Cryptocurrency trading signals are an essential tool for both beginner and seasoned traders, offering recommendations on potential trading opportunities in the volatile crypto markets. These signals typically include buy/sell alerts, price targets, stop-loss levels, and sometimes even analysis or reasoning behind the call. With the increasing number of signal services, it’s crucial to understand how to evaluate them to ensure you’re using reliable information for effective decision-making.

In this article, we will explore what cryptocurrency trading signals are, how they work, the types of signals available, and how to evaluate and choose the best service to suit your trading needs.

What Are Cryptocurrency Trading Signals?

Cryptocurrency trading signals are suggestions or alerts, typically generated by professional traders, analysts, or automated algorithms, which indicate the best times to buy, sell, or hold a cryptocurrency asset. These signals can be manual, based on human analysis, or automated, relying on algorithms and technical indicators.

A typical trading signal might include the following components:

- Asset: The specific cryptocurrency being recommended (e.g., Bitcoin, Ethereum).

- Entry Point: The suggested price at which to enter a trade.

- Price Targets: One or more price levels where a trader should consider exiting the trade to lock in profits.

- Stop-Loss Level: A predefined price at which the trade should be closed to limit potential losses.

- Trade Type: Whether it’s a long position (buying in anticipation of a price increase) or a short position (selling in anticipation of a price decrease).

Trading signals provide actionable insights, allowing traders to make decisions without conducting extensive research. This is particularly helpful in the fast-paced and often confusing world of cryptocurrencies.

Types of Cryptocurrency Trading Signals

Before selecting a signal service, it’s important to understand the types of signals available and how they differ:

- Technical Analysis-Based Signals: These signals are based on technical indicators, such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and support/resistance levels. They rely on historical price data to predict future price movements.

- Fundamental Analysis-Based Signals: These signals consider the underlying fundamentals of a cryptocurrency project, including news, partnerships, market trends, and developments in blockchain technology.

- Automated Algorithmic Signals: These signals are generated by algorithms and bots that scan the market and execute trades based on predefined criteria. They are designed to respond quickly to market conditions and remove human emotions from the trading process.

- Social Media/News-Based Signals: With the growing influence of social media on cryptocurrency markets, some signals are generated based on sentiment analysis from platforms like Twitter, Reddit, or news outlets. These signals capitalize on the rapid response of the market to news events or social media trends.

- Hybrid Signals: Some services combine both technical and fundamental analysis, offering a more comprehensive approach. These signals may be manually curated by experts and backed by algorithmic data analysis for a balanced view.

Factors to Consider When Choosing a Signal Service

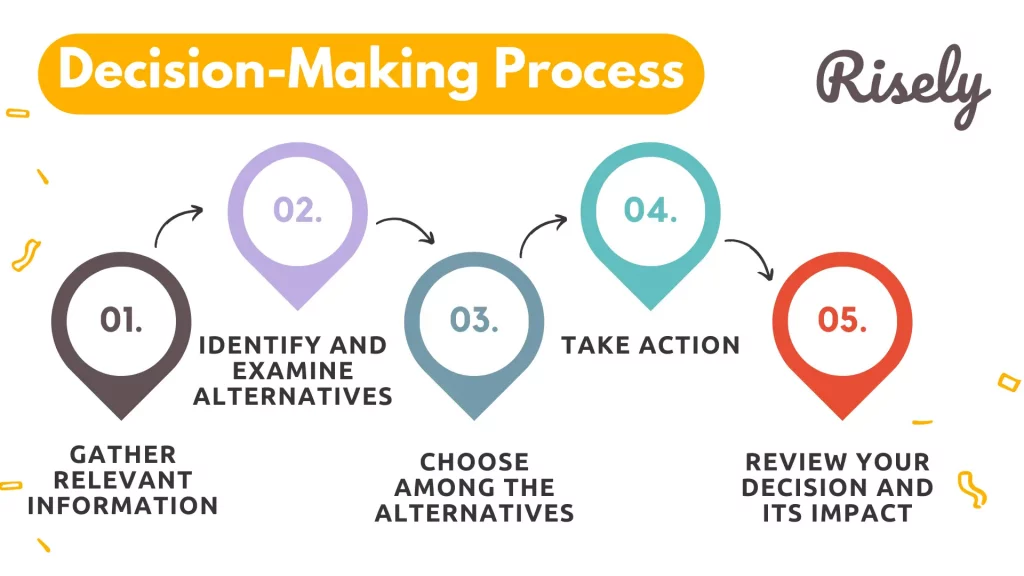

Given the abundance of signal providers, it’s essential to carefully evaluate a service before committing to it. Below are some key factors to consider when choosing the best cryptocurrency trading signals for effective decision-making:

1. Reputation and Credibility

The first and most important factor is the reputation of the signal provider. A reliable service will have a strong track record, backed by positive reviews and testimonials from actual users. Avoid services that promise guaranteed profits or seem too good to be true. Instead, look for providers with transparent performance records and real-world examples of their signals’ success.

How to evaluate:

- Search for independent reviews and user feedback on forums like Reddit, Bitcointalk, and Trustpilot.

- Check social media presence to see how the community engages with the service.

- Request historical performance data to see how their past signals have performed over time.

2. Signal Accuracy and Success Rate

The accuracy of a trading signal is critical. The success rate of the signals should be a key metric in your decision-making process. While no service can guarantee a 100% success rate, a high-performing service should have a consistent track record of profitable signals over time.

How to evaluate:

- Ask for performance reports, including the percentage of successful trades.

- Look for services that provide transparency in their success rates without overstating their performance.

- Verify whether the success rates are consistent across different market conditions (bullish, bearish, or sideways markets).

3. Transparency and Analysis

A high-quality signal service will not only provide signals but also explain the reasoning behind them. Whether based on technical analysis, fundamental news, or a combination of factors, understanding why a signal is being issued can help you make more informed decisions and learn in the process.

How to evaluate:

- Check if the service explains the logic behind each signal, such as identifying specific technical indicators or news events.

- Look for educational content that helps traders understand the methodology behind the signals.

- Avoid services that provide signals with no accompanying explanation, as this can lead to blind trading.

4. Risk Management Tools

The best signal providers also focus on risk management, which is crucial for long-term success in cryptocurrency trading. Along with entry and exit points, reliable services provide stop-loss levels and position-sizing recommendations to help traders manage their risk exposure.

How to evaluate:

- Ensure that the service includes stop-loss recommendations for every signal.

- Look for guidance on position sizing based on your portfolio size and risk tolerance.

- Check whether the service emphasizes risk-reward ratios for each trade, ensuring a balanced approach to potential gains and losses.

5. Frequency of Signals

The frequency of signals can vary widely between services. Some provide several signals daily, while others focus on fewer, higher-quality opportunities. Depending on your trading style, you may prefer more frequent signals if you are a day trader, or less frequent but well-researched signals if you are a swing or long-term trader.

How to evaluate:

- Determine how many signals are sent per day or week.

- Make sure the frequency of signals aligns with your trading strategy and time commitment.

- Beware of services that flood you with signals, as quality is often more important than quantity.

6. User Experience and Support

The ease of use and the quality of customer support offered by the signal provider can greatly impact your experience. A good service will offer a user-friendly interface and clear, timely communication. Look for signal providers that offer multiple communication channels, such as email, SMS, Telegram, or Discord.

How to evaluate:

- Test the platform’s user interface to ensure it’s easy to navigate and signals are delivered in real time.

- Check for the availability of customer support and response times.

- Make sure the signal delivery method (Telegram, email, etc.) suits your preferences and is easy to use on the go.

7. Pricing and Subscription Models

While some signal services are free, most high-quality services charge a subscription fee. The price can vary depending on the level of detail, frequency of signals, and additional features like educational resources or personal consultations. Be cautious of free signal services, as they often lack reliability or have hidden costs.

How to evaluate:

- Compare the pricing structure to the features offered, such as the number of signals, support, and additional tools like market analysis.

- Look for services that offer a free trial or money-back guarantee, so you can test the service before committing long-term.

- Ensure the price fits within your trading budget without cutting into potential profits.

8. Compatibility with Exchanges and Tools

Some signal services are compatible with specific exchanges or trading platforms, allowing for direct integration with trading bots or portfolio management tools. Check whether the signal service integrates with your preferred exchange or tools for seamless trade execution.

How to evaluate:

- Verify that the signals work with the exchanges and trading platforms you use.

- Look for integration with automated trading bots or APIs that allow for hands-free execution of trades based on the signals.

- Ensure the service provides guidance for manual trade execution if needed.

Top Cryptocurrency Signal Providers to Consider

Here are a few popular signal providers known for their reliability and performance:

- Crypto Addicts: Known for providing well-researched signals, Crypto Addicts offers both technical and fundamental analysis. They also provide educational resources to help users understand the rationale behind each signal.

- CoinSignals: Offering both free and paid services, CoinSignals provides signals based on a combination of technical analysis and AI-powered algorithms. Their transparency regarding historical performance is a plus.

- Learn2Trade: This service provides cryptocurrency signals, focusing on technical analysis and market trends. They offer real-time signals via Telegram and provide detailed explanations of each trade.

- CryptoSignals.org: One of the more popular services, CryptoSignals.org offers comprehensive trade recommendations, including detailed entry and exit points. They specialize in Binance and Coinbase trades.

- MYC Signals: Known for their focus on both Bitcoin and altcoins, MYC Signals are provided through Telegram. They offer advanced technical analysis with a solid track record and emphasis on risk management.

Conclusion

Choosing the right cryptocurrency trading signal service can significantly enhance your trading decisions and improve your overall performance. However, it’s essential to do your due diligence and evaluate the reputation, transparency, risk management, and performance of each service. No signal service guarantees success, but a well-researched and reliable one can provide valuable insights that complement your trading strategy.

Remember, while trading signals can offer a shortcut to market analysis, they should not replace your own research and judgment. By combining signals with your own knowledge and discipline, you can make informed decisions that help you navigate the volatile world of cryptocurrency trading with greater confidence.