Forex trading, or foreign exchange trading, involves buying and selling currencies with the aim of making a profit. As the largest financial market in the world, with over $6 trillion traded daily, forex offers numerous opportunities for traders to make money. However, it also involves risk, and beginners need to understand the basics, strategies, and risks before diving in.

Here’s a step-by-step guide for beginners to make money with forex trading.

1. Understanding Forex Basics

Before you can make money trading forex, you need to understand the fundamentals:

- Currency Pairs: Forex trading involves trading in pairs, where one currency is bought, and another is sold simultaneously. The most popular currency pairs are called majors, like EUR/USD, GBP/USD, and USD/JPY.

- Pip: A pip is the smallest price movement in a currency pair, typically the fourth decimal point (e.g., 0.0001 for most pairs).

- Leverage: Forex brokers often offer leverage, allowing you to control a large position with a small amount of capital. For example, 1:100 leverage means you can control $100,000 with just $1,000.

- Spread: The spread is the difference between the buying price (ask) and the selling price (bid) of a currency pair. It is a key cost of trading.

2. Choosing a Forex Broker

Choosing the right broker is essential for success in forex trading. Here’s what to look for:

- Regulation: Ensure the broker is regulated by financial authorities like the FCA (UK), CySEC (EU), or ASIC (Australia). This guarantees security for your funds.

- Low Spreads and Fees: Lower spreads mean lower transaction costs. Compare brokers and choose one that offers tight spreads.

- Leverage Options: Start with moderate leverage (1:50 or 1:100) until you gain experience.

- Account Types: Many brokers offer demo accounts (virtual trading), standard accounts, and raw spread accounts. Beginners should start with a demo account to practice trading without risk.

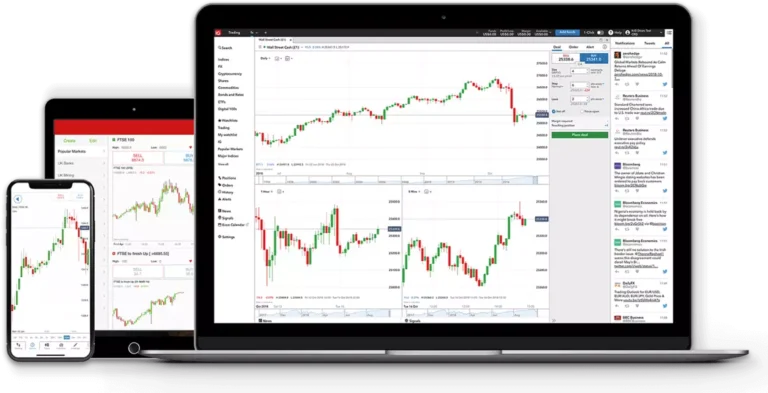

- Trading Platforms: Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used for forex trading.

3. Learn Technical and Fundamental Analysis

To make money in forex trading, you need to know how to predict the direction of currency prices. Two major approaches to analysis are technical analysis and fundamental analysis.

Technical Analysis

Technical analysis involves studying price charts and patterns to predict future price movements. Key tools and concepts include:

- Charts and Candlestick Patterns: Common patterns like head and shoulders, double tops/bottoms, and flags can signal market reversals or continuations.

- Indicators: Indicators like the Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands help identify trends, entry, and exit points.

- Support and Resistance Levels: These are price levels where the currency has historically had difficulty moving beyond (resistance) or below (support).

Fundamental Analysis

Fundamental analysis involves analyzing economic, political, and financial data to forecast currency movements. Key factors include:

- Interest Rates: Central banks set interest rates, which directly influence currency value. Rising rates usually strengthen a currency, while falling rates weaken it.

- Economic Indicators: Reports like GDP, inflation, and employment figures influence currency prices. For example, strong economic data often boosts a currency.

- Geopolitical Events: Political stability and global events (like wars or trade agreements) can cause volatility in the forex market.

4. Develop a Trading Strategy

A solid trading strategy is crucial for consistent profits. Here are a few strategies beginners can use:

Day Trading

- What it is: Day trading involves opening and closing trades within a single day, capitalizing on small price movements.

- Best for: Traders who can monitor the market throughout the day.

- Tip: Focus on currency pairs with low spreads and high liquidity, such as EUR/USD.

Swing Trading

- What it is: Swing traders hold positions for several days or weeks, aiming to profit from medium-term market movements.

- Best for: Traders with limited time who prefer fewer but longer trades.

- Tip: Use a combination of technical and fundamental analysis to identify trends.

Scalping

- What it is: Scalping involves making small, quick trades within minutes or seconds to profit from tiny price fluctuations.

- Best for: Traders who can react quickly and want fast results.

- Tip: Choose brokers with very low spreads since this strategy involves frequent trades.

Position Trading

- What it is: Position traders hold trades for weeks or months, basing their decisions on long-term trends and economic fundamentals.

- Best for: Traders with patience and a focus on long-term gains.

- Tip: Fundamental analysis is key for this strategy.

5. Risk Management

Risk management is one of the most important aspects of forex trading. It helps protect your capital and prevents large losses.

1% Rule

A common rule is to never risk more than 1% of your trading capital on a single trade. For example, if you have $1,000 in your account, you should risk only $10 on a trade.

Stop-Loss Orders

Always use a stop-loss order to limit your potential loss. A stop-loss automatically closes your position if the market moves against you by a predetermined amount. This ensures that you don’t lose more than you’re willing to risk.

Take-Profit Orders

A take-profit order automatically closes your trade once it reaches a set profit target. This locks in profits before the market can reverse.

Leverage Control

Beginners should use low leverage. High leverage amplifies both potential gains and losses. As a rule of thumb, start with 1:50 or 1:100 leverage, and only increase it when you have more experience.

6. Start with a Demo Account

If you’re a beginner, the best way to learn forex trading without risking real money is to start with a demo account. Most brokers offer demo accounts with virtual money where you can practice trading in a risk-free environment. Use the demo account to:

- Get familiar with the broker’s platform.

- Test your trading strategies.

- Learn how to place and manage trades.

- Understand how leverage and margin work.

Only switch to a live account when you feel comfortable with your strategy and have a good grasp of the market.

7. Keep a Trading Journal

A trading journal helps track your trades, analyze your performance, and learn from your mistakes. Record details like:

- The currency pair you traded.

- Your entry and exit points.

- Why you entered the trade (strategy/analysis).

- The outcome (profit or loss).

By reviewing your trading journal, you can identify patterns in your trading behavior and fine-tune your strategies.

8. Control Your Emotions

Forex trading can be emotionally challenging, especially when you’re dealing with real money. Greed and fear are common emotions that can lead to poor decisions.

- Avoid chasing losses: If a trade goes against you, don’t immediately try to recover the loss with another trade. Stick to your strategy and risk management plan.

- Don’t overtrade: Focus on quality trades rather than trying to trade all the time.

- Be patient: Profitable trading requires patience and discipline. Don’t expect to become rich overnight.

9. Stay Informed

The forex market is constantly influenced by news and events. Stay informed about:

- Economic news: Central bank meetings, interest rate decisions, and economic reports can cause significant currency movements.

- Political events: Elections, trade deals, and geopolitical tensions also impact forex markets.

Many brokers provide economic calendars and news feeds to help you stay updated on important events.

10. Start Small

When you’re ready to trade with real money, start small. Avoid trading large positions or using high leverage initially. Grow your account steadily over time by compounding profits rather than risking too much in one trade.

Conclusion

Making money with forex trading as a beginner is possible, but it requires a clear understanding of the market, proper risk management, and discipline. Start by learning the basics, developing a trading strategy, and using a demo account to practice. With the right mindset and tools, you can gradually build your skills and increase your chances of success in forex trading.

Remember, consistent profits come from following a plan, managing risk, and staying patient. Keep learning, refine your strategy, and don’t rush—success in forex trading takes time.