Overview of FBS

FBS is a globally recognized Forex broker that has been in operation since 2009. The broker offers various trading instruments, including forex, commodities, stocks, indices, and cryptocurrencies. With a wide array of trading account types and competitive trading conditions, FBS serves both beginner and advanced traders.

- Founded: 2009

- Regulated by:

- IFSC (International Financial Services Commission of Belize)

- CySEC (Cyprus Securities and Exchange Commission)

- ASIC (Australian Securities and Investments Commission)

- Website: fbs.com

Account Types

FBS offers multiple account types tailored for different trading needs:

- Cent Account: Ideal for beginners; trading is done in cents, allowing for smaller positions.

- Minimum deposit: $1

- Spread: Floating, from 1 pip

- Leverage: Up to 1:1000

- Standard Account: Designed for experienced traders with more flexibility.

- Minimum deposit: $100

- Spread: Floating, from 0.5 pips

- Leverage: Up to 1:3000

- Micro Account: Features fixed spreads for simpler calculation of trading costs.

- Minimum deposit: $5

- Spread: Fixed, from 3 pips

- Leverage: Up to 1:3000

- Zero Spread Account: For those looking for precision trading with no spreads.

- Minimum deposit: $500

- Spread: Fixed, 0 pips

- Leverage: Up to 1:3000

- Commission: From $20 per lot

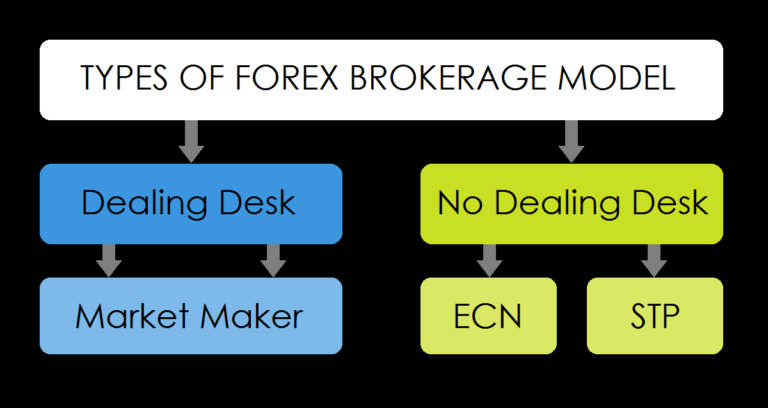

- ECN Account: Suitable for professionals with direct market access.

- Minimum deposit: $1000

- Spread: Floating, from -1 pip

- Leverage: Up to 1:500

- Commission: $6 per lot

- Crypto Account: Focuses on cryptocurrency trading.

- Minimum deposit: $1

- Spread: From 1 pip

- Leverage: Up to 1:5

Spreads and Fees

FBS offers competitive spreads depending on the account type:

- Cent and Standard Accounts: Spreads start from 1 pip, making them suitable for those who prefer lower capital requirements and moderate trading costs.

- Zero Spread Account: Traders benefit from 0 pip spreads but need to account for the commission.

- ECN Account: Offers ultra-tight spreads, which can sometimes even be negative, but a commission is charged per lot.

Trading Platforms

FBS offers access to the industry-standard platforms:

- MetaTrader 4 (MT4): Widely used for its robust charting tools and automated trading systems.

- MetaTrader 5 (MT5): An advanced version of MT4 with additional features like more timeframes and order types.

- FBS Trader App: A proprietary trading app designed for mobile traders with essential features for account management and trading on the go.

Regulations and Safety

FBS operates under multiple regulatory bodies, such as CySEC, IFSC, and ASIC, ensuring that client funds are secure and segregated. This enhances trader protection, especially under well-regulated environments like Cyprus and Australia.

Deposits and Withdrawals

FBS provides multiple payment methods, including:

- Bank Transfers

- Credit/Debit Cards

- E-wallets: Skrill, Neteller, Perfect Money, Sticpay

- Cryptocurrencies: Bitcoin, Ethereum

The minimum deposit starts from as low as $1 for the Cent account and can go up to $1000 for the ECN account. Withdrawal times range from instant to a few business days, depending on the payment method.

Pros of FBS

- Wide range of account types: From Cent accounts for beginners to ECN accounts for professionals.

- High leverage: Up to 1:3000, allowing traders to control larger positions with smaller capital.

- Low minimum deposit: Starting from $1, FBS is accessible to all types of traders.

- Multiple payment methods: Deposits and withdrawals are supported via bank transfers, cards, e-wallets, and crypto.

- Good customer support: 24/7 multilingual support available via live chat, phone, and email.

- Bonus offerings: FBS regularly provides promotions and bonuses, such as deposit bonuses and no-deposit bonuses.

Cons of FBS

- High commissions on Zero Spread and ECN accounts: Despite the low spreads, commissions can add up, especially for high-frequency traders.

- Spreads on Micro accounts: Fixed spreads starting from 3 pips can be expensive compared to other brokers.

- Regulatory status in some regions: While FBS is regulated by reputable bodies like CySEC and ASIC, traders from certain regions may only have access to the IFSC-regulated entity, which has lighter regulations compared to CySEC and ASIC.

- Limited asset classes: While FBS offers a wide range of forex pairs, its offerings in stocks and cryptocurrencies are somewhat limited compared to some competitors.

Conclusion

FBS is a highly versatile forex broker with options for both beginners and advanced traders. Its extensive choice of account types, coupled with low minimum deposits and competitive spreads, makes it appealing. However, traders should weigh the pros and cons based on their individual needs, particularly regarding account fees and spread options.