Forex (foreign exchange) trading revolves around the exchange of currencies. Unlike stocks or commodities, forex transactions involve the simultaneous buying of one currency and selling of another. To navigate the world of forex trading, understanding currency pairs and their quotes is essential. This article will guide you through the details of reading and interpreting currency pairs and quotes, equipping you with the necessary knowledge to trade confidently.

Table of Contents:

- What Are Currency Pairs?

- Understanding Base and Quote Currencies

- Types of Currency Pairs

- How to Read Forex Quotes

- Bid and Ask Prices Explained

- Understanding Spreads in Forex Trading

- Direct vs. Indirect Quotes

- Currency Pair Pricing and Pip Movement

- How to Calculate Profit and Loss with Currency Pairs

- Factors That Affect Currency Pair Prices

- Conclusion

1. What Are Currency Pairs?

In forex trading, currencies are always traded in pairs. A currency pair represents the value of one currency in relation to another. This is because a trade in the forex market involves buying one currency while simultaneously selling another. For example, when you trade the EUR/USD currency pair, you are buying euros and selling U.S. dollars at the same time.

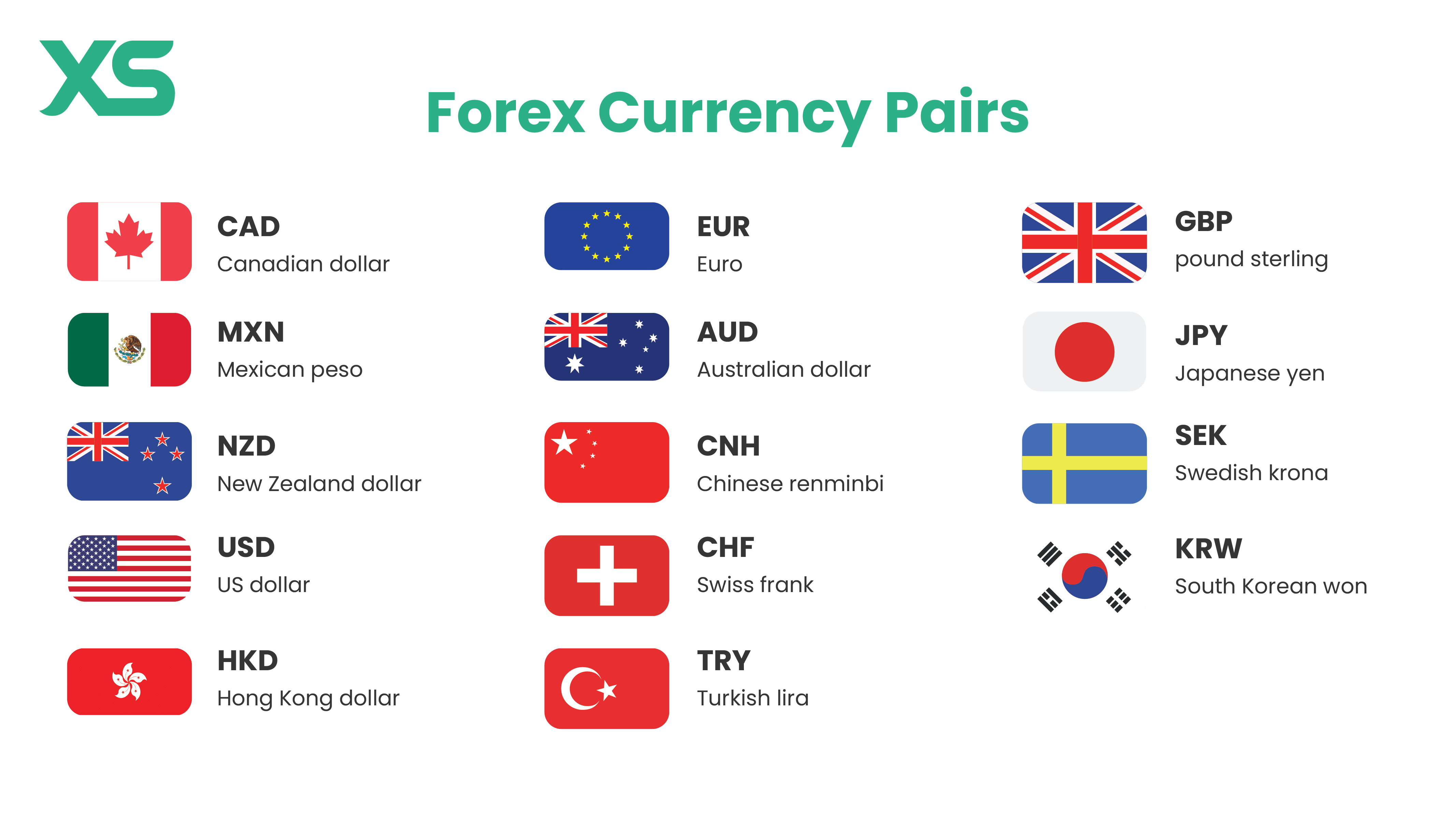

Each currency is represented by a three-letter code, as standardized by the International Organization for Standardization (ISO). For instance:

- USD represents the United States dollar.

- EUR represents the euro.

- GBP represents the British pound.

- JPY represents the Japanese yen.

These codes make it easier to identify currencies in the global market.

2. Understanding Base and Quote Currencies

Every currency pair consists of two parts: the base currency and the quote currency.

- Base Currency: This is the first currency listed in the pair. In the pair EUR/USD, EUR (euro) is the base currency.

- Quote Currency: The second currency in the pair is the quote currency. In EUR/USD, USD (U.S. dollar) is the quote currency.

The price of the currency pair tells you how much of the quote currency is needed to buy one unit of the base currency. If the EUR/USD pair is quoted as 1.2000, it means that 1 euro (base currency) is worth 1.20 U.S. dollars (quote currency).

When you buy a currency pair, you are essentially buying the base currency and selling the quote currency. Conversely, when you sell a currency pair, you are selling the base currency and buying the quote currency.

3. Types of Currency Pairs

Currency pairs can be classified into three main categories: major pairs, minor pairs, and exotic pairs. Understanding the differences between these categories is crucial for selecting the right pairs to trade.

a. Major Pairs

Major pairs involve the most traded currencies in the world and include the U.S. dollar as either the base or quote currency. Examples of major pairs are:

- EUR/USD (euro/U.S. dollar)

- GBP/USD (British pound/U.S. dollar)

- USD/JPY (U.S. dollar/Japanese yen)

- USD/CHF (U.S. dollar/Swiss franc)

Major pairs are highly liquid and typically have lower spreads, making them more attractive to traders.

b. Minor Pairs

Minor pairs, or cross-currency pairs, do not include the U.S. dollar but involve other major currencies. Examples include:

- EUR/GBP (euro/British pound)

- EUR/AUD (euro/Australian dollar)

- GBP/JPY (British pound/Japanese yen)

While less liquid than major pairs, these pairs still see significant trading volumes.

c. Exotic Pairs

Exotic pairs involve one major currency and one currency from an emerging or smaller economy. Examples include:

- USD/TRY (U.S. dollar/Turkish lira)

- EUR/ZAR (euro/South African rand)

- USD/MXN (U.S. dollar/Mexican peso)

Exotic pairs tend to have lower liquidity, higher volatility, and wider spreads, making them more challenging to trade, especially for beginners.

4. How to Read Forex Quotes

Forex quotes can initially appear confusing, but once you understand the structure, they become easier to interpret. A typical forex quote looks like this:

EUR/USD: 1.2000

This quote tells you the following:

- EUR (base currency): You are buying euros.

- USD (quote currency): You are selling U.S. dollars.

- 1.2000: This is the exchange rate. In this case, 1 euro equals 1.20 U.S. dollars.

If you expect the euro to strengthen against the dollar, you would buy the pair (go long). If you expect the euro to weaken, you would sell the pair (go short).

5. Bid and Ask Prices Explained

In the forex market, currency pairs are quoted with two prices: the bid price and the ask price.

- Bid Price: The bid price is the price at which the market (or your broker) is willing to buy the base currency in exchange for the quote currency. This is the price you can sell the base currency at.

- Ask Price: The ask price is the price at which the market (or your broker) is willing to sell the base currency in exchange for the quote currency. This is the price you can buy the base currency at.

For example, you might see a quote like this:

EUR/USD: 1.2000/1.2005

- Bid Price: 1.2000 (the price at which you can sell euros)

- Ask Price: 1.2005 (the price at which you can buy euros)

The difference between the bid and ask prices is known as the spread.

6. Understanding Spreads in Forex Trading

The spread represents the broker’s fee or the cost of the trade. It is the difference between the bid price and the ask price. In the example above, the spread is:

1.2005 (ask price) - 1.2000 (bid price) = 0.0005 (5 pips)

A tighter spread (smaller difference) means lower trading costs, which is advantageous for traders, especially those who trade frequently. Major currency pairs tend to have tighter spreads due to higher liquidity, while exotic pairs generally have wider spreads due to lower liquidity.

7. Direct vs. Indirect Quotes

Forex quotes can be classified as direct or indirect, depending on how they are presented in relation to your home currency.

- Direct Quote: A direct quote shows how much of your home currency is needed to buy one unit of a foreign currency. For example, if you are in the U.S. and see a EUR/USD quote, this is a direct quote, as it shows how many U.S. dollars are required to buy one euro.

- Indirect Quote: An indirect quote shows how much of a foreign currency you can get for one unit of your home currency. For example, if you are in the U.S. and see a USD/JPY quote, it is indirect, as it shows how many Japanese yen can be bought with one U.S. dollar.

Understanding the difference helps traders from various countries interpret quotes correctly.

8. Currency Pair Pricing and Pip Movement

Currency pair prices change in small increments called pips (percentage in point). A pip is typically the smallest price movement in a currency pair, and it is usually the fourth decimal place in most currency pairs (0.0001).

For example, if the EUR/USD pair moves from 1.2000 to 1.2001, that is a 1-pip movement. However, in currency pairs involving the Japanese yen (e.g., USD/JPY), a pip is typically represented as the second decimal place (0.01).

9. How to Calculate Profit and Loss with Currency Pairs

Understanding how to calculate profit and loss (P&L) is essential for managing your forex trades. Profit or loss is determined by the difference in the price of the currency pair from the time you enter to the time you exit a trade.

Example of a Buy Trade (Long Position):

- You buy EUR/USD at 1.2000.

- The price rises to 1.2050, and you decide to sell.

- You have made a profit of 50 pips (1.2050 – 1.2000 = 0.0050 or 50 pips).

If you traded a standard lot (100,000 units), each pip is worth $10. Therefore, your profit is:

50 pips x $10 per pip = $500 profit.

If the price had dropped instead, you would have incurred a loss.

10. Factors That Affect Currency Pair Prices

Several factors influence the movement of currency pairs in the forex market:

- Economic Data: Key economic reports, such as GDP, unemployment figures, and inflation, can cause significant fluctuations in currency prices.

- Interest Rates: Central bank decisions regarding interest rates play a major role in determining currency strength. Higher interest rates often attract more foreign capital, leading to currency appreciation.

- Political Stability: Countries with stable governments and predictable policies tend to have stronger currencies.

- Market Sentiment: Investor sentiment and market psychology can cause sudden movements in currency prices, especially during times of uncertainty or crisis.

- Geopolitical Events: Elections, trade disputes, and global events such as wars or natural disasters can impact forex markets.

11. Conclusion

Understanding how to read currency pairs and quotes is fundamental for anyone looking to trade forex. By mastering the basics—such as the roles of the base and quote currencies, bid and ask prices, and the concept of spreads—you can make informed decisions in the fast-paced world of currency trading.

As you continue to deepen your knowledge, remember that forex trading involves significant risks, and it’s crucial to approach the market with a solid understanding of both technical and fundamental factors. Whether you’re a beginner or an experienced trader, a clear grasp of how currency pairs and quotes work will greatly enhance your trading journey.