Forex trading, or foreign exchange trading, has become increasingly accessible to individuals, thanks to modern technology and online trading platforms. However, diving into live forex trading without prior experience or understanding of the market can lead to significant losses. This is where demo accounts come into play. A forex demo account provides an excellent environment for beginner traders to practice and hone their skills without risking real money.

In this comprehensive guide, we will explore what a forex trading demo account is, its key benefits, how to use it effectively, and the transition to a live account.

What is a Forex Demo Account?

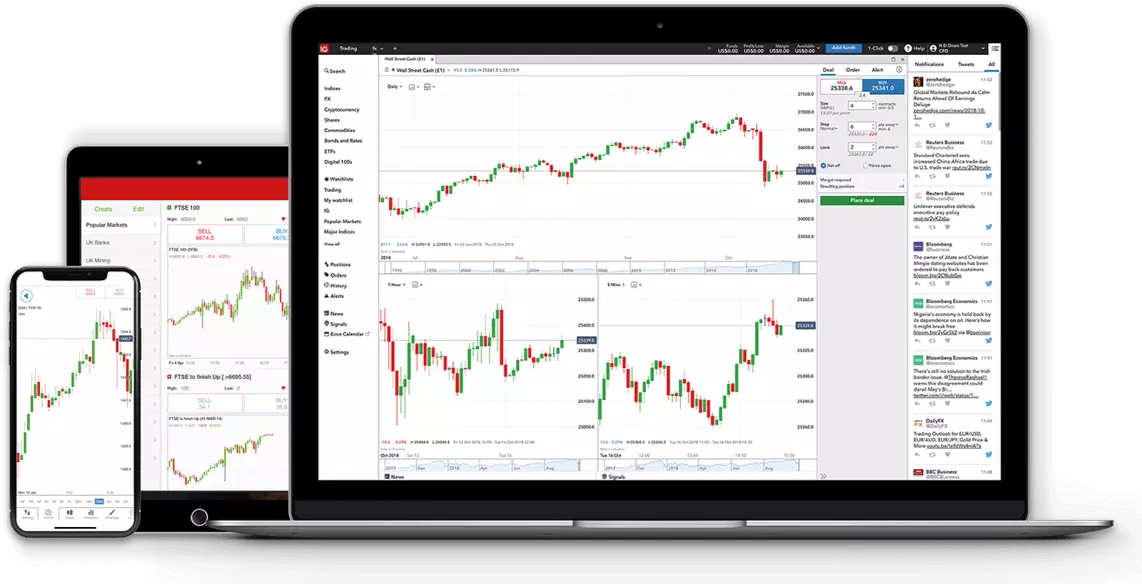

A forex demo account is a simulated trading environment that allows you to trade forex using virtual funds rather than real money. Most brokers offer demo accounts as part of their trading platform to provide a risk-free environment where traders can practice trading, test strategies, and familiarize themselves with the broker’s tools and features.

How It Works:

- The demo account operates in real-time, meaning you receive the same live market data and price feeds as those using live accounts.

- You trade on actual forex pairs, such as EUR/USD or GBP/JPY, and can use the same trading tools, indicators, and charting features that are available on the live platform.

- However, since you are trading with virtual money, any profits or losses are purely hypothetical. This makes it an ideal training ground for beginners.

Benefits of a Forex Demo Account

- Risk-Free Learning: The primary benefit of a demo account is that it provides a risk-free environment for learning how to trade forex. As a beginner, you can make mistakes and experiment with different trading strategies without the fear of losing real money.

- Platform Familiarization: Before jumping into live trading, it’s crucial to familiarize yourself with the trading platform. A demo account allows you to explore the broker’s platform, from placing orders to using charting tools, understanding how leverage works, and learning how to navigate the interface.

- Testing Trading Strategies: Even experienced traders use demo accounts to test new strategies. Whether you are a technical trader using charts and indicators or a fundamental trader analyzing economic news, a demo account helps you test strategies in real-time without financial risk.

- Understanding Market Dynamics: Trading in a demo account exposes you to real-time market conditions, price fluctuations, and volatility. While there is no emotional pressure since real money isn’t involved, you still get an idea of how the forex market behaves, including periods of high and low volatility.

- Building Confidence: Forex trading can be intimidating, especially for beginners. A demo account helps build confidence as you practice and refine your skills. Once you start seeing consistent results in your demo account, you’ll be better prepared to transition to a live account.

- Access to Advanced Features: Most forex demo accounts give you access to advanced features like charting tools, technical indicators, and risk management tools like stop-loss and take-profit orders. This hands-on experience will be invaluable when you begin live trading.

How to Open a Forex Demo Account

Opening a forex demo account is simple and typically involves the following steps:

- Choose a Broker:

- Select a reputable forex broker that offers demo accounts. Popular brokers like MetaTrader 4/5, eToro, OANDA, and Forex.com all offer demo accounts that mirror live trading conditions.

- Register for the Demo Account:

- Visit the broker’s website and register for a demo account. You’ll need to provide basic information such as your name, email, and country of residence.

- Download the Trading Platform:

- Once registered, you may need to download the broker’s trading platform or mobile app, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the broker’s proprietary platform.

- Log In to Your Demo Account:

- Use the login credentials provided by the broker to access your demo account. Some brokers will offer a web-based platform, while others may require you to download software.

- Start Trading with Virtual Funds:

How to Use a Demo Account Effectively

Simply opening a demo account is not enough; to truly benefit from it, you need to use it effectively. Here are some best practices for maximizing your experience:

- Treat it Like a Live Account:

- Although you’re trading with virtual money, it’s important to treat your demo account as if it’s a live account. This means you should avoid taking unnecessary risks, such as leveraging too high or trading without a strategy.

- Test Trading Strategies:

- Use the demo account to test different strategies. For example, you can experiment with scalping, day trading, or swing trading. Testing strategies in a risk-free environment will help you refine them before implementing them in real trading.

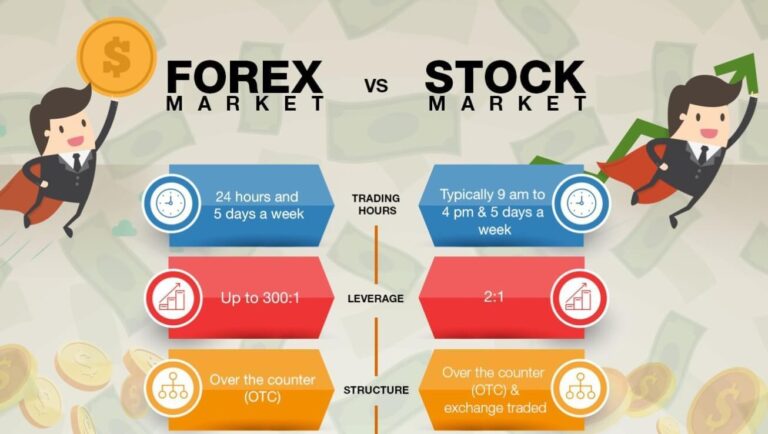

- Understand Leverage and Margin:

- Forex brokers offer leverage, allowing you to control larger positions with a smaller amount of capital. In a demo account, practice using leverage to understand how it magnifies both gains and losses.

- Utilize Risk Management Tools:

- Learn how to use tools such as stop-loss orders and take-profit orders. These tools help you manage risk and protect your account from large losses, ensuring you exit trades when they move against you or hit your profit target.

- Track Your Progress:

- Keep a trading journal to record your trades, strategies, and results. Analyzing your demo account performance will help you identify strengths and weaknesses in your approach.

- Practice Emotional Control:

- One challenge in forex trading is managing emotions like fear and greed. While demo accounts don’t involve real money, practice maintaining emotional discipline, as it’s crucial when transitioning to live trading.

Transitioning from a Demo Account to a Live Account

Once you’ve spent sufficient time in the demo environment and feel confident in your skills, it’s time to consider transitioning to a live trading account. Here are some tips to ensure a smooth transition:

- Start Small:

- When you open a live account, begin with a small deposit to minimize risk. Many brokers allow you to trade with micro-lots, which are ideal for beginners.

- Stick to Your Demo Strategies:

- Don’t abandon the strategies that worked in your demo account. Stay disciplined and stick to your tested approach when trading with real money.

- Manage Your Emotions:

- Live trading brings emotional challenges that aren’t present in demo trading. You may experience anxiety, fear, or greed when real money is on the line. Be mindful of your emotions and use sound risk management practices.

- Continue Learning:

- Forex trading is a continual learning process. Even after transitioning to a live account, stay up to date with market news, economic data, and new trading strategies.

Conclusion

A forex trading demo account is an indispensable tool for both beginner and experienced traders. It offers a risk-free environment to practice trading, test strategies, and familiarize yourself with the trading platform. The key to success in using a demo account is treating it like a live account, testing strategies, and focusing on risk management. Once you feel confident in your demo performance, transitioning to a live account becomes much easier, as you’ll be better equipped with the knowledge and skills to trade successfully.

Using a demo account as a training ground can help you develop a profitable trading strategy and prepare you mentally and emotionally for the real challenges of the forex market.