Forex Trading Software: A Comprehensive Guide for Beginners

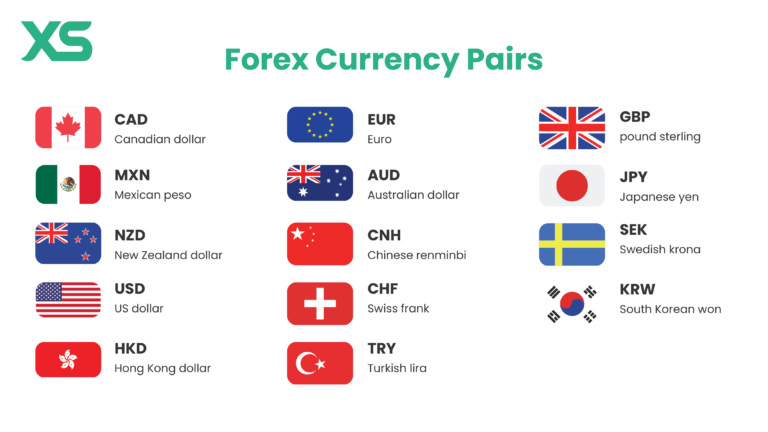

In the fast-paced world of forex trading, success often hinges on the tools and software traders use to navigate the markets. Forex trading software can be a game-changer for both beginners and experienced traders by automating processes, providing real-time data, and offering technical analysis. Whether you’re looking to execute trades manually or automate them using algorithms, understanding the various types of forex software is essential.

This guide will walk you through the importance of forex trading software, the key features to look for, and a step-by-step guide to getting started.

What is Forex Trading Software?

Forex trading software refers to computer programs and platforms that help traders execute trades, analyze markets, and manage their portfolios. It can range from basic charting software to complex algorithmic trading platforms. The main categories of forex trading software include:

- Trading Platforms: Software that allows traders to place trades, analyze market conditions, and monitor their portfolios.

- Charting Software: Specialized software that helps traders conduct technical analysis by providing detailed price charts, indicators, and other tools.

- Automated Trading Software: Programs that can automatically execute trades based on pre-defined strategies and algorithms.

- Social Trading Platforms: Allow traders to copy or follow experienced traders, making it easier for beginners to learn from experts.

Key Features to Look for in Forex Trading Software

When choosing forex trading software, there are several key features you should consider to ensure it meets your needs.

- User-Friendly Interface:

- Ease of use is crucial, especially for beginners. The software should have a clean, intuitive interface that makes it easy to execute trades and manage your portfolio without getting overwhelmed.

- Real-Time Data and Quotes:

- Forex markets move rapidly, and having access to real-time price data is essential. Make sure the software provides real-time quotes and doesn’t have delays that could impact your decision-making.

- Technical Analysis Tools:

- Look for software that offers a wide range of technical indicators, such as moving averages, MACD, and RSI. These tools will help you analyze price patterns and forecast future movements.

- Automated Trading Capabilities:

- If you plan on using automated strategies, ensure the software can handle algorithmic trading and backtesting. This feature allows you to test your strategies before executing them live.

- Backtesting and Simulations:

- Good forex trading software allows you to test your trading strategies in a simulated environment using historical data. This gives you a better idea of how your strategy would perform under real market conditions.

- Customizability:

- The ability to customize charts, indicators, and even trading algorithms is important for traders who want to tailor their tools to suit specific strategies.

- Security Features:

- Since forex trading involves real money, the software should offer top-notch security features, such as two-factor authentication and encryption, to protect your account.

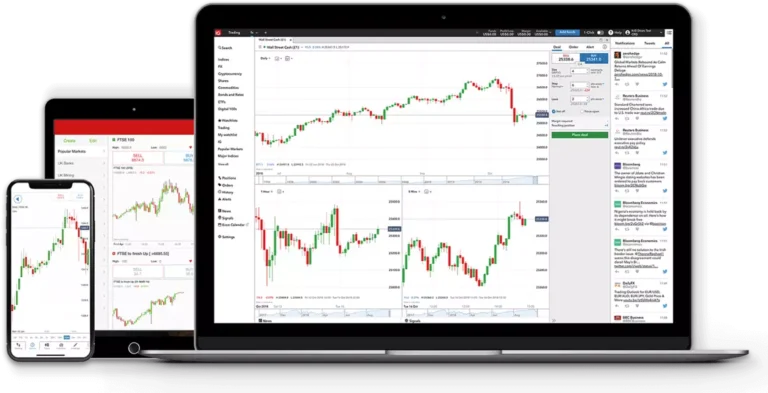

- Mobile Access:

- With traders often on the go, mobile access is a must. Ensure the software has a robust mobile app or a web-based platform that works seamlessly across devices.

Popular Forex Trading Software

Here are some of the most widely used forex trading platforms and software for different types of traders:

1. MetaTrader 4 (MT4)

- Overview: MetaTrader 4 is the most popular forex trading platform in the world. It offers advanced charting tools, a user-friendly interface, and the ability to execute trades with just one click. The platform is highly customizable and supports automated trading via Expert Advisors (EAs).

- Best For: Beginner and intermediate traders who need a reliable, all-in-one platform for manual and automated trading.

2. MetaTrader 5 (MT5)

- Overview: MT5 is an upgraded version of MT4, offering more advanced features such as additional timeframes, more technical indicators, and improved order execution. It also supports trading in other asset classes, like stocks and commodities.

- Best For: Advanced traders who need more in-depth tools for technical and fundamental analysis.

3. cTrader

- Overview: cTrader is known for its clean and intuitive interface, making it ideal for beginners. It offers advanced order management, Level 2 pricing, and various charting tools. The platform is also popular for algorithmic trading, thanks to its integration with cAlgo.

- Best For: Traders who want a simple platform with powerful execution features.

4. NinjaTrader

- Overview: While primarily designed for futures and stock trading, NinjaTrader is a powerful platform for forex traders. It offers excellent charting, advanced order types, and support for automated trading strategies.

- Best For: Advanced traders and those interested in algorithmic trading.

5. TradingView

- Overview: TradingView is a cloud-based charting platform that allows traders to share ideas and conduct detailed analysis. It’s known for its social trading features and vast community of traders sharing strategies.

- Best For: Traders who rely heavily on technical analysis and want to connect with a global trading community.

6. ZuluTrade

- Overview: ZuluTrade is a social trading platform that enables users to copy the trades of experienced traders. It’s great for beginners who want to follow successful traders while learning how to trade on their own.

- Best For: Beginners and those interested in copy trading.

Guide to Getting Started with Forex Trading Software

Now that you understand the different types of software and their features, here’s a step-by-step guide to getting started with forex trading software:

Step 1: Choose the Right Software

- Assess your trading style and choose the software that fits your needs. If you’re a beginner, platforms like MetaTrader 4 or cTrader offer a balance of usability and features. If you’re looking to automate trades, you might opt for MT4 or NinjaTrader for algorithmic trading.

Step 2: Open a Demo Account

- Almost all forex trading platforms offer demo accounts, which allow you to trade in real market conditions with virtual money. Use this opportunity to practice and familiarize yourself with the software interface, technical analysis tools, and order execution.

Step 3: Backtest Your Trading Strategy

- Before going live, it’s essential to backtest your trading strategy using historical data. This feature is available on most platforms, and it helps you evaluate how well your strategy performs in various market conditions.

Step 4: Customize Your Interface

- Tailor your trading interface to suit your needs by adjusting chart settings, adding technical indicators, and setting up alerts. Many platforms allow you to save layouts, making it easier to switch between different setups for various strategies.

Step 5: Automate (Optional)

- If you plan on using automated trading strategies, spend time setting up your Expert Advisors or custom scripts. Be sure to test them thoroughly in a demo environment before applying them in the live markets.

Step 6: Monitor and Optimize

- Once you start trading with real money, regularly monitor your performance. Platforms like MT4 and cTrader provide detailed analytics, allowing you to track your win rate, risk-to-reward ratio, and other key performance metrics.

Conclusion

Forex trading software plays an essential role in a trader’s success by providing powerful tools for analysis, execution, and automation. Whether you’re a beginner just starting out or an advanced trader looking to refine your strategy, selecting the right forex trading platform is key. With platforms like MetaTrader, cTrader, and TradingView available, traders have access to world-class technology that can help them make informed decisions, automate their strategies, and navigate the forex market more effectively.

Before committing to any platform, take advantage of demo accounts and backtesting features to refine your skills and strategy.