Forex Trading News Today: September 29, 2024 – Key Market Developments

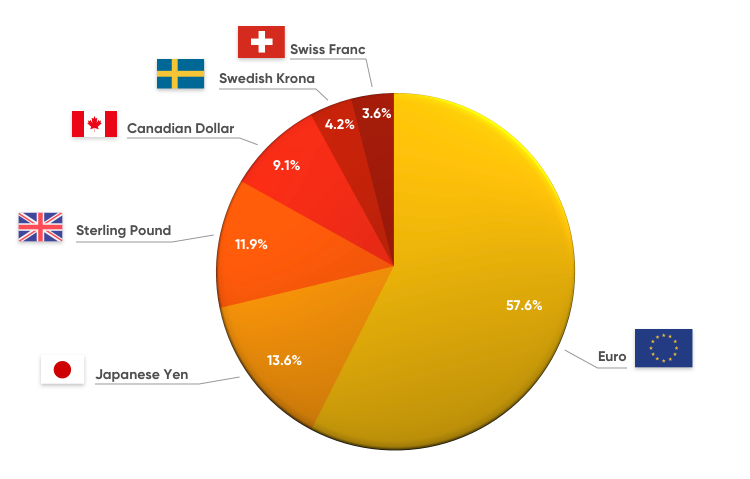

The global foreign exchange (forex) market continues to show significant volatility in response to a range of geopolitical and economic events. With trillions of dollars traded daily, the forex market is constantly reacting to major developments such as central bank policies, economic data, and global political shifts. Today’s forex news sheds light on key developments influencing the movements of major currency pairs, the role of central bank policies, and the market sentiment surrounding global economic uncertainty.

U.S. Dollar (USD) Remains Resilient Despite Rate Cuts

One of the most significant factors impacting the forex market today is the U.S. Federal Reserve’s recent decision to cut interest rates by 50 basis points. Historically, such cuts often lead to a decline in a currency’s value, as lower interest rates reduce the attractiveness of that currency for investors seeking higher returns. However, the U.S. dollar has shown unexpected resilience, maintaining relative stability against other major currencies such as the euro (EUR) and the Japanese yen (JPY)(

).

Traders had anticipated a sharp decline in the dollar following the rate cut, especially given the ongoing concerns about inflation and potential recession in the United States. However, the stability of the dollar may be attributed to a combination of factors, including global investor confidence in the U.S. economy and the Federal Reserve’s overall monetary policy strategy. While the dollar’s performance remains a focal point for traders, the currency’s future movements will largely depend on upcoming U.S. economic data, including inflation figures and employment reports(

)(

).

Eurozone Inflation Concerns and the EUR/USD Pair

In Europe, the euro (EUR) has been under pressure as traders monitor the European Central Bank’s (ECB) evolving stance on inflation. ECB President Christine Lagarde recently indicated that the Eurozone may face increasing inflationary volatility in the coming months, creating uncertainty in the EUR/USD pair(

). The ECB’s cautious approach to raising interest rates has left many forex traders speculating on future monetary policy moves, especially as inflation in the Eurozone has remained persistently above target.

The EUR/USD pair, one of the most widely traded currency pairs in the world, has been particularly sensitive to changes in market sentiment driven by the ECB’s actions. The pair recently experienced downward pressure, but it remains relatively stable as traders await further economic data and speeches from ECB officials. Lagarde’s upcoming comments are expected to offer more insight into how the central bank plans to combat inflation while fostering economic stability.

Bank of Japan and USD/JPY Volatility

The Japanese yen (JPY) has also been a focal point in today’s forex trading news. Following the Bank of Japan’s (BoJ) recent statements on economic recovery, the USD/JPY pair has experienced heightened volatility. The BoJ has indicated moderate optimism about Japan’s economic prospects, which has provided some support for the yen(

). However, the yen remains vulnerable to fluctuations in U.S. interest rate policy, as higher U.S. rates tend to attract capital flows away from Japan and into dollar-denominated assets.

The USD/JPY pair is particularly sensitive to changes in both U.S. and Japanese economic conditions. For traders, this pair offers a clear reflection of the differing monetary policy approaches between the Federal Reserve, which has been actively adjusting rates, and the BoJ, which has maintained a more cautious stance on policy changes.

China’s Economic Slowdown and Its Impact on Asian Currencies

The Chinese yuan (CNY) is also under scrutiny as China grapples with significant economic challenges. Recent reports highlight concerns over a substantial drop in government budget spending, raising fears of an economic slowdown in the world’s second-largest economy(

). This has led to declines in Asian currencies tied to China’s economic performance, including the South Korean won (KRW) and the Singapore dollar (SGD).

The potential for a prolonged economic slowdown in China could have far-reaching consequences for the global forex market. As China is a key trading partner for many countries, its economic performance directly influences the value of currencies in the Asia-Pacific region. Traders are closely monitoring upcoming Chinese economic data, particularly reports on industrial production and consumer demand, to assess the broader impact of China’s economic challenges on the forex market.

British Pound (GBP) Under Pressure Amid Economic Uncertainty

In the United Kingdom, the British pound (GBP) has faced recent volatility, particularly against the U.S. dollar (GBP/USD). Economic data from the UK, including reports on retail sales and inflation, has been mixed, creating uncertainty about the overall health of the British economy(

). Despite a recent uptick in inflation, concerns about slowing economic growth have weighed on the pound.

The Bank of England’s (BoE) approach to monetary policy will be critical in determining the future direction of the GBP/USD pair. The BoE has already raised interest rates in response to rising inflation, but there is growing speculation about whether further rate hikes are needed to keep inflation under control. Traders are advised to keep a close eye on upcoming UK economic reports and BoE statements to gauge the pound’s future movements.

Geopolitical Risks and Market Sentiment

In addition to central bank policies and economic data, geopolitical risks continue to play a significant role in shaping forex market sentiment. Tensions between major global powers, such as the U.S. and China, have the potential to create uncertainty in the market, influencing the value of safe-haven currencies like the U.S. dollar and the Swiss franc (CHF). Additionally, the ongoing conflict in Ukraine continues to affect European markets, particularly the euro and the British pound(

).

Geopolitical events can lead to sudden spikes in volatility, as traders seek to hedge against risks by moving funds into safer assets. As a result, the demand for certain currencies may fluctuate rapidly in response to geopolitical developments, creating both opportunities and challenges for forex traders.

Upcoming Economic Events to Watch

For forex traders, staying informed about upcoming economic events is essential for successful trading. Key events in the coming days that could impact currency movements include:

- U.S. Retail Sales Data: This report will provide valuable insights into consumer spending trends in the United States, a key driver of economic growth.

- ECB Speeches: Further speeches from ECB officials will offer guidance on the central bank’s approach to inflation control and interest rates.

- China’s Economic Reports: Traders should closely watch for upcoming economic data from China, particularly industrial production and GDP growth figures, as these reports will influence sentiment on Asian currencies(

).

Conclusion: Staying Ahead in the Forex Market

Today’s forex market developments underscore the importance of staying informed and adapting to rapidly changing conditions. Central bank policies, economic data, and geopolitical risks continue to drive volatility in major currency pairs, offering both opportunities and challenges for traders. For those involved in the forex market, monitoring key events and understanding the broader economic context will be crucial for making informed trading decisions.

As markets react to the latest economic news, forex traders should focus on maintaining a disciplined approach to risk management while staying alert to the potential impact of global events on currency movements. With the right strategies and access to timely information, traders can navigate the complexities of the forex market and capitalize on opportunities as they arise.