading capital on a single trade. This limits potential losses and helps maintain emotional stability.

4. Trading Based on Emotions

The Mistake

New traders often let emotions drive their trading decisions. Fear of missing out (FOMO), anxiety after losses, or overconfidence after a win can lead to impulsive actions.

The Emotional Impact

Emotional trading can create a cycle of losses, leading to frustration and a desire to “get even” by taking riskier trades. This can escalate emotional stress and result in further poor decision-making.

How to Avoid It

- Practice Mindfulness: Take time to reflect on your emotions before making a trade. Consider whether your decisions are based on analysis or emotional impulses.

- Create a Trading Journal: Document your trades, including your emotions during each decision. Analyzing your emotions can help you identify patterns and make more rational choices.

5. Lack of Patience and Discipline

The Mistake

Many beginner Forex traders lack patience and discipline. They expect quick profits and become frustrated when trades don’t go their way immediately.

The Emotional Impact

The desire for instant gratification can lead traders to deviate from their trading plans, chase losses, or overtrade. This often results in emotional exhaustion and a significant erosion of capital.

How to Avoid It

- Set Realistic Expectations: Understand that Forex trading is not a get-rich-quick scheme. Set achievable goals and be prepared for setbacks.

- Stick to Your Trading Plan: Maintain discipline by following your trading plan, even in challenging market conditions. Remind yourself that trading is a long-term endeavor.

6. Neglecting Market Analysis

The Mistake

Some beginners dive into trades without sufficient analysis of market conditions. They might follow trends blindly or rely solely on tips from others without doing their research.

The Emotional Impact

Neglecting analysis can lead to a false sense of confidence, making traders more susceptible to emotional reactions when the market turns against them. This can cause them to panic and exit positions prematurely.

How to Avoid It

- Conduct Thorough Analysis: Utilize both technical and fundamental analysis to inform your trading decisions. Understand market trends, news events, and economic indicators that can influence currency prices.

- Stay Informed: Follow financial news and updates related to the Forex market. Keeping yourself informed can help reduce anxiety during trading.

7. Revenge Trading

The Mistake

After experiencing a loss, many traders fall into the trap of revenge trading, where they make impulsive trades to try and recover their losses quickly. This often leads to further losses.

The Emotional Impact

Revenge trading is typically driven by emotions such as frustration and anger. This emotional turmoil can cloud judgment, resulting in more significant losses.

How to Avoid It

- Take a Break: After a losing trade, take a step back from the market. Allow yourself time to cool off before re-entering, reducing the risk of emotional decision-making.

- Reflect on the Loss: Analyze what went wrong in the losing trade. Understanding your mistakes can provide valuable lessons for future trading.

8. Overtrading

The Mistake

Beginners often trade too frequently, seeking to capitalize on every market movement. This can lead to increased transaction costs and emotional fatigue.

The Emotional Impact

Overtrading is often a result of impatience and the desire to recover losses. This can lead to burnout and a deterioration of trading discipline.

How to Avoid It

- Set Trade Limits: Establish a maximum number of trades you will make in a day or week. This can help you focus on quality over quantity.

- Wait for High-Probability Trades: Be selective about the trades you take. Look for setups that align with your trading plan and offer a favorable risk-to-reward ratio.

9. Ignoring the Bigger Picture

The Mistake

Some traders focus too narrowly on short-term price movements, ignoring broader market trends and economic factors that influence currency prices.

The Emotional Impact

This narrow focus can lead to frustration and confusion when trades don’t go as expected. Emotional responses may result in erratic trading behavior.

How to Avoid It

- Keep an Economic Calendar: Stay informed about important economic events, such as interest rate decisions and economic reports, that can impact currency values.

- Adopt a Holistic Approach: Consider both short-term and long-term trends when making trading decisions. This broader perspective can help you make more informed choices.

10. Failing to Adapt

The Mistake

Markets are constantly changing, and strategies that work in one environment may not work in another. Beginners often fail to adapt to changing market conditions.

The Emotional Impact

Inflexibility can lead to frustration when trades don’t perform as expected. Emotional resistance to changing strategies can result in significant losses.

How to Avoid It

- Review and Adjust Your Strategy: Regularly analyze your trading performance and adapt your strategies based on market conditions. Be willing to learn and evolve as a trader.

- Stay Open to Feedback: Seek feedback from more experienced traders or mentors. Constructive criticism can provide valuable insights for improvement.

Conclusion

Forex trading offers significant opportunities for profit, but it also presents numerous challenges, particularly for beginners. The most common mistakes made by novice traders often stem from emotional decision-making, which can lead to substantial financial losses.

To achieve success in Forex trading, it’s essential to develop a comprehensive trading plan, practice effective risk management, and maintain discipline and patience. By acknowledging the role of emotions in trading and implementing strategies to control them, traders can make more rational decisions and improve their chances of long-term success.

Continuous education, self-reflection, and a willingness to adapt are critical components of a successful trading journey. As you navigate the Forex market, remember that emotional control is just as important as technical skills, and it can be the difference between success and failure.