Breakout trading is a powerful strategy used by many traders in the forex market and beyond. This approach focuses on capitalizing on price movements that occur after the price breaks through established support or resistance levels. When a breakout occurs, it often signifies a potential shift in market sentiment and can lead to significant price movements.

In this article, we will delve into the intricacies of breakout trading strategies, exploring their fundamentals, various types of breakouts, effective techniques, and practical tips for successful implementation. By the end of this guide, you will have a comprehensive understanding of how to use breakout trading strategies effectively.

Table of Contents

- What is Breakout Trading?

- 1.1. Understanding Breakouts

- 1.2. Types of Breakouts

- 1.3. Why Breakout Trading Works

- Key Components of Breakout Trading Strategies

- 2.1. Identifying Key Levels

- 2.2. Tools and Indicators

- 2.3. Setting Up Breakout Trades

- Different Breakout Trading Strategies

- 3.1. Momentum Breakouts

- 3.2. Pullback Breakouts

- 3.3. News Breakouts

- 3.4. False Breakouts

- Risk Management in Breakout Trading

- 4.1. Setting Stop-Loss Orders

- 4.2. Position Sizing

- 4.3. Managing Profits

- Common Mistakes in Breakout Trading

- 5.1. Ignoring Market Conditions

- 5.2. Overtrading

- 5.3. Poor Risk Management

- Developing a Breakout Trading Plan

- 6.1. Defining Your Goals

- 6.2. Backtesting Your Strategy

- 6.3. Continuous Learning and Improvement

- Conclusion

- Frequently Asked Questions (FAQs)

1. What is Breakout Trading?

Breakout trading involves entering a position when the price moves beyond a defined support or resistance level. The underlying principle is that once a price breaks through these levels, it will continue to move in the same direction due to increased momentum and trading volume.

1.1. Understanding Breakouts

A breakout occurs when the price of an asset surpasses a significant support or resistance level. This event often attracts the attention of traders and investors, leading to increased buying or selling pressure. There are two main types of breakouts:

- Bullish Breakout: This occurs when the price breaks above resistance, indicating a potential uptrend.

- Bearish Breakout: This occurs when the price breaks below support, signaling a potential downtrend.

Breakouts are significant because they often indicate a shift in market sentiment. When traders see a breakout, they may enter the market, which can lead to further price movements in the same direction.

1.2. Types of Breakouts

Understanding the different types of breakouts is crucial for implementing effective breakout trading strategies:

- Continuation Breakouts: These occur in the direction of the prevailing trend. For instance, if the market is in an uptrend, a bullish breakout above resistance can signal a continuation of the trend.

- Reversal Breakouts: These occur against the prevailing trend. For example, if the market has been in a downtrend, a bullish breakout above resistance could signal a potential reversal to an uptrend.

- Volatile Breakouts: These happen during periods of high volatility, often due to news events or economic announcements. Traders must be cautious during these breakouts, as they can lead to unpredictable price movements.

- False Breakouts: Also known as “fakeouts,” these occur when the price breaks a level but quickly reverses. Traders must be vigilant to avoid being caught in these situations.

1.3. Why Breakout Trading Works

Breakout trading works due to the psychological and behavioral patterns of market participants. When a price breaks through a key level, it often creates a sense of urgency among traders, leading to increased buying or selling pressure. Several factors contribute to the effectiveness of breakout trading:

- Increased Volume: Breakouts are often accompanied by a surge in trading volume, indicating strong interest from market participants. High volume can confirm the strength of the breakout.

- Market Sentiment: Breakouts can shift market sentiment, leading to increased momentum in the direction of the breakout. Traders often react to breakouts, which can exacerbate price movements.

- Stop-Loss Orders: Many traders place stop-loss orders just beyond key support or resistance levels. When a breakout occurs, these orders can trigger, leading to further price movement in the direction of the breakout.

2. Key Components of Breakout Trading Strategies

To effectively implement breakout trading strategies, traders must consider several key components:

2.1. Identifying Key Levels

The first step in breakout trading is to identify significant support and resistance levels. These levels can be determined using various methods:

- Historical Price Levels: Analyze past price action to identify areas where the price has previously reversed or stalled. These historical levels often act as significant support or resistance.

- Chart Patterns: Recognize chart patterns such as triangles, flags, or head and shoulders, which often have breakout points. Understanding these patterns can help traders anticipate potential breakouts.

- Technical Indicators: Use indicators like Fibonacci retracement levels, pivot points, and moving averages to identify key levels that may influence price movements.

2.2. Tools and Indicators

Several tools and indicators can assist traders in identifying breakouts and confirming their validity:

- Moving Averages: Simple moving averages (SMA) or exponential moving averages (EMA) can help smooth price action and identify trends. Traders often look for crossovers or price action relative to moving averages to confirm breakouts.

- Volume Indicators: Volume is a crucial factor in breakout trading. Tools like the On-Balance Volume (OBV) or Volume Oscillator can help traders assess whether a breakout is supported by strong trading activity.

- Bollinger Bands: This volatility indicator can help identify potential breakouts when the price breaks out of the bands. A squeeze in the Bollinger Bands often precedes a breakout.

2.3. Setting Up Breakout Trades

Once key levels are identified, traders need to establish clear entry and exit points for their trades:

- Entry Point: Enter the trade when the price breaks above resistance for a bullish breakout or below support for a bearish breakout. Some traders prefer to wait for a confirmation candle to ensure the breakout is valid.

- Stop-Loss Orders: Place stop-loss orders just below the breakout point for bullish trades or just above the breakout point for bearish trades. This helps protect against false breakouts.

- Take Profit Levels: Set profit targets based on risk-reward ratios. A common approach is to aim for a profit target that is at least two times the risk taken on the trade.

3. Different Breakout Trading Strategies

Breakout trading strategies can vary based on market conditions, individual preferences, and specific techniques. Here are some common breakout trading strategies:

3.1. Momentum Breakouts

Momentum breakouts focus on entering trades when the price breaks through a significant level with strong momentum. The strategy involves the following steps:

- Identify a Key Level: Determine a strong support or resistance level that the price has approached.

- Look for Volume Confirmation: Ensure that the breakout is accompanied by increased trading volume.

- Enter the Trade: Once the breakout occurs, enter the trade in the direction of the breakout.

- Set Stop-Loss and Take Profit: Place a stop-loss order just below the breakout level and set a profit target based on the potential move.

This strategy works well in trending markets where momentum can carry the price significantly after a breakout.

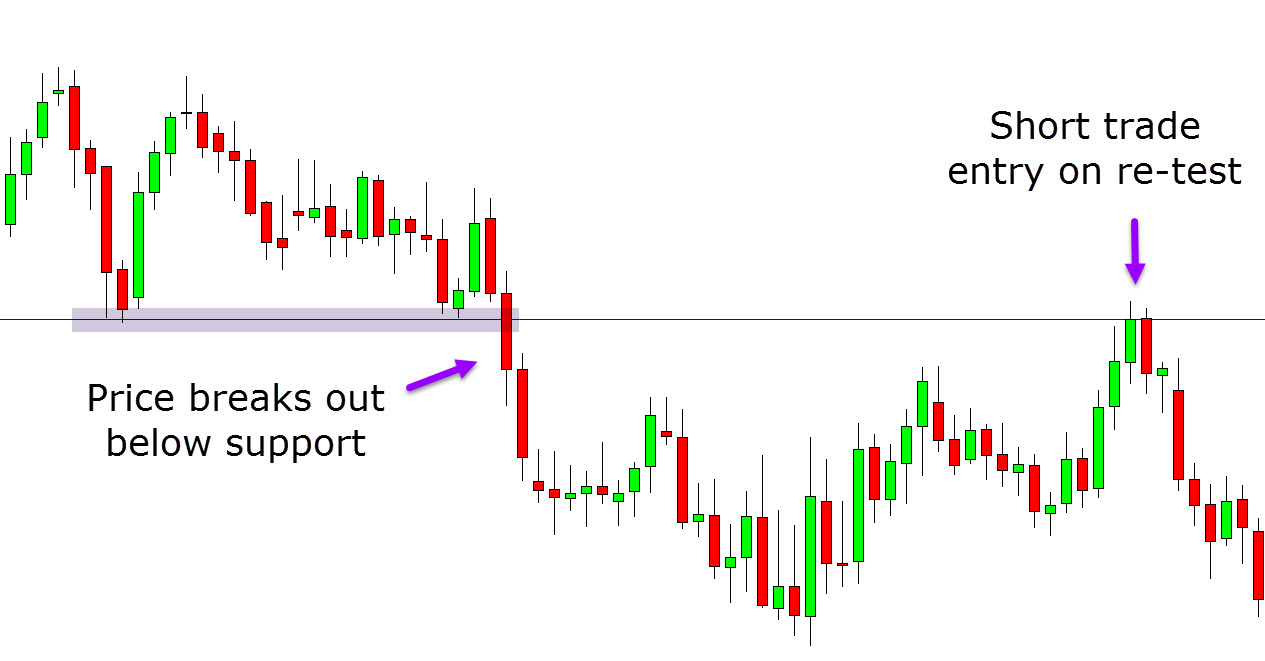

3.2. Pullback Breakouts

Pullback breakouts involve waiting for a temporary price pullback after a breakout before entering a trade. This strategy aims to capture trades at a better price. The steps are as follows:

- Identify a Breakout: Wait for the price to break above resistance (or below support).

- Look for a Pullback: Wait for the price to pull back to the breakout level, which may act as support (or resistance).

- Enter the Trade: When the price shows signs of bouncing off the breakout level, enter the trade in the direction of the initial breakout.

- Set Stop-Loss and Take Profit: Place a stop-loss order just below the pullback low and set a profit target based on the expected move.

This strategy allows traders to enter trades at more favorable prices and can be effective in trending markets.

3.3. News Breakouts

News events can lead to significant price movements and create breakout opportunities. This strategy involves the following steps:

- Identify Upcoming News Events: Stay informed about scheduled economic releases, central bank announcements, or geopolitical events that could impact the market.

- Monitor Price Action: As the news release approaches, observe price behavior around key support and resistance levels.

- Enter the Trade: After the news is released, look for a clear breakout above resistance or below support. Enter the trade in the direction of the breakout.

- Set Stop-Loss and Take Profit: Use wider stop-loss levels to accommodate increased volatility and set profit targets based on anticipated market movement.

News breakouts can provide opportunities for rapid price movements, but traders should be cautious of increased volatility and potential slippage.

3.4. False Breakouts

False breakouts can be tricky but offer opportunities for savvy traders. This strategy involves:

- Identify Key Levels: Determine significant support and resistance levels.

- Wait for a Breakout: Watch for a breakout above resistance or below support.

- Look for Confirmation: After the breakout, observe the price action. If the price quickly reverses and moves back into the range, it may indicate a false breakout.

- Enter the Trade: Enter a trade in the opposite direction of the breakout, taking advantage of the price reversal.

- Set Stop-Loss and Take Profit: Place a stop-loss order just beyond the breakout level and set profit targets based on the anticipated reversal move.

While false breakouts can lead to losses if not recognized, they can also provide opportunities for profit when identified correctly.

4. Risk Management in Breakout Trading

Effective risk management is crucial in breakout trading to protect capital and maximize profitability. Here are some key considerations:

4.1. Setting Stop-Loss Orders

Placing stop-loss orders is essential for managing risk in breakout trading. Consider the following strategies:

- Tight Stop-Loss: For momentum breakouts, place a stop-loss just below the breakout level to minimize losses if the breakout fails.

- Wider Stop-Loss: For pullback breakouts, consider a wider stop-loss to accommodate price fluctuations during the pullback.

4.2. Position Sizing

Determine the size of your position based on your risk tolerance and account size. A common rule is to risk only a small percentage (e.g., 1-2%) of your trading capital on any single trade. Adjust your position size accordingly based on the distance between your entry point and stop-loss level.

4.3. Managing Profits

As a trade moves in your favor, consider adjusting your stop-loss to lock in profits. Some strategies include:

- Trailing Stop-Loss: Move your stop-loss level up (for long positions) or down (for short positions) as the price moves in your favor, allowing for potential additional gains while protecting profits.

- Partial Profit Taking: Consider taking partial profits at predetermined levels to secure gains while leaving a portion of your position open for further potential upside.

5. Common Mistakes in Breakout Trading

While breakout trading can be highly effective, traders often make common mistakes that can lead to losses. Here are some pitfalls to avoid:

5.1. Ignoring Market Conditions

Breakout trading works best in trending markets or during periods of high volatility. Ignoring broader market conditions can lead to poor trading decisions. Always assess the overall market sentiment before entering trades.

5.2. Overtrading

Traders may be tempted to take every breakout opportunity that arises. However, overtrading can lead to increased transaction costs and emotional decision-making. Focus on high-quality setups and avoid chasing breakouts that lack strong confirmation.

5.3. Poor Risk Management

Neglecting risk management is a common mistake. Ensure you have a clear plan for stop-loss placement, position sizing, and profit management. Without effective risk management, even the best breakout strategies can result in significant losses.

6. Developing a Breakout Trading Plan

A well-defined trading plan is essential for successful breakout trading. Here’s how to develop one:

6.1. Defining Your Goals

Establish clear trading goals, including profit targets, risk tolerance, and the amount of time you can dedicate to trading. This will guide your decision-making and keep you focused.

6.2. Backtesting Your Strategy

Before implementing a breakout strategy in live trading, backtest it using historical data. Analyze past performance to identify strengths, weaknesses, and potential adjustments to improve results.

6.3. Continuous Learning and Improvement

Stay informed about market developments and continuously improve your trading skills. Analyze your trades, learn from mistakes, and adapt your strategies as needed.

7. Conclusion

Breakout trading is a dynamic and potentially profitable strategy for forex traders. By understanding the principles of breakouts, identifying key levels, and employing effective techniques, traders can capitalize on significant price movements.

Successful breakout trading requires careful analysis, effective risk management, and a disciplined approach. By avoiding common mistakes and continuously improving your trading skills, you can increase your chances of success in the forex market.

8. Frequently Asked Questions (FAQs)

1. What is the best time frame for breakout trading?

The best time frame for breakout trading depends on your trading style. Day traders may prefer shorter time frames (e.g., 15-minute or hourly charts), while swing traders may focus on daily or weekly charts.

2. How can I avoid false breakouts?

To avoid false breakouts, look for confirmation signals such as increased volume or price action patterns. Waiting for a confirmation candle before entering the trade can also help.

3. Is breakout trading suitable for beginners?

Yes, breakout trading can be suitable for beginners, but it’s essential to practice proper risk management and thoroughly understand the strategy before risking real capital.

4. How do I know when to exit a breakout trade?

You can exit a breakout trade based on your predetermined profit targets, trailing stop-loss levels, or if the price shows signs of reversing.

5. Can I use breakout trading in other markets besides forex?

Yes, breakout trading strategies can be applied in various financial markets, including stocks, commodities, and cryptocurrencies. The principles remain the same, but specific market conditions may vary.