Cryptocurrency investment has become a popular way for individuals to seek financial gains, with many investors having profited from the rapid rise in the value of digital assets like Bitcoin, Ethereum, and various altcoins. While investing in cryptocurrency can be highly rewarding, it also involves risks due to the volatility and unpredictability of the market.

This guide will walk you through the steps of how to invest in cryptocurrency for profit, explain key strategies, and highlight risks to be aware of.

Step 1: Understand the Basics of Cryptocurrency

Before investing, it’s essential to have a basic understanding of what cryptocurrency is and how it works:

- Cryptocurrency: A form of digital or virtual currency that uses cryptography for security and operates on decentralized networks known as blockchains.

- Blockchain Technology: The underlying technology that powers cryptocurrencies, enabling secure, transparent, and immutable transactions.

- Altcoins: These are any cryptocurrencies other than Bitcoin. Ethereum (ETH), Solana (SOL), and Ripple (XRP) are popular examples.

- Stablecoins: Cryptocurrencies that are pegged to the value of stable assets like the U.S. dollar (e.g., USDT or USDC), offering a less volatile investment option.

Step 2: Choose the Right Cryptocurrency

The cryptocurrency market offers thousands of digital assets, but not all of them are suitable for investment. Here’s how to choose wisely:

- Bitcoin (BTC): Often referred to as digital gold, Bitcoin is the largest and most established cryptocurrency. It is typically considered a safer option for long-term investors.

- Ethereum (ETH): Known for its smart contract capabilities, Ethereum is the second-largest cryptocurrency and a major player in decentralized finance (DeFi) and NFTs (non-fungible tokens).

- Altcoins: These include a wide range of projects, from more stable coins like Litecoin to highly speculative options like Dogecoin or Shiba Inu. While some altcoins have high profit potential, they also come with higher risks.

- Research: Look into the fundamentals of the cryptocurrency you’re interested in—its use case, development team, adoption rate, and market potential. CoinMarketCap and CoinGecko are useful platforms for tracking the market capitalization and performance of different cryptocurrencies.

Step 3: Choose a Cryptocurrency Exchange

To invest in cryptocurrency, you’ll need to choose a reliable exchange. These platforms allow you to buy, sell, and hold cryptocurrencies. Popular choices include:

- Binance: Offers a wide range of cryptocurrencies and features for trading. Suitable for both beginners and advanced users.

- Coinbase: A user-friendly platform that’s ideal for beginners. It supports a limited number of major cryptocurrencies.

- Kraken: A reputable exchange known for its security and a wide selection of coins.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and PancakeSwap allow for direct peer-to-peer trading of cryptocurrencies without intermediaries, providing access to more obscure tokens.

Step 4: Create and Secure Your Wallet

After purchasing cryptocurrency, it’s crucial to store your assets securely. There are two primary types of wallets:

- Hot Wallets (Online Wallets): These are connected to the internet, making them more convenient for daily transactions but also more vulnerable to hacks. Examples include Trust Wallet, MetaMask, and exchange wallets.

- Cold Wallets (Hardware Wallets): These are offline wallets that provide the highest level of security, making them ideal for long-term holding. Examples include Ledger Nano S and Trezor.

For serious investors, it’s recommended to store the bulk of your holdings in a cold wallet to minimize the risk of cyberattacks.

Step 5: Develop a Clear Investment Strategy

To invest in cryptocurrency for profit, you need a clear strategy. Some of the most common strategies include:

1. HODLing (Buy and Hold)

The HODL strategy involves purchasing cryptocurrency and holding onto it for an extended period, regardless of market volatility, with the expectation that its value will rise over time. This strategy works best with well-established cryptocurrencies like Bitcoin and Ethereum.

Key Points:

- Suitable for long-term investors.

- Focus on major cryptocurrencies with solid track records.

- Ideal for those who want to minimize short-term trading risks.

2. Dollar-Cost Averaging (DCA)

Dollar-cost averaging is the practice of investing a fixed amount of money at regular intervals (e.g., weekly or monthly) into a cryptocurrency, regardless of its current price. This strategy helps mitigate the effects of market volatility by spreading out investments over time.

Key Points:

- Reduces the impact of short-term price fluctuations.

- Helps avoid the emotional pitfalls of market timing.

- Effective for long-term portfolio growth.

3. Swing Trading

Swing trading involves taking advantage of the market’s price fluctuations. Traders buy when the price is low and sell when the price is high within a short or medium timeframe (days, weeks, or months). It requires more active involvement and knowledge of technical analysis.

Key Points:

- High potential for quick profits but also increased risks.

- Requires monitoring market trends and price movements closely.

- Suitable for those willing to dedicate time to trading.

4. Staking and Yield Farming

Some cryptocurrencies allow you to earn passive income by staking your coins (locking them in a network to support its operations) or participating in yield farming (providing liquidity to decentralized finance platforms).

Key Points:

- Suitable for those looking for steady income.

- Staking provides rewards in the form of interest or additional tokens.

- Yield farming is riskier, as it involves locking your funds in liquidity pools that can be subject to hacks.

Step 6: Managing Risk

Investing in cryptocurrency involves substantial risk, and it’s important to have a solid risk management plan in place:

- Diversify Your Portfolio: Avoid putting all your money into one cryptocurrency. Diversification across several assets can help reduce risk and cushion potential losses.

- Only Invest What You Can Afford to Lose: Cryptocurrency markets are extremely volatile, and prices can drop significantly within short periods. Never invest more than you’re willing to lose.

- Set Clear Investment Goals: Decide whether you’re aiming for long-term growth or short-term gains. Have a clear exit strategy and set profit targets to lock in gains.

- Use Stop-Loss Orders: For active traders, stop-loss orders help limit losses by automatically selling your assets if they drop to a certain price.

Step 7: Monitor and Adjust Your Investment

After making your investment, it’s important to monitor the performance of your cryptocurrency portfolio:

- Track the Market: Regularly check the price movements of your assets. You can use apps like Blockfolio or CoinGecko to monitor your portfolio and market trends.

- Stay Informed: Keep up with news, developments, and regulatory changes that could impact the cryptocurrency market. Twitter, Reddit, and crypto news sites like CoinDesk and The Block provide timely information.

- Rebalance Your Portfolio: Over time, certain assets may outperform others, leading to an unbalanced portfolio. Periodically rebalance your investments to ensure you’re maintaining your desired level of risk and exposure.

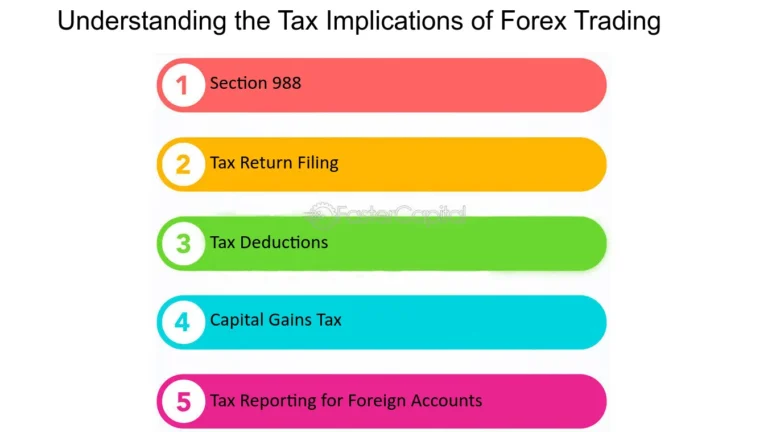

Step 8: Understand the Tax Implications

In many countries, cryptocurrency investments are subject to taxation. Capital gains taxes may apply when you sell your cryptocurrency at a profit. It’s important to understand your local tax laws and keep detailed records of all your trades and investments.

Conclusion

Investing in cryptocurrency offers the potential for significant profit, but it also comes with a high level of risk due to market volatility. By understanding the market, choosing the right assets, developing a clear strategy, and managing your risks, you can navigate the world of cryptocurrency investing successfully.

Remember, patience and discipline are key when investing in cryptocurrencies. Start small, learn continuously, and never invest more than you can afford to lose. With the right approach, cryptocurrency can be a rewarding addition to your investment portfolio.