The cryptocurrency market, known for its high volatility and unpredictability, can be a mental battleground for traders. While technical analysis, fundamental research, and strategy are crucial for success, one of the most overlooked aspects of trading is psychology. The ability to master emotional discipline can make or break a trader’s career.

Trading psychology refers to the emotional and mental state that influences trading decisions. Unlike traditional assets, the crypto market operates 24/7, amplifying emotions like fear and greed, which can lead to impulsive decisions. In this article, we will explore the key elements of trade psychology, the most common emotional challenges faced by traders, and strategies for mastering emotional discipline.

The Role of Psychology in Cryptocurrency Trading

Trading is often seen as a logical endeavor based on charts, numbers, and analysis. However, human psychology plays a significant role in decision-making. Every trader faces emotions like fear, greed, excitement, and anxiety, which can cause deviations from a planned strategy.

Emotional trading often leads to poor decisions, such as chasing price pumps, panic selling during dips, or holding onto losses in the hope of a market reversal. Mastering the mental game of trading is just as important as mastering technical or fundamental analysis.

Cryptocurrency markets are particularly prone to psychological influence because of the following factors:

- High volatility: Prices can swing drastically in minutes, triggering emotional responses.

- 24/7 market: The constant availability of markets makes it harder to step away, leading to emotional exhaustion.

- Lack of regulation: The relative lack of regulation and security concerns adds a layer of fear and uncertainty.

- News cycles and social media hype: Crypto markets are heavily influenced by online communities, where hype and fear can drive price movements irrationally.

Common Emotional Challenges in Cryptocurrency Trading

Traders face several emotional hurdles that can cloud judgment and lead to mistakes. Recognizing these emotional traps is the first step to overcoming them.

1. Fear of Missing Out (FOMO)

One of the most common emotional pitfalls is the fear of missing out. FOMO occurs when a trader sees a rapid price increase and feels pressured to jump in to avoid missing a potential profit. This often leads to buying at inflated prices, driven by market euphoria rather than sound analysis.

Example: A cryptocurrency sees a 20% price increase within hours due to a favorable news announcement. Social media is flooded with excitement, and traders jump in without researching the underlying reasons for the price surge. In many cases, this leads to buying near the top, followed by a sharp correction.

2. Fear, Uncertainty, and Doubt (FUD)

On the flip side, FUD is another psychological trap. When negative news spreads, traders often panic and sell their holdings in a rush, fearing further losses. While some news events may be legitimate causes for concern, many are exaggerated or based on rumors, leading to impulsive decisions.

Example: A tweet or media report suggesting that a government might ban cryptocurrencies often causes panic selling. This can lead to sharp price drops, even if the actual event never happens or turns out to be inconsequential.

3. Overconfidence

After a series of successful trades, traders can become overconfident in their abilities. This overconfidence can lead to increased risk-taking, neglecting proper risk management, or ignoring market signals that contradict their assumptions.

Example: A trader makes several profitable trades during a bull market and begins to believe they are invincible. They may increase their position sizes or ignore technical signs of an impending reversal, leading to significant losses.

4. Loss Aversion

Loss aversion refers to the tendency to fear losses more than valuing equivalent gains. This often leads to holding onto losing positions for too long, hoping the market will turn around. Traders become emotionally attached to their investments and are unwilling to accept that they made a wrong decision.

Example: A trader buys into a cryptocurrency at $100, expecting it to rise. When the price drops to $80, instead of cutting their losses, they hold onto the position, hoping for a recovery. The price continues to fall, leading to even greater losses.

5. Revenge Trading

When traders experience losses, there’s often a temptation to immediately “make up” for them through revenge trading. This involves placing riskier trades or deviating from the original strategy in an attempt to recover lost capital quickly. Unfortunately, this emotional response usually leads to even more losses.

Example: After a losing trade, a trader doubles down on a high-risk position, trying to win back their lost funds. This impulsive action typically ignores market conditions and can result in further losses.

Strategies to Master Emotional Discipline in Trading

Mastering emotional discipline is an ongoing process that requires self-awareness, mental control, and practical strategies to avoid emotional mistakes.

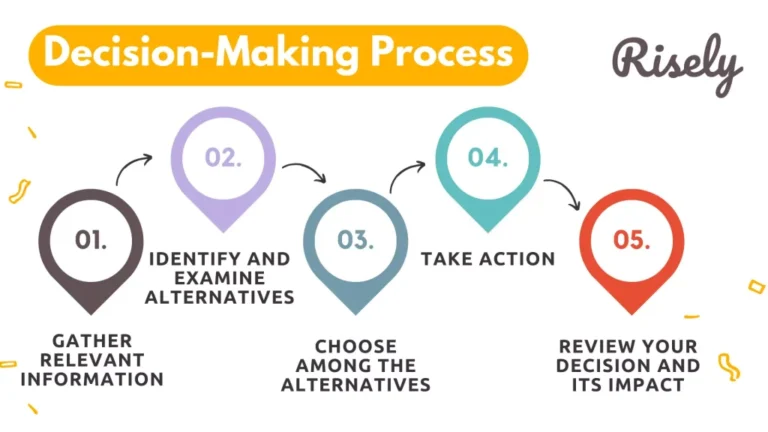

1. Develop and Stick to a Trading Plan

One of the most effective ways to manage emotional impulses is by creating a trading plan and sticking to it. Your plan should include entry and exit points, risk management strategies, and position sizing rules. By following a predetermined set of guidelines, you minimize the likelihood of making impulsive decisions based on emotions.

A well-constructed trading plan should answer the following questions:

- What are your trading goals (short-term, long-term)?

- How much risk are you willing to take per trade?

- What technical or fundamental indicators will you use for decision-making?

- What will your stop-loss and take-profit levels be?

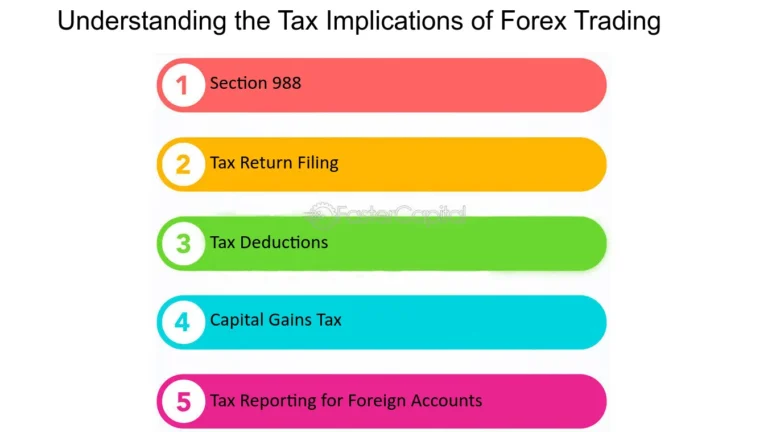

2. Use Risk Management Techniques

Good risk management is crucial for keeping emotions in check. By setting stop-loss orders and position sizing, you reduce the emotional weight of each trade. Knowing that your losses are capped at a certain percentage of your capital gives you the confidence to follow through with your strategy without panicking during temporary downturns.

Key risk management strategies include:

- Position Sizing: Only risking a small percentage of your total capital on each trade (e.g., 1-2%).

- Stop-Loss Orders: Automatically exiting a trade when a specific loss threshold is reached.

- Diversification: Avoid putting all your funds into a single asset, spreading risk across multiple investments.

3. Practice Mindfulness and Emotional Awareness

To master emotional discipline, traders need to develop emotional intelligence. This involves recognizing emotions like fear, greed, or frustration as they arise, and understanding how they affect decision-making. Practicing mindfulness can help traders stay calm and make more rational decisions during market swings.

Ways to enhance emotional awareness include:

- Journaling: Keep a trading journal that records your trades and emotional states at the time. This helps identify patterns in emotional decision-making and can offer insights into what triggers poor decisions.

- Taking Breaks: The crypto market is available 24/7, but that doesn’t mean you should be. Step away from the screen after a stressful trade or significant loss to regain emotional balance.

- Meditation: Many traders find that daily meditation or breathing exercises help them stay grounded and calm, especially during periods of high market volatility.

4. Backtesting and Demo Trading

To build confidence in your strategy, consider backtesting it on historical data or using a demo trading account. Backtesting allows you to see how your strategy would have performed in the past, giving you a sense of its strengths and weaknesses. Demo trading, on the other hand, provides a risk-free environment to practice trading and refine emotional control without the fear of losing real money.

When you see your strategy’s past performance, it’s easier to trust it during live trading, even when emotions are high.

5. Understand and Accept Losses

Losses are a natural part of trading, but they can trigger strong emotional reactions if not handled properly. To master emotional discipline, traders must learn to accept that losses are inevitable and part of the process. Instead of reacting emotionally to a loss, view it as a learning opportunity and analyze what went wrong.

Reframe your mindset: Successful traders aren’t those who avoid losses entirely but those who manage them effectively. Accepting smaller losses and moving on is critical for long-term success.

6. Avoid Overtrading

Overtrading is often the result of emotional trading, where traders place too many trades in a short period, hoping to capitalize on every market move. This can lead to emotional exhaustion and poor decision-making. It’s essential to wait for the right setups and avoid trading out of boredom, revenge, or desperation.

Focus on quality over quantity. A few well-executed trades based on solid analysis are far more effective than a flurry of emotional trades.

The Power of Self-Control and Patience

Two key traits that successful traders exhibit are self-control and patience. In the fast-paced and highly volatile cryptocurrency market, it’s easy to feel pressured into making quick decisions. However, mastering the art of patience, waiting for the right market conditions, and sticking to your strategy is crucial for long-term success.

Cryptocurrency markets are especially prone to emotional reactions due to their speculative nature. As a trader, cultivating a mindset of self-discipline will help you resist the pull of the market’s ups and downs and make decisions based on logic rather than emotion.

Conclusion

In the world of cryptocurrency trading, emotional discipline is often the defining factor between success and failure. Mastering trade psychology requires recognizing common emotional traps such as FOMO, FUD, overconfidence, and revenge trading, while also adopting practical strategies like developing a solid trading plan, using risk management techniques, and practicing mindfulness.

By learning to manage your emotions and sticking to your strategy, you can avoid impulsive decisions, minimize losses, and increase your chances of long-term success. Cryptocurrency trading is as much a mental game as it is a technical one. Building emotional resilience is the key to staying ahead in this high-stakes