Foreign exchange trading, or Forex, has gained immense popularity among retail traders over the last few decades. It offers unparalleled liquidity, a 24-hour market, and the ability to start trading with relatively low capital. However, the appeal of making fast money is often matched by the risk of losing it just as quickly. Forex trading is not just about entering and exiting trades; it requires a deep understanding of global markets, the development of a strategic mindset, and rigorous self-discipline.

This article will cover the essential steps to becoming a successful Forex trader, from learning the basics of the market to developing a trading strategy, understanding risk management, and choosing the right tools and platforms.

Table of Contents

- Understanding Forex Trading

- What is Forex Trading?

- Currency Pairs and Pips

- Leverage and Margin

- The Role of Liquidity

- Building the Right Foundation

- Education and Learning

- Understanding Market Analysis

- Psychological Preparedness

- Selecting the Right Broker and Tools

- Choosing a Reliable Forex Broker

- Trading Platforms

- Additional Tools for Success

- Developing a Forex Trading Strategy

- Technical vs. Fundamental Analysis

- Key Forex Strategies

- Testing and Refining Your Strategy

- Risk Management

- The Importance of Risk Management

- Setting Stop-Loss and Take-Profit Orders

- Position Sizing and Leverage Control

- Continuous Learning and Adaptation

- Conclusion

1. Understanding Forex Trading

What is Forex Trading?

Forex (FX) trading involves the buying and selling of currencies in the global marketplace. Unlike the stock market, which operates on central exchanges, Forex trading takes place over the counter (OTC), meaning it’s conducted electronically between traders worldwide through a decentralized network.

The Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. The main participants include banks, governments, large corporations, hedge funds, and retail traders.

Currency Pairs and Pips

In Forex, currencies are traded in pairs, such as EUR/USD or GBP/JPY. Each currency pair represents a relationship between two currencies, where the first (the base currency) is compared to the second (the quote currency). For example, in the pair EUR/USD, if the exchange rate is 1.1000, it means 1 Euro equals 1.10 US dollars.

A “pip” is the smallest price move that an exchange rate can make based on market convention. Most currency pairs are quoted to four decimal places, so a movement from 1.1000 to 1.1001 is a one-pip change.

Leverage and Margin

Forex brokers offer traders leverage, allowing them to control large positions with a smaller amount of capital. For example, a leverage of 100:1 means that with $1,000, you can control a $100,000 position. While this can magnify profits, it also increases the risk of substantial losses.

Margin refers to the collateral you must deposit with your broker to open a leveraged position. Understanding how leverage and margin work is essential for managing risk effectively.

The Role of Liquidity

Liquidity is a measure of how easily you can enter or exit trades in the Forex market. High liquidity means large volumes of currency can be traded without significant price fluctuations, which is one reason Forex trading can be so attractive. The most liquid currency pairs are those associated with major economies, such as EUR/USD, GBP/USD, and USD/JPY.

2. Building the Right Foundation

Education and Learning

Becoming a Forex trader requires a deep understanding of how the market works, and that starts with education. Various resources, including online courses, webinars, and tutorials, are available for aspiring traders. Learning the basics of Forex trading, such as how to read currency charts, identify trends, and analyze economic data, is essential.

Some key areas to study include:

- Types of market analysis (technical and fundamental)

- Key indicators such as Moving Averages, RSI, and Bollinger Bands

- Economic factors that influence currency movements (e.g., interest rates, inflation, and geopolitical events)

Understanding Market Analysis

Forex trading is driven by two main forms of market analysis: technical analysis and fundamental analysis.

- Technical Analysis involves analyzing historical price movements and patterns using charts and indicators. Traders use this data to predict future price movements.

- Fundamental Analysis focuses on economic indicators, news events, and geopolitical developments that impact currency values. This includes understanding economic calendars, interest rates, and government policies.

Psychological Preparedness

The psychological aspect of trading is often overlooked but plays a crucial role in success. A strong mental game is required to manage losses, handle emotions, and avoid impulsive trading decisions. Successful traders practice patience, discipline, and emotional control, knowing that no trade is a guaranteed win.

3. Selecting the Right Broker and Tools

Choosing a Reliable Forex Broker

Selecting the right broker is critical to your success in Forex trading. Factors to consider include:

- Regulation: Ensure the broker is regulated by a recognized financial authority (e.g., FCA, ASIC, or CySEC).

- Spreads and Fees: Understand the spreads (the difference between the bid and ask prices) and any commissions charged by the broker.

- Leverage Options: Choose leverage that aligns with your risk tolerance.

- Customer Service: Ensure the broker provides responsive customer support.

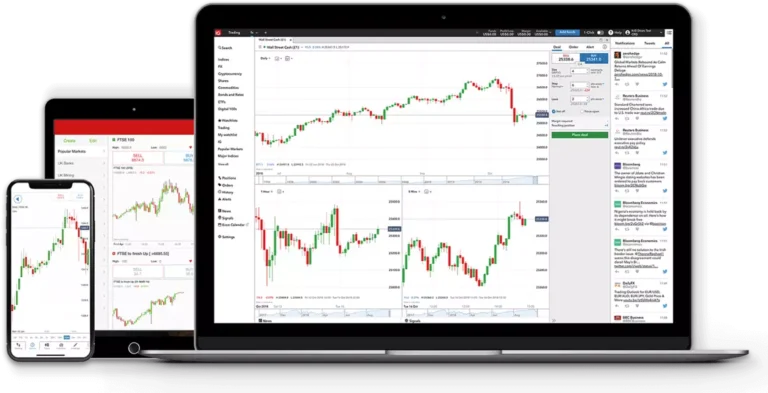

Trading Platforms

The most commonly used Forex trading platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer charting tools, market indicators, and automated trading systems (Expert Advisors).

Ensure that the platform you choose is user-friendly, has robust security features, and supports your preferred trading style.

Additional Tools for Success

Successful Forex traders use various tools to improve their performance:

- Economic Calendars: Track important news events that can impact currency prices.

- Trading Journals: Record your trades, including reasons for entering and exiting, and review them to improve.

- Position Size Calculators: Help determine the appropriate size for each trade based on risk tolerance.

4. Developing a Forex Trading Strategy

Technical vs. Fundamental Analysis

A solid Forex trading strategy is built on either technical analysis, fundamental analysis, or a combination of both.

- Technical traders focus on price charts and indicators, looking for patterns like head and shoulders, flags, or double bottoms.

- Fundamental traders base their trades on economic data, news events, and interest rates.

Key Forex Strategies

Some popular Forex strategies include:

- Scalping: Involves making multiple small trades throughout the day to capture tiny price movements.

- Day Trading: Traders open and close trades within a single trading day, avoiding overnight exposure.

- Swing Trading: Positions are held for days or weeks to capture larger price moves.

- Position Trading: Long-term trading strategy where positions are held for months, sometimes years, based on fundamental analysis.

Testing and Refining Your Strategy

Before trading live, test your strategy on a demo account. This allows you to refine your approach without risking real money. Once comfortable, you can begin live trading with small positions, gradually increasing your exposure as you gain experience.

5. Risk Management

The Importance of Risk Management

In Forex trading, it is crucial to understand that capital preservation is more important than chasing profits. Proper risk management ensures that you can stay in the market long enough to develop skills and grow your trading account.

Setting Stop-Loss and Take-Profit Orders

Stop-loss orders automatically close a trade if it moves against you by a certain amount, limiting your losses. Take-profit orders lock in profits once a trade reaches a specific target.

Traders must define these levels before entering a trade and stick to them. Emotional decision-making often leads to overtrading or holding onto losing positions for too long.

Position Sizing and Leverage Control

Position sizing is a risk management technique that involves controlling the size of each trade relative to your account balance. Many traders use the “1% rule,” meaning they only risk 1% of their capital on any given trade. Proper position sizing and leverage control are essential to ensure that a single trade doesn’t wipe out your entire account.

6. Continuous Learning and Adaptation

Forex trading is dynamic, and what works today may not work tomorrow. To succeed, traders must continually adapt to changing market conditions. This means staying up-to-date with global economic events, refining strategies, and learning from past mistakes.

Joining Forex trading communities, attending webinars, and reading trading books are excellent ways to stay informed. Tracking performance and adjusting strategies based on market changes is key to long-term success.

Conclusion

Becoming a successful Forex trader requires dedication, patience, and a willingness to continuously learn and adapt. It’s not enough to rely on a single trading strategy or follow market signals blindly. Instead, traders must build a solid foundation of market knowledge, choose the right broker and tools, develop a tested strategy, and manage risks effectively.

By following the steps outlined in this article, you will be better equipped to navigate the Forex market and improve your chances of achieving success. Remember, consistency is key—small, steady gains over time are far more sustainable than aiming for quick, high-risk profits.