Contract for Difference (CFD) trading has gained significant popularity due to its flexibility, accessibility, and the ability to trade on margin. Unlike traditional investing, CFDs allow traders to speculate on price movements without owning the underlying asset. This article explores the best assets to invest in the CFD market for the long term, covering various asset classes, their benefits, risks, and strategic considerations.

Understanding CFDs: A Brief Overview

What are CFDs?

A CFD is a financial derivative that enables traders to speculate on the price movement of various assets, including stocks, commodities, indices, and currencies, without actually owning the underlying asset. When you trade a CFD, you enter into an agreement with a broker to exchange the difference in the asset’s price from the time the contract is opened to when it is closed.

Benefits of CFD Trading

- Leverage: CFDs allow traders to control larger positions with a smaller amount of capital, enabling the potential for higher returns.

- Diverse Asset Range: Investors can trade a wide variety of assets, including stocks, commodities, currencies, and indices.

- Short Selling: CFDs allow traders to profit from falling prices by selling the asset without needing to own it first.

- No Ownership Responsibilities: Since you don’t own the underlying asset, you are not responsible for things like storage costs for commodities or dividend taxes for stocks.

Risks of CFD Trading

While CFDs offer many advantages, they also come with risks, including:

- Leverage Risk: While leverage can amplify profits, it can also magnify losses.

- Market Risk: Price movements can be unpredictable, and long-term investments may not always yield positive results.

- Liquidity Risk: Some CFD markets may have lower liquidity, affecting your ability to enter or exit positions at desired prices.

Choosing the Best Assets for Long-Term CFD Investment

When selecting assets for long-term CFD investments, it’s essential to consider factors like market trends, economic fundamentals, and your risk tolerance. Below, we explore various asset classes and highlight the most promising options for long-term CFD trading.

1. Stocks and Equity CFDs

Overview

Investing in stock CFDs allows you to speculate on the price movements of individual companies. This can be particularly beneficial for long-term investors who want to capitalize on a company’s growth potential.

Best Practices for Stock CFDs

- Diversification: Invest in a diversified portfolio of stocks across various sectors to mitigate risks.

- Fundamental Analysis: Focus on companies with strong fundamentals, including solid earnings growth, good management, and competitive advantages.

- Long-Term Trends: Identify long-term trends, such as technological advancements or demographic shifts, that may benefit specific companies or sectors.

Promising Sectors

- Technology: The tech sector continues to evolve rapidly, driven by innovations in artificial intelligence, cloud computing, and renewable energy. Companies like Apple, Microsoft, and Nvidia are leaders with strong growth potential.

- Healthcare: As populations age and healthcare needs increase, companies in pharmaceuticals, biotechnology, and healthcare technology are likely to see long-term growth. Firms like Johnson & Johnson and Pfizer are noteworthy contenders.

2. Commodity CFDs

Overview

Commodity CFDs allow you to trade physical goods, including gold, oil, and agricultural products. They can serve as a hedge against inflation and market volatility, making them attractive for long-term investment.

Popular Commodities

- Gold: Often seen as a safe haven asset, gold tends to perform well during economic uncertainty. It can be a valuable addition to a long-term portfolio, particularly in times of inflation or geopolitical tension.

- Oil: Despite fluctuations in price, oil remains a vital global commodity. As economies recover and demand rises, investing in oil CFDs may offer significant long-term returns.

Risk Considerations

- Market Volatility: Commodity prices can be highly volatile due to geopolitical events, natural disasters, and changes in supply and demand.

- Currency Fluctuations: Many commodities are priced in U.S. dollars, meaning currency fluctuations can impact returns for non-U.S. investors.

3. Index CFDs

Overview

Index CFDs allow you to trade on the performance of a specific stock market index, such as the S&P 500, FTSE 100, or Nikkei 225. They provide a way to invest in the overall market rather than individual stocks, making them suitable for long-term investors.

Benefits of Index CFDs

- Diversification: By trading index CFDs, you gain exposure to a broad range of companies within the index, reducing the risk associated with individual stock investments.

- Market Trends: Indexes often reflect the overall health of an economy, making them useful indicators for long-term trends.

Recommended Indices

- S&P 500: As a benchmark for U.S. equities, investing in S&P 500 CFDs can provide exposure to some of the largest and most successful companies in the world.

- Nasdaq 100: This index comprises 100 of the largest non-financial companies listed on the Nasdaq stock exchange, primarily in the technology sector. Its focus on innovation and growth makes it an appealing option for long-term investors.

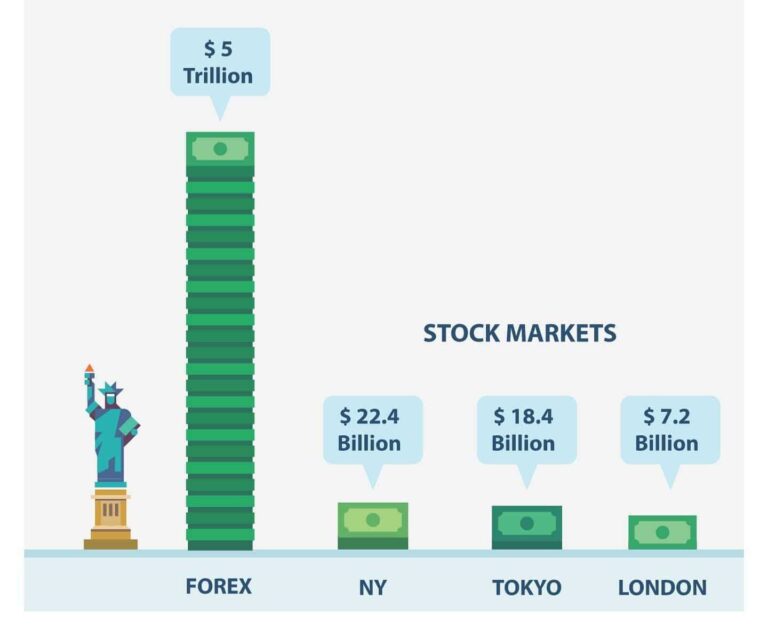

4. Forex CFDs

Overview

While Forex trading is typically more short-term focused, certain currency pairs can be suitable for long-term investments, particularly those related to stable economies or emerging markets.

Key Currency Pairs

- Major Pairs: Currency pairs like EUR/USD, GBP/USD, and USD/JPY are highly liquid and widely traded, making them relatively stable for long-term investments.

- Emerging Market Currencies: Investing in currencies from emerging markets can offer growth potential, but they often come with higher volatility and risk.

Economic Indicators to Watch

- Interest Rates: Changes in interest rates can significantly impact currency values. Long-term investors should monitor central bank policies and economic indicators.

- Political Stability: Currencies from politically stable countries tend to be less volatile, making them more suitable for long-term investment.

5. Cryptocurrency CFDs

Overview

Cryptocurrencies have emerged as an alternative asset class with the potential for high returns. While they are highly volatile, some long-term investors see value in certain digital currencies.

Notable Cryptocurrencies

- Bitcoin (BTC): As the first and most widely recognized cryptocurrency, Bitcoin has established itself as a store of value and is often referred to as “digital gold.”

- Ethereum (ETH): With its smart contract functionality and growing ecosystem, Ethereum presents long-term growth opportunities, particularly as decentralized finance (DeFi) and non-fungible tokens (NFTs) gain traction.

Risks and Considerations

- Market Volatility: Cryptocurrency prices can fluctuate dramatically, making them riskier than traditional assets.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving, and potential government regulations could impact the market.

Strategies for Long-Term CFD Investment

1. Research and Analysis

Conduct thorough research before making any investment decisions. Stay informed about economic indicators, market trends, and news that may impact your chosen assets. Utilize both fundamental and technical analysis to support your trading strategies.

2. Setting Investment Goals

Define your long-term investment goals, including desired returns, risk tolerance, and time horizon. This clarity will help guide your asset selection and trading strategies.

3. Risk Management

Implement effective risk management strategies to protect your capital. This includes setting stop-loss and take-profit levels, diversifying your portfolio, and avoiding overleveraging.

4. Review and Adjust

Regularly review your investment portfolio and adjust your strategies as necessary. The markets are dynamic, and staying adaptable is crucial for long-term success.

Conclusion

Investing in the CFD market for the long term can offer significant opportunities, but it requires careful consideration and strategy. By focusing on a diversified range of assets, including stocks, commodities, indices, Forex, and cryptocurrencies, you can build a robust portfolio that aligns with your investment goals.

While the potential for high returns exists, it’s essential to remain mindful of the risks involved in CFD trading. By conducting thorough research, maintaining discipline, and employing effective risk management techniques, you can navigate the CFD market with confidence and work toward achieving your long-term investment objectives.