Forex trading can be an attractive avenue for those looking to invest and grow their capital. However, it’s essential to recognize that all trading involves some level of risk. The goal of this article is to explore strategies and approaches that can significantly reduce risk in Forex trading, helping you succeed while preserving your capital.

Understanding Forex Trading

What is Forex Trading?

The foreign exchange market, or Forex, is the largest financial market globally, with daily trading volumes exceeding $6 trillion. It involves the exchange of currencies, where traders speculate on the price movements of currency pairs, such as EUR/USD or GBP/JPY.

Why Minimize Risk?

Minimizing risk is crucial in Forex trading because:

- Preserving Capital: Protecting your investment allows you to stay in the market longer.

- Psychological Well-being: Reduced risk leads to less stress and better decision-making.

- Long-term Success: Sustainable trading practices promote consistent returns over time.

Common Risks in Forex Trading

Market Risk

The most apparent risk in Forex trading is market risk, which arises from fluctuations in currency prices. Economic indicators, geopolitical events, and market sentiment can all influence currency values.

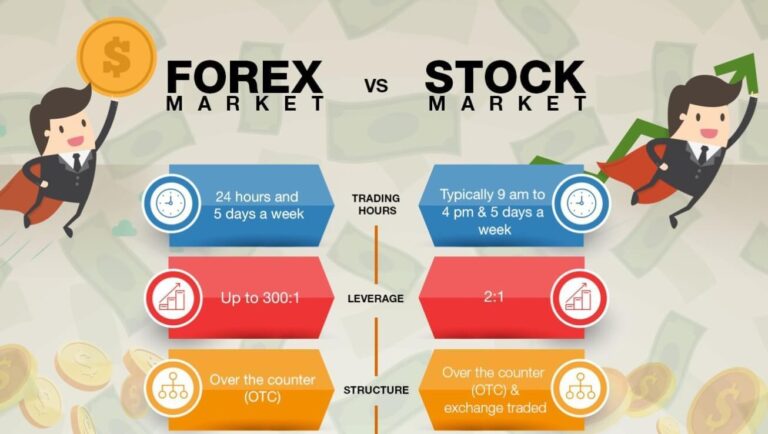

Leverage Risk

Forex trading often involves using leverage, which allows traders to control large positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the potential for significant losses.

Emotional Risk

Traders can be influenced by their emotions, leading to impulsive decisions and poor risk management. Fear, greed, and frustration can cloud judgment and result in costly mistakes.

Liquidity Risk

Liquidity risk occurs when traders cannot buy or sell a currency pair without causing a significant impact on its price. In volatile markets, this can lead to slippage, where trades are executed at unfavorable prices.

Strategies for Minimizing Risk in Forex Trading

1. Create a Comprehensive Trading Plan

What is a Trading Plan?

A trading plan is a documented strategy that outlines your trading goals, methods, risk management rules, and specific criteria for entering and exiting trades.

Key Components of a Trading Plan

- Trading Goals: Define what you want to achieve, whether it’s a specific percentage return or mastering a particular trading strategy.

- Trading Style: Identify whether you will be a day trader, swing trader, or position trader, depending on your lifestyle and risk tolerance.

- Risk Management Rules: Establish guidelines for how much of your capital you are willing to risk on each trade.

2. Implement Risk Management Techniques

Position Sizing

Position sizing is crucial for effective risk management. It involves determining the amount of capital to allocate to each trade, based on your overall account balance and risk tolerance.

- Calculate Position Size: Use the formula: Position Size=Account Balance×Risk PercentageStop-Loss in Pips\text{Position Size} = \frac{\text{Account Balance} \times \text{Risk Percentage}}{\text{Stop-Loss in Pips}}

Stop-Loss Orders

A stop-loss order automatically closes a position at a predetermined price level, helping to limit potential losses.

- Set Stop-Loss Orders: Always use stop-loss orders to protect your capital. Consider placing them based on technical levels (e.g., support or resistance).

Risk-to-Reward Ratio

This ratio assesses the potential return of a trade relative to its risk.

- Aim for a Favorable Ratio: Strive for a risk-to-reward ratio of at least 1:2, meaning you expect to gain $2 for every $1 risked.

3. Start with a Demo Account

Purpose of a Demo Account

A demo account allows you to practice trading without risking real money. This risk-free environment is ideal for learning and refining your skills.

Benefits

- Practice Strategies: Test different trading strategies and understand their effectiveness without financial pressure.

- Build Confidence: Gain experience and confidence before transitioning to live trading.

4. Start Small and Scale Up

Begin with Small Capital

Starting with a smaller amount of capital allows you to learn the ropes without exposing yourself to significant risk.

- Gradual Increase: As you gain experience and confidence, you can gradually increase your position sizes.

Use Micro or Mini Lots

Many brokers offer micro and mini lots, allowing you to trade smaller amounts and manage risk effectively.

5. Stay Informed About Market Conditions

Economic News and Events

Economic indicators, such as interest rates, employment data, and inflation, can significantly impact currency prices.

- Use an Economic Calendar: Stay updated on upcoming economic releases that may affect the Forex market.

Technical Analysis

Understanding technical indicators and chart patterns can help you make more informed trading decisions.

- Learn Technical Analysis: Familiarize yourself with common indicators (e.g., Moving Averages, RSI) to identify potential entry and exit points.

6. Focus on One or Two Currency Pairs

Specialization

Focusing on one or two currency pairs allows you to better understand their behavior and market dynamics.

- Deep Analysis: Concentrate your efforts to perform in-depth analysis and refine your trading strategies for those specific pairs.

7. Implement Emotional Control

Recognizing Emotional Triggers

Emotions such as fear, greed, and frustration can significantly impact trading decisions.

- Maintain Awareness: Acknowledge when emotions are influencing your trading, and take steps to mitigate their effects.

Develop a Trading Routine

Establishing a consistent routine can help create a disciplined approach to trading.

- Set Specific Trading Hours: Determine when you will trade and stick to that schedule, minimizing impulsive decisions outside of your routine.

8. Continuous Learning and Improvement

Educate Yourself

The Forex market is constantly evolving, and ongoing education is essential for success.

- Read Books and Articles: Explore trading literature and resources to deepen your knowledge.

Review Your Trades

After each trading session, review your trades to analyze what worked and what didn’t.

- Maintain a Trading Journal: Document your trades, including your reasoning, outcomes, and emotional state. This reflection can help you identify patterns and improve your strategies.

9. Use Automated Trading Systems

What are Automated Trading Systems?

Automated trading systems (or algorithmic trading) use predefined criteria to execute trades without human intervention.

Benefits

- Emotion-Free Trading: Automation eliminates emotional decision-making, as trades are executed based on predetermined rules.

- Consistency: Automated systems can maintain consistent trading performance, provided the underlying strategy is sound.

Caution

While automation can reduce emotional influences, it is essential to thoroughly test and understand any system you employ.

10. Limit Trading Frequency

Avoid Overtrading

New traders often feel compelled to trade frequently, thinking that more trades mean more opportunities. This can lead to increased transaction costs and emotional fatigue.

- Set Trade Limits: Establish a maximum number of trades you will make in a day or week to help you focus on quality over quantity.

Wait for High-Probability Trades

Be selective about the trades you take. Look for setups that align with your trading plan and offer a favorable risk-to-reward ratio.

11. Diversify Your Trading Portfolio

Spread Risk Across Different Markets

Diversification involves spreading your investments across different currency pairs or asset classes to reduce risk.

- Explore Different Pairs: While focusing on one or two pairs is important, consider adding others that may behave differently under various market conditions.

Limit Correlated Trades

Be cautious about trading multiple pairs that are highly correlated, as this can amplify risk.

12. Prepare for Volatile Market Conditions

Understand Market Behavior

Volatility can present both opportunities and risks. Understanding how different currency pairs behave in volatile conditions is crucial.

- Adjust Your Strategies: Be prepared to adapt your trading strategies based on market conditions, increasing your stop-loss levels or adjusting position sizes during high volatility.

Conclusion

While it is impossible to eliminate risk entirely in Forex trading, implementing effective strategies can significantly minimize it. By developing a comprehensive trading plan, practicing disciplined risk management, and maintaining emotional control, you can enhance your chances of success in the Forex market.

Continuous learning, self-reflection, and adaptation to changing market conditions are key to becoming a successful Forex trader. Remember, the journey of trading is not just about making profits; it’s also about preserving your capital and developing the skills needed to thrive in a complex financial landscape. By approaching Forex trading with a clear strategy and a focus on risk management, you can navigate this exciting market more safely and effectively.