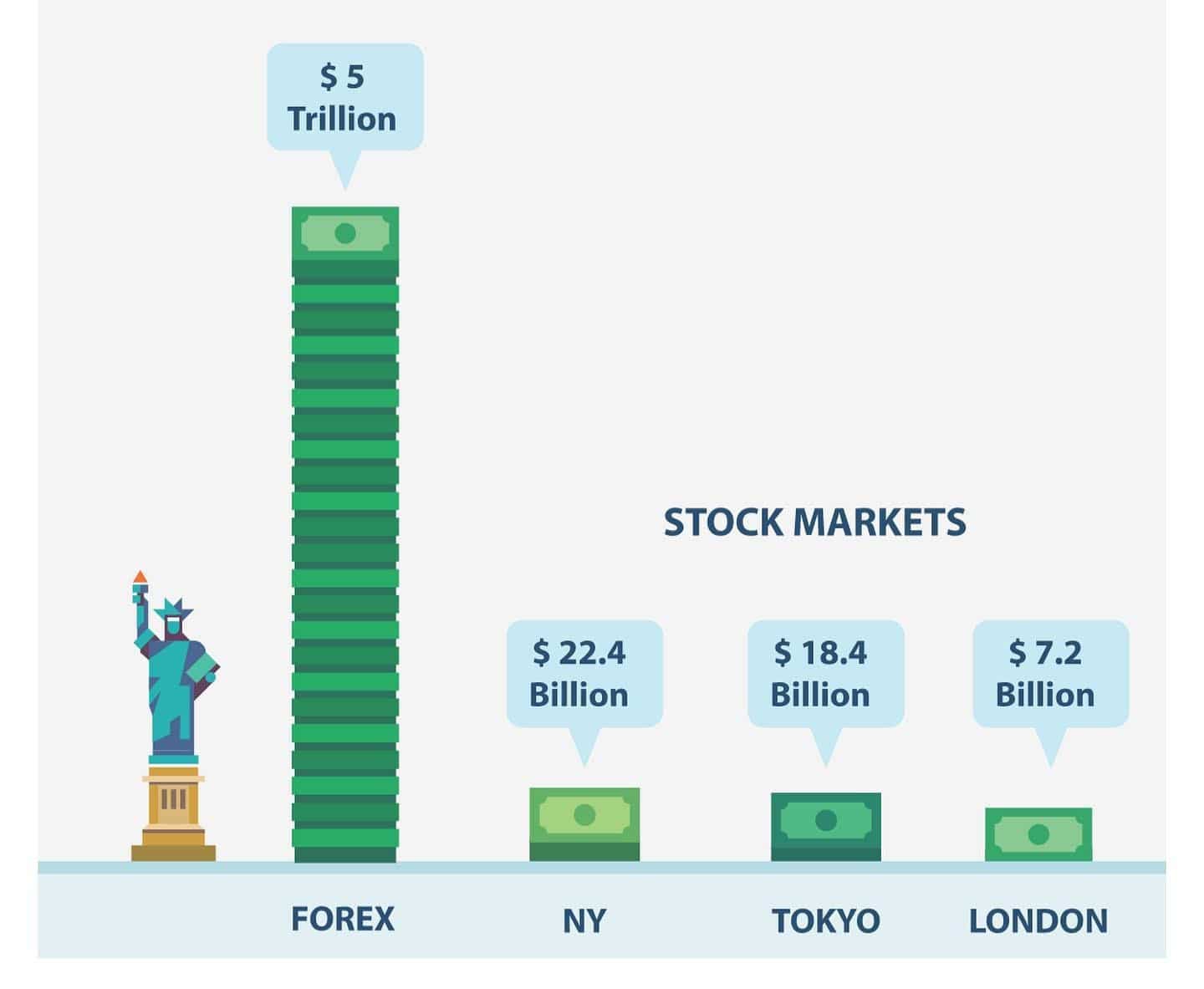

In 2024, the Forex (Foreign Exchange) market remains the largest and most liquid financial market globally, with a trading volume that has expanded substantially from its earlier figures. Daily trading volumes now exceed $7 trillion, reflecting both the growing integration of global economies and the rise of new technologies, which have made trading faster and more accessible.

Current Structure of the Forex Market in 2024

The Forex market in 2024 is a highly decentralized global marketplace where currencies are traded against one another. The most commonly traded currencies—known as major pairs—include the U.S. dollar (USD), Euro (EUR), British pound (GBP), Japanese yen (JPY), and Swiss franc (CHF). The dominance of the U.S. dollar continues, as it is involved in approximately 88% of all Forex transactions, a testament to the currency’s central role in the global economy.

The market operates 24 hours a day across five major trading hubs: London, New York, Tokyo, Hong Kong, and Singapore. Each region experiences peak trading hours that overlap with others, providing continuous liquidity. London remains the most significant Forex hub, accounting for around 40% of global daily trading volume, followed by New York and Tokyo.

Capital and Trading Volume in 2024

In 2024, the daily Forex trading volume is estimated to exceed $7.5 trillion, representing a growth from $6.6 trillion recorded in 2019. This growth is driven by a combination of factors, including:

- Increased Participation by Institutional Investors: Large institutional players such as hedge funds, central banks, multinational corporations, and investment banks continue to dominate the market. Their participation in Forex trading is often motivated by hedging risks associated with currency fluctuations, optimizing international portfolios, and executing large-volume transactions.

- Retail Forex Market Expansion: The rise of retail trading has also contributed to the surge in market volume. Retail traders, empowered by sophisticated online platforms and mobile trading apps, now account for roughly 6-10% of the daily Forex trading volume. Though smaller in comparison to institutional trading, the ease of access and growth of education in Forex trading have significantly broadened retail participation.

- Algorithmic and High-Frequency Trading (HFT): In 2024, algorithmic trading accounts for over 70% of the daily trading volume. High-frequency traders (HFTs) execute trades based on pre-programmed algorithms designed to capitalize on small, rapid price fluctuations, often holding positions for fractions of a second. The use of artificial intelligence (AI) and machine learning (ML) further enhances the precision and efficiency of such strategies.

- Cryptocurrency and Central Bank Digital Currencies (CBDCs): The influence of digital currencies on Forex markets has become more pronounced in 2024. Although traditional currencies still dominate, the introduction of Central Bank Digital Currencies (CBDCs), like China’s digital yuan and the European Union’s digital euro, has increased the complexity and scale of currency trading. CBDCs allow for instant settlements and are backed by governments, providing a new layer of competition to traditional Forex instruments.

- Geopolitical and Economic Drivers: Macroeconomic factors such as inflation, interest rates, government policies, and geopolitical tensions continue to drive Forex trading. In 2024, several economic trends, including fluctuating energy prices, changing trade policies, and global inflationary pressures, create volatility that encourages active participation in the Forex market. For instance, emerging market currencies, which are often more volatile, are becoming more attractive for traders looking for higher returns amid global uncertainties.

Technological Developments in 2024

Technology has played a pivotal role in shaping the Forex market of 2024. The rapid pace of innovation has made trading more accessible, automated, and efficient. Some of the key technological trends include:

- Blockchain and Distributed Ledger Technology (DLT): Blockchain has significantly impacted how Forex transactions are settled. In 2024, many Forex brokers and financial institutions use blockchain for secure and transparent transaction settlement, reducing the time and costs associated with traditional methods. This is particularly useful for cross-border transactions, as blockchain enables near-instantaneous transfers, bypassing intermediaries.

- Artificial Intelligence (AI) and Machine Learning (ML): AI-driven Forex trading strategies have gained popularity, especially in high-frequency and algorithmic trading. Machine learning algorithms analyze vast amounts of data—historical price trends, news, economic indicators, and even social sentiment—to predict price movements and execute trades autonomously. This reduces human error and allows for faster decision-making in volatile markets.

- Mobile and Social Trading Platforms: In 2024, retail traders have access to a wide range of mobile apps that offer real-time market data, charting tools, and the ability to trade on the go. Social trading platforms also allow traders to replicate strategies from experienced professionals. This accessibility has democratized Forex trading, making it easier for individuals with limited resources to enter the market.

- Regulation and Compliance Technology (RegTech): In the increasingly regulated environment of 2024, RegTech solutions help Forex brokers and traders comply with international regulations. These technologies use AI to automate compliance monitoring, ensuring that firms follow anti-money laundering (AML) laws, know-your-customer (KYC) regulations, and other financial rules that govern global trading.

Key Currency Pairs and Emerging Market Currencies in 2024

While major currency pairs like EUR/USD, GBP/USD, and USD/JPY remain the most traded pairs in 2024, emerging market currencies have gained more attention. For example, the Chinese yuan (CNY) and the Indian rupee (INR) are increasingly traded, reflecting their growing influence in global trade.

Emerging market currencies typically offer higher potential returns but come with increased volatility. As countries like Brazil, South Africa, and India grow economically, their currencies attract traders seeking to capitalize on higher yields and diversification. This adds complexity and opportunity to the Forex market in 2024.

Additionally, commodity-based currencies like the Canadian dollar (CAD) and Australian dollar (AUD) are closely watched, as fluctuations in global commodity prices (e.g., oil and gold) directly affect their value.

The Role of Central Banks in 2024

Central banks remain major players in the Forex market through their interventions in the currency markets. In 2024, central banks influence currency values through interest rate policies, monetary tightening or easing, and direct market intervention. For instance, central banks may buy or sell their own currencies in the open market to influence exchange rates, which can have wide-reaching effects on inflation, trade balances, and economic stability.

One notable development in 2024 is the rise of coordinated central bank action, where groups of central banks work together to stabilize the market or address global economic concerns. This cooperation is often seen during times of financial crisis, where currency stability becomes a major concern.

Conclusion: The Forex Market of 2024

The Forex market in 2024 is more dynamic, liquid, and technologically advanced than ever before. Its sheer size, with daily trading volumes exceeding $7.5 trillion, reflects its critical role in the global economy. With new technologies such as blockchain, AI-driven trading algorithms, and the rise of digital currencies like CBDCs, the Forex market continues to evolve.

As globalization deepens and technology advances, the Forex market is likely to see further changes, offering new opportunities and challenges for traders. While institutional investors remain the dominant players, the democratization of Forex trading through retail platforms and social trading ensures that individuals also have a significant impact on this ever-evolving marketplace.