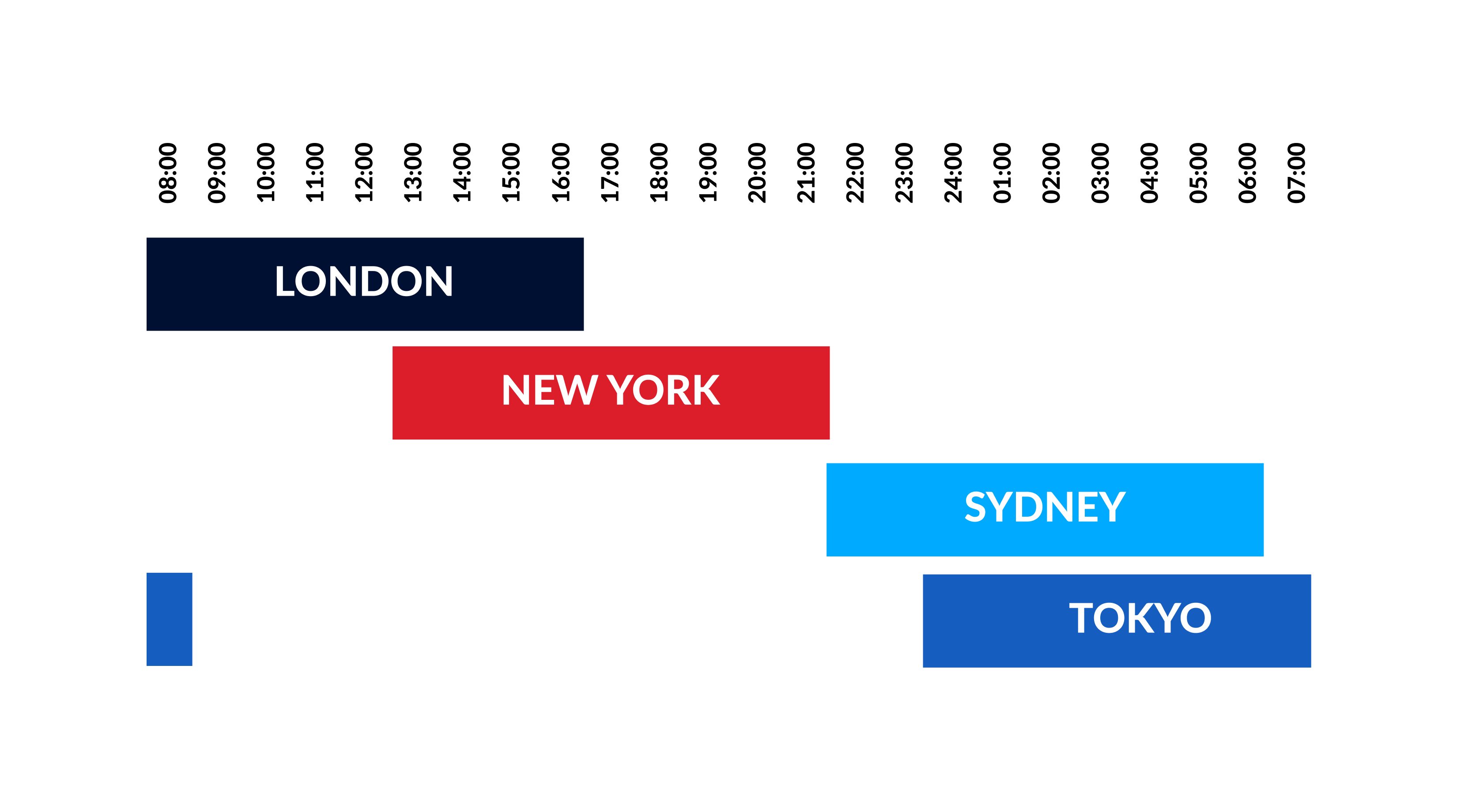

Forex trading sessions are divided into four key periods based on the most active financial centers: Sydney, Tokyo, London, and New York. Each session is characterized by different levels of trading activity and volatility, based on the currencies and markets that are most active at that time.

1. Sydney Session (Pacific Session)

- Time: 10:00 PM to 7:00 AM GMT (5:00 PM to 2:00 AM EST)

- Currencies Impacted: AUD (Australian Dollar), NZD (New Zealand Dollar)

- Overview: The Sydney session marks the beginning of the forex market week. It’s a relatively low-volatility period compared to the others, as fewer participants are actively trading. However, traders focusing on the Australian dollar (AUD) or New Zealand dollar (NZD) often find opportunities, especially as the market reacts to economic news from the Pacific region, such as interest rate announcements from the Reserve Bank of Australia (RBA).

- Best Suited For: Traders focusing on Pacific currency pairs like AUD/USD, NZD/USD.

2. Tokyo Session (Asian Session)

- Time: 12:00 AM to 9:00 AM GMT (7:00 PM to 4:00 AM EST)

- Currencies Impacted: JPY (Japanese Yen), SGD (Singapore Dollar), CNY (Chinese Yuan)

- Overview: The Tokyo session represents the Asian market and brings higher liquidity compared to Sydney. Japan is one of the largest forex hubs, with significant trading volumes in the yen (JPY). Traders often see movement in pairs like USD/JPY, GBP/JPY, and EUR/JPY. The Japanese yen and other Asian currencies such as the Singapore dollar (SGD) and Chinese yuan (CNY) can experience sharp moves during this session, especially when the Bank of Japan (BoJ) makes announcements.

- Best Suited For: Traders looking to capitalize on movements in Asian currency pairs, particularly JPY-based pairs. It also overlaps with the Sydney session for a few hours, providing moderate volatility.

3. London Session (European Session)

- Time: 8:00 AM to 5:00 PM GMT (3:00 AM to 12:00 PM EST)

- Currencies Impacted: EUR (Euro), GBP (British Pound), CHF (Swiss Franc)

- Overview: The London session is one of the most important and active forex trading periods. London has been a major financial center for centuries, and this session accounts for a significant portion of daily forex trading volume. The liquidity and volatility are high, especially when economic reports from the Eurozone or the UK are released. Pairs like EUR/USD, GBP/USD, and USD/CHF tend to see significant movements. The London session also overlaps with the New York session, which creates a surge in volatility.

- Best Suited For: Traders focusing on European currency pairs such as EUR/USD, GBP/USD, EUR/GBP. Traders seeking high liquidity and volatility will find opportunities during this period.

4. New York Session (American Session)

- Time: 1:00 PM to 10:00 PM GMT (8:00 AM to 5:00 PM EST)

- Currencies Impacted: USD (U.S. Dollar), CAD (Canadian Dollar), MXN (Mexican Peso)

- Overview: The New York session is the second-largest trading session after London and is extremely important due to the size of the U.S. economy. Major U.S. economic data, such as Non-Farm Payrolls (NFP), Federal Reserve interest rate decisions, and GDP reports, are released during this period, causing significant volatility in the U.S. dollar and related pairs. This session overlaps with the London session for four hours, leading to heightened trading activity. Pairs like USD/CAD, EUR/USD, and GBP/USD are most heavily traded during this period.

- Best Suited For: Traders seeking to trade U.S. economic news and events, particularly U.S. dollar-based pairs.

Session Overlaps (Most Active Periods)

- London – New York Overlap:

- Time: 1:00 PM to 5:00 PM GMT (8:00 AM to 12:00 PM EST)

- Overview: This overlap is the most active and volatile period in the forex market. Both the London and New York markets are open, leading to high liquidity and sharp price movements. Most of the day’s major economic news releases happen during this period, making it a prime time for traders to execute their strategies.

- Best Suited For: Day traders, scalpers, and those seeking high volatility, especially in major pairs like EUR/USD, GBP/USD, and USD/JPY.

- Sydney – Tokyo Overlap:

- Time: 12:00 AM to 7:00 AM GMT (7:00 PM to 2:00 AM EST)

- Overview: While not as volatile as the London-New York overlap, this period sees increased activity in Asian currencies like the yen (JPY), Australian dollar (AUD), and New Zealand dollar (NZD). Traders may find opportunities in JPY crosses and Pacific pairs.

- Best Suited For: Traders interested in Asian and Pacific currency pairs, and those looking for moderate volatility in the early hours.

Best Times to Trade Forex

- For Major Pairs (EUR/USD, GBP/USD, USD/JPY): The best time to trade is during the London-New York overlap (1:00 PM to 5:00 PM GMT). Liquidity is highest, and spreads are tighter, offering opportunities for short-term traders like scalpers and day traders.

- For Asian Pairs (USD/JPY, AUD/JPY, AUD/USD): The Tokyo session (12:00 AM to 9:00 AM GMT) and the Sydney-Tokyo overlap (12:00 AM to 7:00 AM GMT) are ideal.

- For Less Volatile Trading: If you prefer slower market conditions, trading outside of the overlap periods (such as during the Sydney session) may offer more relaxed conditions for longer-term strategies like swing trading.

Factors That Influence Session Activity

- News Releases: Major economic data releases such as U.S. Non-Farm Payrolls, UK GDP figures, or ECB interest rate decisions tend to spark high volatility during the session of the country in question.

- Bank Interventions: Central bank announcements or interventions can have significant impacts on currency values during the relevant trading session.

- Holidays: National holidays, especially in major financial centers, can reduce trading volumes and lead to less volatility.

Conclusion

Understanding the forex market sessions is crucial for developing an effective trading strategy. The market behaves differently during each session, and traders should adjust their approach depending on the session’s characteristics. For high liquidity and the best trading opportunities, focus on trading during the London-New York overlap. However, for traders who specialize in particular regions or pairs, sessions like Tokyo or Sydney may offer better opportunities. By aligning your strategy with the right session, you can capitalize on the unique characteristics of each trading period.