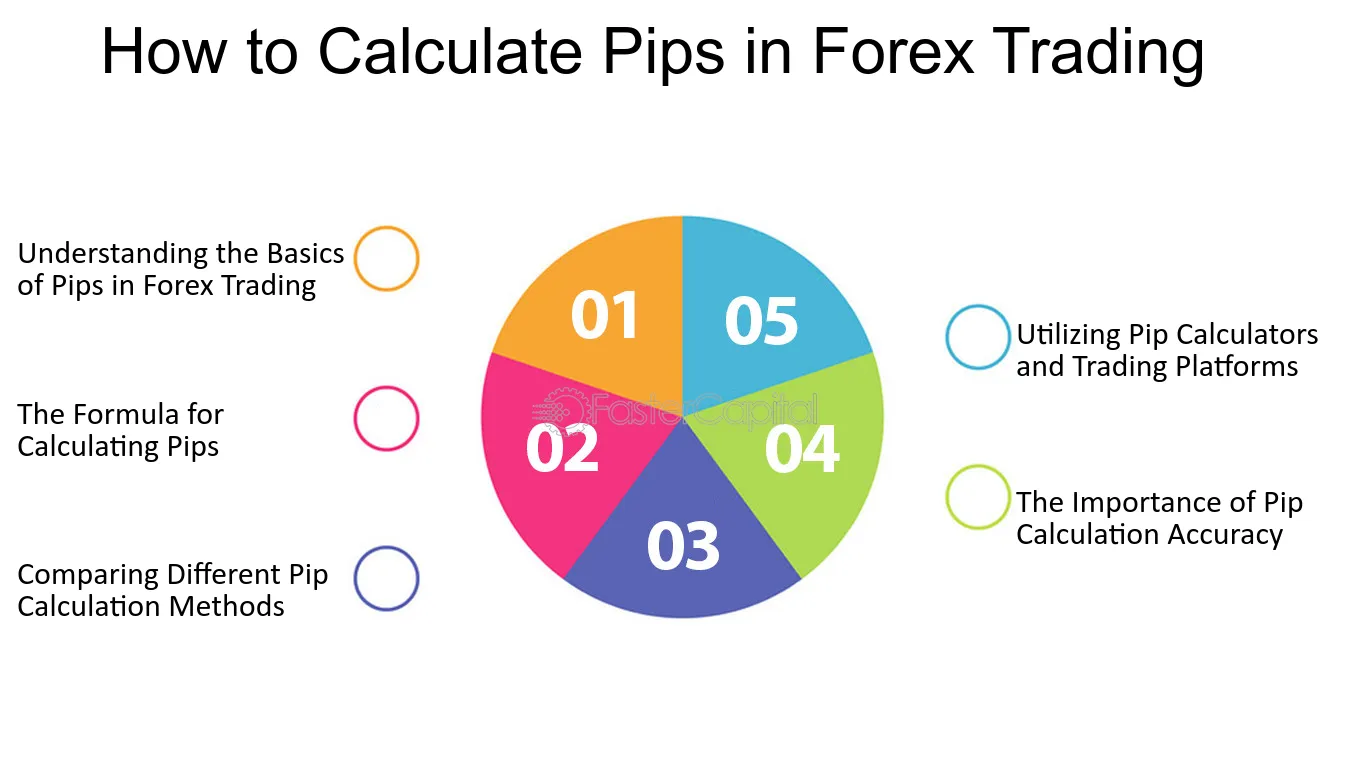

Pips are the foundation of forex trading. They are the smallest unit of price movement in a currency pair and play a critical role in determining both profits and losses. Understanding how to calculate pips is crucial for any forex trader, as it directly influences trading strategies and risk management decisions. In this article, we will dive deep into the concept of pips, how to calculate them, and how money management strategies like risk-reward ratio and position sizing can help you succeed in the forex market.

Table of Contents

- What Is a Pip in Forex?

- How to Calculate Pips

- Calculating Pips for Major Currency Pairs

- Calculating Pips for Cross Currency Pairs

- Pips in Japanese Yen Pairs

- Why Pips Are Important in Forex Trading

- Understanding Pip Value

- How to Calculate Pip Value

- Pip Value for Different Lot Sizes

- Examples of Pip Calculation

- What is Money Management in Forex?

- Key Money Management Concepts

- The 1-2% Risk Rule

- Risk-Reward Ratio

- Position Sizing

- Using Stop-Loss and Take-Profit Orders

- Money Management Strategies for Forex Trading

- Strategy 1: Fixed Percentage Risk Per Trade

- Strategy 2: Kelly Criterion

- Strategy 3: Martingale Strategy

- Common Mistakes in Money Management

- Conclusion

1. What Is a Pip in Forex?

A pip (short for “percentage in point” or “price interest point”) is the smallest price movement in a currency pair’s exchange rate, traditionally measured as the fourth decimal place (0.0001) in most currency pairs. For pairs involving the Japanese yen, a pip is measured as the second decimal place (0.01).

For example:

- If the EUR/USD pair moves from 1.1000 to 1.1005, it has moved 5 pips.

- In the USD/JPY pair, if the price moves from 110.00 to 110.10, that’s a movement of 10 pips.

Understanding pips is critical in forex trading because they form the basis of calculating profits and losses.

2. How to Calculate Pips

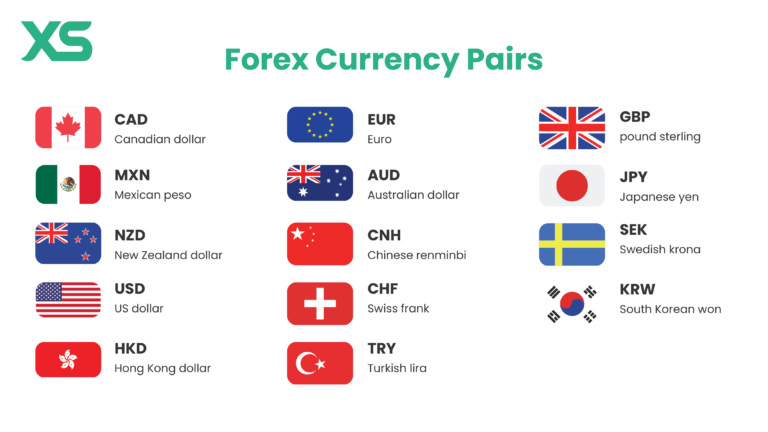

The calculation of pips in forex varies depending on the currency pair being traded. Different pairs have different decimal placements, but the basic calculation principle remains consistent.

Calculating Pips for Major Currency Pairs

For most currency pairs (EUR/USD, GBP/USD, AUD/USD), a pip is the fourth decimal place. Here’s how you can calculate the number of pips:

- Formula: Pips=(New Price−Old Price)×10,000\text{Pips} = (\text{New Price} – \text{Old Price}) \times 10,000Pips=(New Price−Old Price)×10,000

Example 1:

- If EUR/USD moves from 1.1100 to 1.1150, the pip movement is: (1.1150−1.1100)×10,000=50 pips(1.1150 – 1.1100) \times 10,000 = 50 \, \text{pips}(1.1150−1.1100)×10,000=50pips

Calculating Pips for Cross Currency Pairs

For cross currency pairs that do not involve USD (e.g., EUR/GBP, AUD/CAD), the pip calculation follows the same rule of counting the fourth decimal place. However, some brokers may apply slight variations depending on the pair.

Pips in Japanese Yen Pairs

For yen pairs (e.g., USD/JPY, EUR/JPY), a pip is the second decimal place.

- Formula: Pips=(New Price−Old Price)×100\text{Pips} = (\text{New Price} – \text{Old Price}) \times 100Pips=(New Price−Old Price)×100

Example 2:

- If USD/JPY moves from 110.25 to 110.75, the pip movement is: (110.75−110.25)×100=50 pips(110.75 – 110.25) \times 100 = 50 \, \text{pips}(110.75−110.25)×100=50pips

3. Why Pips Are Important in Forex Trading

Pips are fundamental to forex trading because they serve as the measure of how much you can win or lose in a trade. Traders monitor pip movements to evaluate their gains or losses, helping them make informed decisions.

Understanding pips is also essential for:

- Risk Management: Knowing pip values helps you set stop-loss orders and calculate the risk associated with each trade.

- Profit Targeting: Traders often set take-profit levels based on pip movements.

- Spread Calculation: The spread (the difference between the bid and ask price) is measured in pips and determines the cost of opening a trade.

4. Understanding Pip Value

The value of a pip changes depending on factors like the currency pair being traded, the size of the trade (lot size), and the currency in which your account is denominated. To calculate your profit or loss in monetary terms, you need to understand the pip value.

How to Calculate Pip Value

The pip value is determined using the following formula:

Pip Value=Pip in Decimal Places×Trade SizeCurrent Exchange Rate of Pair\text{Pip Value} = \frac{\text{Pip in Decimal Places} \times \text{Trade Size}}{\text{Current Exchange Rate of Pair}}Pip Value=Current Exchange Rate of PairPip in Decimal Places×Trade Size

Pip Value for Different Lot Sizes

- Standard Lot (100,000 units): Each pip is worth approximately $10 in a USD-denominated account for most major pairs.

- Mini Lot (10,000 units): Each pip is worth approximately $1.

- Micro Lot (1,000 units): Each pip is worth approximately $0.10.

Example 3:

- For EUR/USD, if the exchange rate is 1.1200 and you’re trading 1 standard lot (100,000 units): Pip Value=0.0001×100,0001.1200=8.93 USD per pip\text{Pip Value} = \frac{0.0001 \times 100,000}{1.1200} = 8.93 \, \text{USD per pip}Pip Value=1.12000.0001×100,000=8.93USD per pip

5. Examples of Pip Calculation

Let’s look at an example to put everything together.

Scenario:

- You buy 1 mini lot (10,000 units) of EUR/USD at 1.1300.

- The price rises to 1.1350, and you close your position.

The number of pips you gained:

(1.1350−1.1300)×10,000=50 pips(1.1350 – 1.1300) \times 10,000 = 50 \, \text{pips}(1.1350−1.1300)×10,000=50pipsPip value for 1 mini lot:

Pip Value=0.0001×10,0001.1300=0.88 USD per pip\text{Pip Value} = \frac{0.0001 \times 10,000}{1.1300} = 0.88 \, \text{USD per pip}Pip Value=1.13000.0001×10,000=0.88USD per pipTotal profit:

50 pips×0.88 USD per pip=44 USD50 \, \text{pips} \times 0.88 \, \text{USD per pip} = 44 \, \text{USD}50pips×0.88USD per pip=44USD

6. What is Money Management in Forex?

Money management in forex refers to the methods and strategies traders use to manage risk and preserve their capital while trading. Without proper money management, even the best trading strategies can result in significant losses.

Effective money management involves setting appropriate risk levels for each trade, determining optimal position sizes, and using stop-loss and take-profit orders to control losses and lock in gains.

7. Key Money Management Concepts

The 1-2% Risk Rule

One of the most common risk management strategies in forex is the 1-2% rule. This rule suggests that you should never risk more than 1-2% of your trading account balance on a single trade. This helps you preserve capital and protect yourself from major losses.

Risk-Reward Ratio

The risk-reward ratio measures the amount of risk you’re willing to take for a potential reward. A common ratio is 1:3, meaning for every dollar risked, you aim to gain three dollars. To calculate the risk-reward ratio:

Risk-Reward Ratio=Potential ProfitPotential Loss\text{Risk-Reward Ratio} = \frac{\text{Potential Profit}}{\text{Potential Loss}}Risk-Reward Ratio=Potential LossPotential ProfitFor example, if you risk 50 pips but target a profit of 150 pips, the ratio is:

15050=3:1\frac{150}{50} = 3:150150=3:1

Position Sizing

Position sizing refers to determining how many lots or units you should trade based on your risk tolerance and the size of your account. Proper position sizing is critical for controlling risk and staying within your money management plan.

- Position Size Formula: Position Size=Account RiskPip Value×Stop-Loss Distance (in Pips)\text{Position Size} = \frac{\text{Account Risk}}{\text{Pip Value} \times \text{Stop-Loss Distance (in Pips)}}Position Size=Pip Value×Stop-Loss Distance (in Pips)Account Risk

Using Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for controlling risk. A stop-loss order automatically closes a trade when the price moves against you by a specified amount. A take-profit order locks in your gains when the price reaches a target level.

8. Money Management Strategies for Forex Trading

Strategy 1: Fixed Percentage Risk Per Trade

This strategy involves risking a fixed percentage of your trading account balance on each trade, typically between 1-2%. As your account grows, the risk per trade increases proportionally, but the percentage remains constant.

Strategy 2: Kelly Criterion

The Kelly Criterion is a more aggressive strategy that helps you determine the optimal position size based on your trading strategy’s past performance. It calculates the ideal position size to maximize returns while managing risk.

Strategy 3: Martingale Strategy

The Martingale strategy involves doubling your position size after each loss, with the expectation that eventually, a winning trade will recover all previous losses. However, this approach is highly risky and not recommended for most traders due to the potential for large drawdowns.

9. Common Mistakes in Money Management

- Over-Leveraging: Using too much leverage increases the risk of significant losses.

- Ignoring Stop-Loss Orders: Failing to use stop-loss orders can lead to larger-than-expected losses.

- Risking Too Much on a Single Trade: Risking a large portion of your account on one trade can quickly lead to account depletion.

10. Conclusion

Calculating pips and managing your money effectively are critical skills for successful forex trading. Understanding how to calculate pips, pip value, and employing proper money management techniques will help you minimize risk and maximize potential gains. By using strategies like the 1-2% rule, maintaining a solid risk-reward ratio, and correctly sizing your positions, you can preserve your capital and improve your long-term profitability in the forex market. Remember, consistency in risk management is key to becoming a successful trader.