In the world of finance, two of the most popular avenues for investment are forex trading and stock trading. Both offer unique opportunities and risks, making them appealing to different types of traders and investors. Understanding the differences between these two markets is crucial for anyone considering entering either space. This article will explore the key differences, advantages, and disadvantages of forex and stock trading, ultimately helping you decide which is better suited for your investment style and goals.

Table of Contents

- Overview of Forex Trading

- Overview of Stock Trading

- Market Hours and Liquidity

- Volatility and Risk

- Leverage and Margin

- Costs and Fees

- Technical and Fundamental Analysis

- Market Participants

- Trading Strategies

- Regulatory Environment

- Accessibility and Technology

- Psychology of Trading

- Conclusion: Which is Better?

1. Overview of Forex Trading

Forex trading, or foreign exchange trading, involves the exchange of one currency for another in the global foreign exchange market. Traders buy and sell currency pairs, speculating on changes in exchange rates. Forex is known for its high liquidity, extensive market hours, and the ability to trade on margin, making it attractive for both retail and institutional traders.

Key Characteristics of Forex Trading:

- Market Size: The forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion.

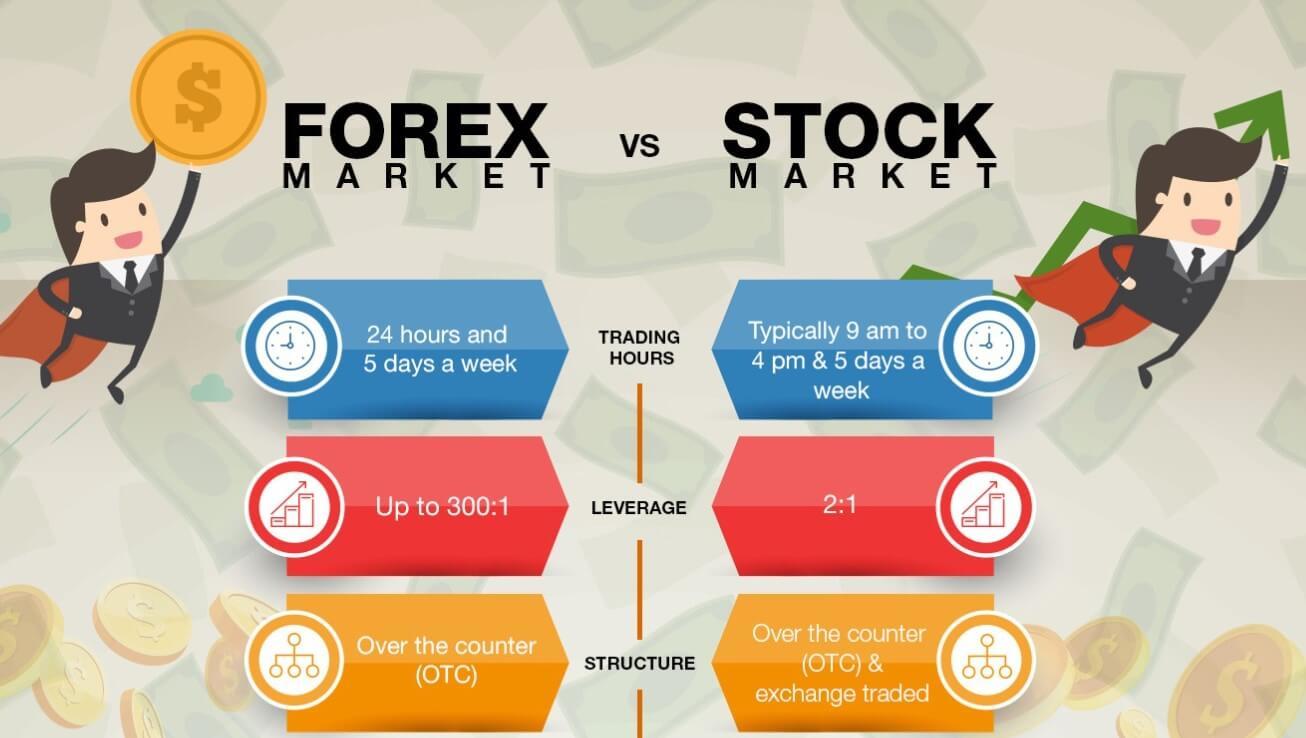

- Decentralized Market: Forex is traded over-the-counter (OTC) through a network of banks, brokers, and electronic trading platforms, meaning it does not have a centralized exchange.

- Currency Pairs: Forex trading involves currency pairs (e.g., EUR/USD, GBP/JPY), where one currency is bought and another sold.

2. Overview of Stock Trading

Stock trading involves buying and selling shares of publicly traded companies. Investors trade stocks to participate in the company’s growth and profit, as they may earn dividends and benefit from capital appreciation. Stock trading typically occurs on centralized exchanges such as the New York Stock Exchange (NYSE) or NASDAQ.

Key Characteristics of Stock Trading:

- Ownership: Buying shares of a company represents ownership in that company, allowing investors to benefit from its success.

- Market Capitalization: Stocks are categorized by market capitalization (small-cap, mid-cap, large-cap), which reflects the company’s size and growth potential.

- Dividends: Many companies pay dividends, providing shareholders with a portion of the company’s profits.

3. Market Hours and Liquidity

One of the most significant differences between forex and stock trading is market hours and liquidity.

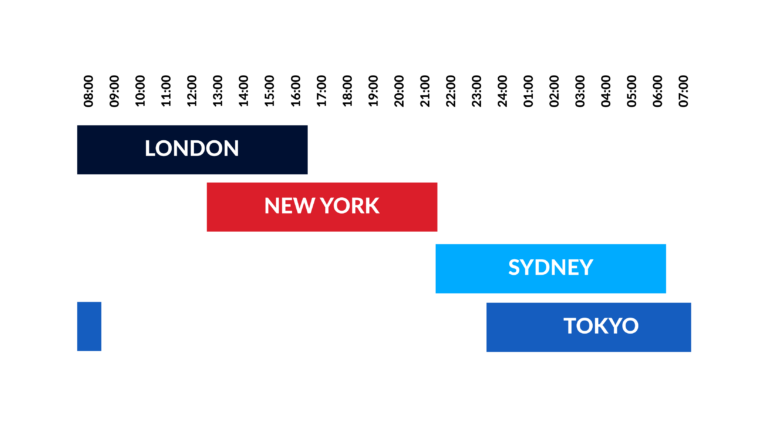

Forex Market Hours:

- The forex market operates 24 hours a day, five days a week, divided into major trading sessions: Sydney, Tokyo, London, and New York.

- High liquidity is maintained throughout the day, especially during the overlap of trading sessions.

Stock Market Hours:

- Stock markets typically operate during regular business hours, which can vary by country. For example, the NYSE and NASDAQ operate from 9:30 AM to 4:00 PM EST on weekdays.

- Liquidity can vary throughout the day, with higher volumes usually occurring at the market open and close.

Conclusion: The forex market offers greater flexibility in terms of trading hours, while stock trading is limited to specific hours.

4. Volatility and Risk

Forex Volatility:

- The forex market can be highly volatile, with rapid price fluctuations driven by economic news, geopolitical events, and changes in market sentiment.

- While volatility can present opportunities for profit, it can also result in significant losses.

Stock Volatility:

- Stock volatility varies by company and sector. Large-cap stocks tend to be less volatile than small-cap stocks.

- Earnings reports, company news, and market trends significantly influence stock prices.

Conclusion: Both markets involve risk, but forex trading typically experiences higher volatility, potentially leading to greater rewards and losses.

5. Leverage and Margin

Leverage allows traders to control larger positions with a smaller amount of capital, magnifying both potential profits and losses.

Forex Leverage:

- Forex trading often offers high leverage, with ratios ranging from 50:1 to 500:1 or more, depending on the broker and regulatory jurisdiction.

- For example, with 100:1 leverage, a trader can control $100,000 with just $1,000.

Stock Leverage:

- Leverage in stock trading is usually lower, often capped at 2:1 for retail investors in the U.S.

- This means an investor can control $10,000 worth of stock with a $5,000 investment.

Conclusion: Forex trading typically offers higher leverage, allowing for larger positions with less capital, but this also increases risk exposure.

6. Costs and Fees

Forex Costs:

- In forex trading, costs are primarily derived from the spread, which is the difference between the bid and ask price.

- Some brokers may charge a commission, but many operate on a spread-only basis.

Stock Costs:

- Stock trading can involve various fees, including commissions, bid-ask spreads, and exchange fees.

- Many brokers now offer commission-free trading for stocks, but investors may still incur costs through spreads.

Conclusion: Forex trading generally has lower costs associated with trading compared to stocks, particularly when considering commission-free options.

7. Technical and Fundamental Analysis

Both forex and stock trading utilize technical and fundamental analysis, but the focus can differ due to the nature of the assets traded.

Forex Analysis:

- Technical Analysis: Forex traders heavily rely on charts, indicators, and price patterns to make trading decisions, given the fast-paced nature of currency trading.

- Fundamental Analysis: Economic indicators (e.g., interest rates, inflation, employment data) and geopolitical events significantly influence currency values.

Stock Analysis:

- Technical Analysis: Stock traders also use technical analysis, but they may place more emphasis on company-specific trends and historical price movements.

- Fundamental Analysis: Stock traders evaluate company fundamentals, such as earnings reports, revenue growth, and management performance, to assess a company’s potential.

Conclusion: While both markets utilize analysis methods, forex trading tends to focus more on economic indicators and technical patterns.

8. Market Participants

The types of participants in forex and stock markets can differ significantly.

Forex Market Participants:

- Central Banks: Influence currency values through monetary policy and interest rates.

- Commercial Banks: Facilitate currency exchange for clients and engage in proprietary trading.

- Hedge Funds and Institutional Investors: Participate in forex trading to hedge against risks or speculate on currency movements.

- Retail Traders: Individual traders use online platforms to trade currencies, often relying on leverage.

Stock Market Participants:

- Retail Investors: Individual investors buy and sell stocks to build wealth and generate income.

- Institutional Investors: Pension funds, mutual funds, and hedge funds invest in stocks to achieve significant returns.

- Market Makers: Provide liquidity by facilitating buy and sell orders on exchanges.

Conclusion: Both markets feature various participants, but the forex market tends to have a higher percentage of institutional traders compared to the stock market.

9. Trading Strategies

Different trading strategies are employed in forex and stock trading, reflecting the unique characteristics of each market.

Forex Trading Strategies:

- Scalping: Traders make numerous small trades throughout the day to profit from minor price changes.

- Day Trading: Positions are opened and closed within the same day, taking advantage of short-term price movements.

- Swing Trading: Traders hold positions for several days to capture larger price movements.

Stock Trading Strategies:

- Value Investing: Investors seek undervalued stocks and hold them for the long term, expecting their value to increase.

- Growth Investing: Investors look for companies with high growth potential, often paying a premium for expected future earnings.

- Dividend Investing: Investors focus on stocks that pay dividends, generating passive income while also benefiting from capital appreciation.

Conclusion: Both markets offer diverse trading strategies, but forex trading often emphasizes short-term tactics due to its volatility and liquidity.

10. Regulatory Environment

The regulatory landscape for forex and stock trading can vary significantly by region.

Forex Regulation:

- Forex trading is regulated differently across countries, with some jurisdictions having stringent regulations and others being more lenient.

- Major regulatory bodies include the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the U.S., the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

Stock Regulation:

- Stock trading is typically subject to more stringent regulations due to the ownership structure and potential for fraud.

- Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the U.S., oversee stock markets to ensure transparency and protect investors.

Conclusion: Stock trading generally operates under a more stringent regulatory framework compared to forex trading, which can vary widely based on the broker and region.

11. Accessibility and Technology

Both forex and stock trading have become increasingly accessible due to advancements in technology and online trading platforms.

Forex Trading Accessibility:

- Online brokers and trading platforms allow retail traders to access the forex market with minimal capital.

- Mobile trading applications enable traders to execute trades and monitor positions on the go.

Stock Trading Accessibility:

- The rise of commission-free trading apps has made stock trading more accessible to retail investors.

- Many platforms offer educational resources and research tools to help investors make informed decisions.

Conclusion: Both markets offer high accessibility, but forex trading is often viewed as more accessible due to lower capital requirements and greater leverage.

12. Psychology of Trading

The psychology of trading can significantly impact a trader’s success in both forex and stock markets.

Forex Trading Psychology:

- Due to the fast-paced nature of forex, traders may experience heightened emotions, leading to impulsive decisions.

- Managing fear and greed is critical, as traders can be tempted to over-leverage or hold onto losing positions for too long.

Stock Trading Psychology:

- Stock traders may experience different emotional challenges, such as attachment to losing positions or overconfidence after a winning streak.

- Long-term investing may help reduce emotional stress compared to the more immediate nature of forex trading.

Conclusion: Both forex and stock trading require strong psychological discipline, but the fast-paced forex market may pose unique challenges.

13. Conclusion: Which is Better?

Deciding whether forex trading or stock trading is better depends on individual preferences, risk tolerance, and investment goals. Here are some key points to consider:

- Time Commitment: Forex trading requires active monitoring of positions due to its 24/5 nature, while stock trading can be more flexible, especially for long-term investors.

- Risk Tolerance: If you are comfortable with higher risk and volatility, forex trading might be appealing due to its potential for high returns. Conversely, if you prefer a more stable investment with dividends, stock trading may be a better fit.

- Investment Goals: Short-term traders may find forex trading more suitable, while long-term investors might prefer stocks for capital appreciation and dividend income.

In summary, both forex and stock trading offer unique advantages and challenges. Understanding the fundamental differences between these markets will help you make informed decisions about where to invest your time and capital. Ultimately, the choice between forex and stock trading should align with your financial goals, trading style, and risk appetite.