Table of Contents

- Understanding the Forex Market

- Common Types of Forex Scams

- 2.1. Signal Seller Scams

- 2.2. Ponzi Schemes

- 2.3. Phony Forex Brokers

- 2.4. Managed Account Scams

- 2.5. Fake Trading Platforms

- Signs of a Potential Scam

- Due Diligence: Researching Brokers and Signals

- Protecting Your Investment

- Reporting Scams

- Conclusion

1. Understanding the Forex Market

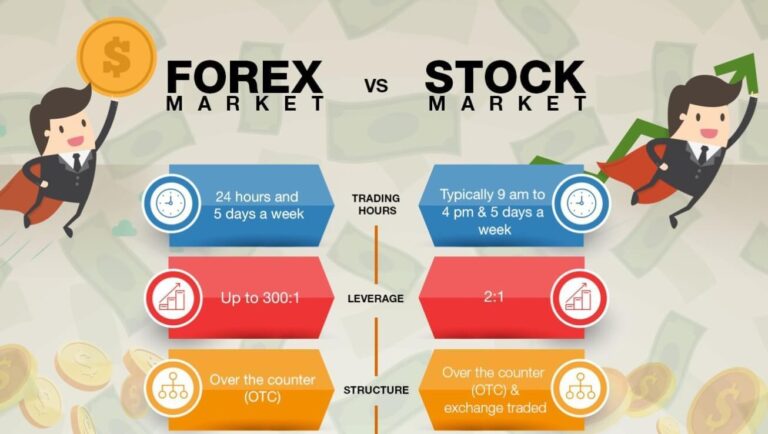

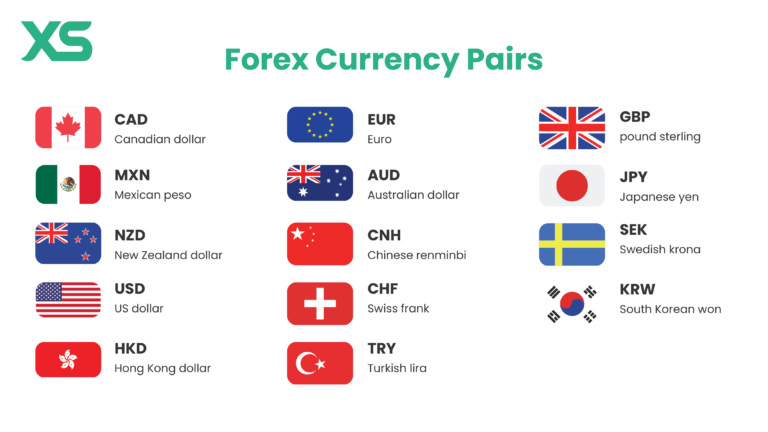

The foreign exchange (forex) market is the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. This decentralized market allows traders to buy and sell currencies, making it highly attractive for individuals seeking to profit from fluctuations in currency values.

While the forex market offers numerous opportunities, its decentralized nature and lack of regulatory oversight in some regions make it susceptible to scams. Understanding the fundamentals of forex trading and the potential risks involved is the first step in protecting yourself from fraud.

2. Common Types of Forex Scams

Forex scams come in various forms, often preying on the inexperience and naivety of new traders. Here are some of the most common scams you should be aware of:

2.1. Signal Seller Scams

Overview: Signal sellers claim to provide profitable trading signals that guarantee success. They often charge hefty fees for their services.

How They Operate:

- Promoting unrealistic success rates (e.g., 90% win rates).

- Using persuasive marketing tactics to convince traders to subscribe to their signals.

Red Flags:

- Lack of verifiable performance data.

- Pressure to act quickly or limited-time offers.

How to Avoid:

- Research the seller’s credibility and performance history.

- Look for independent reviews or testimonials from other traders.

2.2. Ponzi Schemes

Overview: Ponzi schemes involve a scammer promising high returns to investors, using the funds from newer investors to pay earlier investors.

How They Operate:

- Promising guaranteed returns with little to no risk.

- Often operate under the guise of a forex investment fund.

Red Flags:

- Promises of high, consistent returns regardless of market conditions.

- Lack of transparency regarding trading strategies and operations.

How to Avoid:

- Avoid investments that promise high returns with low risk.

- Conduct thorough research and due diligence before investing.

2.3. Phony Forex Brokers

Overview: Some brokers operate without proper licenses and may manipulate trades or steal deposits.

How They Operate:

- Claiming to be regulated or licensed without proof.

- Offering high leverage and bonuses that seem too good to be true.

Red Flags:

- Lack of regulatory oversight from recognized authorities.

- Negative reviews or complaints from other traders.

How to Avoid:

- Verify the broker’s regulatory status through official sources (e.g., FCA, ASIC, NFA).

- Use well-known and reputable brokers with positive reviews.

2.4. Managed Account Scams

Overview: Scammers offer to manage your trading account, claiming to achieve substantial returns on your investment.

How They Operate:

- Promising high returns while claiming to be expert traders.

- Requesting access to your trading account or funds.

Red Flags:

- Lack of transparency about trading strategies and results.

- Promises of unrealistic returns with no risk.

How to Avoid:

- Never give control of your account to anyone without thorough research.

- Choose reputable asset management firms that are regulated.

2.5. Fake Trading Platforms

Overview: Some scammers create fake trading platforms that look legitimate but are designed to steal your money.

How They Operate:

- Offering a sleek interface and seemingly competitive trading conditions.

- Manipulating price feeds and trade executions to cause losses.

Red Flags:

- Difficulty withdrawing funds or suspiciously high withdrawal fees.

- Technical issues or platform crashes during critical trading moments.

How to Avoid:

- Verify the legitimacy of the trading platform through reviews and regulatory checks.

- Use established trading platforms recognized in the industry.

3. Signs of a Potential Scam

Recognizing the warning signs of a forex scam is vital to protecting yourself. Here are some key indicators:

- Unrealistic Promises: If an offer sounds too good to be true, it probably is. Promises of guaranteed profits or “secret” strategies should raise suspicion.

- Lack of Transparency: If the broker or signal seller is not forthcoming about their methods, fees, and performance history, be cautious.

- Pressure Tactics: Scammers often create a sense of urgency to push you into making quick decisions. Be wary of high-pressure sales tactics.

- Poor Communication: Legitimate brokers and service providers maintain open lines of communication. If you encounter difficulties reaching customer support or getting answers, consider it a red flag.

4. Due Diligence: Researching Brokers and Signals

Before engaging with any forex broker or service, conducting thorough research is crucial. Here’s how to perform due diligence:

a) Check Regulatory Status

Always verify that the broker is regulated by a recognized authority. Regulatory bodies help ensure that brokers operate fairly and transparently. Some reputable regulators include:

- FCA (UK Financial Conduct Authority)

- ASIC (Australian Securities and Investments Commission)

- NFA (National Futures Association, USA)

b) Read Reviews and Testimonials

Look for independent reviews and testimonials from other traders. Websites like Trustpilot or ForexPeaceArmy can provide insights into the broker’s reputation and performance.

c) Test Customer Support

Reach out to customer support with questions before opening an account. Assess their responsiveness and professionalism. A reliable broker should provide prompt and helpful assistance.

d) Compare Trading Conditions

Evaluate the trading conditions offered by different brokers, such as spreads, commissions, leverage, and available trading instruments. Choose a broker that meets your trading needs.

5. Protecting Your Investment

Taking proactive measures can help safeguard your investment from potential scams. Here are some strategies:

a) Use Strong Passwords and Two-Factor Authentication

Ensure that your trading account is secure by using strong, unique passwords and enabling two-factor authentication whenever possible.

b) Limit the Amount You Invest

When starting with a new broker or trading service, limit your investment to a small amount until you gain confidence in their legitimacy.

c) Educate Yourself

Knowledge is your best defense against scams. Continuously educate yourself about forex trading, market analysis, and risk management. The more you know, the less likely you are to fall for scams.

d) Stay Skeptical

Always maintain a healthy level of skepticism when presented with investment opportunities. If something seems too good to be true, take a step back and reevaluate.

6. Reporting Scams

If you encounter a forex scam or suspect fraudulent activity, it’s essential to report it to the appropriate authorities. Here’s how to proceed:

a) Contact Regulatory Bodies

Report the scam to the regulatory authority that oversees the broker or service provider. They may be able to take action against the scammer and protect other traders.

b) File a Complaint

File a complaint with consumer protection agencies in your country. Many countries have organizations dedicated to handling financial fraud and scams.

c) Alert the Trading Community

Share your experience in online trading forums and social media groups. Informing others about potential scams can help protect fellow traders.

d) Consider Legal Action

If you have lost a significant amount of money due to a scam, consider seeking legal advice to explore options for recovering your funds.

7. Conclusion

The forex market offers tremendous opportunities for traders, but it also poses risks, especially from scams targeting inexperienced individuals. By understanding the common types of forex scams and recognizing the signs of potential fraud, you can protect yourself and your investments.

Conduct thorough research, maintain skepticism, and implement effective risk management strategies to ensure a safe and profitable trading experience. Remember, education and diligence are your best allies in navigating the forex market responsibly. By taking these precautions, you can pursue your trading goals without falling victim to scams, allowing you to focus on building a successful forex trading career.