In the world of forex trading, choosing the right broker is crucial. Each broker offers different features, spreads, fees, and platforms, catering to traders of various levels. Below is a detailed review of some popular brokers to help you make an informed decision.

1. IC Markets

Overview:

IC Markets is a well-known broker based in Australia, highly regarded for its low spreads and excellent trading conditions. It is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority of Seychelles.

Pros:

- Low spreads: IC Markets is particularly known for offering some of the tightest spreads, especially for forex pairs.

- High liquidity: With access to multiple liquidity providers, slippage is minimal, offering smooth order execution.

- Multiple platforms: Supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Customer support: Available 24/7 through live chat, email, and phone.

Cons:

- No bonus promotions: IC Markets doesn’t offer bonuses or promotions, unlike some other brokers.

- Limited asset classes: Focuses more on forex and CFDs, so other assets like stocks are less emphasized.

Best for: Professional traders who value tight spreads and excellent execution.

2. RoboForex

Overview:

RoboForex is a Belize-based broker known for offering a wide range of account types and assets. Regulated by the International Financial Services Commission of Belize (IFSC), RoboForex caters to both retail and professional traders.

Pros:

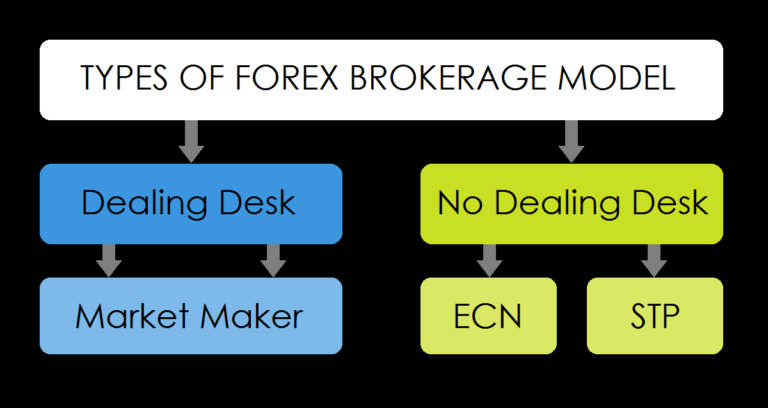

- Diverse account types: Offers several account options such as Pro, ECN, and R Trader, making it suitable for traders with different preferences.

- Wide asset variety: Forex, stocks, indices, ETFs, and commodities are all available.

- Bonuses and promotions: Offers a range of bonus programs, including welcome bonuses and cashback.

- Copy trading platform: RoboForex has its own copy trading platform, CopyFX, which is user-friendly.

Cons:

- Moderate spreads: Although the broker provides ECN accounts, spreads can be wider compared to more specialized ECN brokers.

- Regulation: While RoboForex is regulated, it’s not as highly regarded as other top-tier regulatory bodies like ASIC or FCA.

Best for: Beginner and intermediate traders looking for diverse account options and bonus incentives.

3. Admiral Markets

Overview:

Admiral Markets is a European-based broker that has earned a reputation for being reliable and transparent. It is regulated by several top-tier bodies, including the UK’s Financial Conduct Authority (FCA), CySEC, and the Australian ASIC.

Pros:

- Highly regulated: One of the most reputable brokers with multiple top-tier regulations.

- Educational resources: Provides a wealth of educational tools, including webinars, articles, and courses.

- Competitive spreads: Offers competitive spreads across multiple asset classes.

- Diverse platforms: Supports MT4 and MT5, alongside its proprietary add-ons.

Cons:

- Limited promotions: Similar to IC Markets, Admiral Markets doesn’t offer many promotions or bonuses.

- Inactive account fees: Charges inactivity fees if the account remains dormant for extended periods.

Best for: Traders who value strong regulation and educational resources.

4. Exness

Overview:

Exness is a global forex broker with strong regulatory oversight from CySEC, FCA, and the Financial Services Commission (FSC). It is known for offering flexible trading conditions and a user-friendly interface.

- High leverage: Offers some of the highest leverage in the industry, with options up to 1:2000 or even unlimited for certain accounts.

- No withdrawal fees: Exness doesn’t charge fees on deposits and withdrawals, which is a great plus.

- Quick account setup: The account-opening process is very fast and easy to navigate.

Cons:

- Limited asset range: While Exness is strong in forex and crypto, other asset classes like stocks are less available.

- Moderate customer support: Support is not available 24/7, which can be a drawback for traders in different time zones.

Best for: Traders seeking high leverage and low-cost withdrawals.

5. FBS

Overview:

FBS is an international broker that operates with regulation from IFSC, CySEC, and the Australian ASIC. It is popular for its aggressive promotions and bonuses.

Pros:

- Generous bonuses: Offers various promotions, such as no-deposit bonuses, trading competitions, and deposit bonuses.

- Account variety: Provides a wide range of account types including Cent, Standard, ECN, and Zero Spread accounts.

- Educational materials: FBS provides excellent resources for beginner traders, including free seminars and tutorials.

Cons:

- Higher spreads on certain accounts: Standard accounts can have relatively higher spreads compared to ECN accounts.

- Limited asset types: Mostly focuses on forex and CFDs, with limited access to stocks and other financial markets.

Best for: Beginners looking for bonuses and promotions along with educational resources.

6. FP Markets

Overview:

FP Markets is an Australian broker regulated by ASIC and CySEC. Known for its excellent customer service, it offers a broad range of assets and a solid trading environment.

Pros:

- Tight spreads: FP Markets offers competitive spreads, especially for ECN account holders.

- Strong customer service: Provides exceptional support with a live chat and phone options.

- Multiple platforms: Supports MT4, MT5, and IRESS, a proprietary trading platform for stock traders.

Cons:

- Withdrawal fees: Some withdrawal methods come with fees, depending on the chosen method and location.

- High minimum deposit for IRESS: IRESS accounts, designed for stock traders, require a higher minimum deposit.

Best for: Advanced traders looking for tight spreads and a variety of trading platforms.

7. IUX Markets

Overview:

IUX Markets is a lesser-known broker with relatively lower regulatory oversight, but it is gaining traction among newer traders due to its flexible trading conditions.

Pros:

- High leverage: Similar to Exness, IUX Markets offers very high leverage, ideal for traders looking to amplify their positions.

- Low deposit requirements: Traders can start with a low initial deposit, making it accessible for beginners.

Cons:

- Regulatory limitations: Not as heavily regulated as other major brokers, which can raise concerns about security and transparency.

- Limited asset choices: Focuses mainly on forex trading, with limited access to other asset classes.

Best for: Traders looking for high leverage with low initial deposits.

8. JustMarkets

Overview:

JustMarkets, formerly JustForex, is a well-known broker in the forex community, offering multiple account types with low deposit requirements. It operates under the regulation of IFSC Belize.

Pros:

- Multiple account types: Offers a variety of accounts catering to both beginners and experienced traders.

- Low minimum deposits: Accessible to new traders with very low minimum deposit requirements.

- Promotions and bonuses: Provides attractive bonus programs, including deposit bonuses and trading contests.

Cons:

- Regulation concerns: IFSC Belize is not regarded as a top-tier regulator, which can be a concern for risk-averse traders.

- Customer support limitations: Customer service may not be available 24/7 depending on your region.

Best for: Beginners looking for low deposit requirements and promotional bonuses.

9. Market4You

Overview:

Market4You is another emerging broker offering competitive trading conditions, but it is less known compared to more established brokers.

Pros:

- Competitive spreads: Offers tight spreads, making it attractive for traders focusing on forex.

- User-friendly platform: Easy-to-use trading platform, making it suitable for beginners.

Cons:

- Limited regulatory oversight: As a newer broker, it lacks the strong regulatory backing that more established brokers have.

- Limited assets: Focuses primarily on forex, with fewer options for stocks or commodities.

Best for: Beginner traders looking for low spreads and a straightforward platform.

Conclusion

Choosing the right broker is essential to your success in forex trading. If you’re a beginner seeking educational resources and low entry barriers, brokers like FBS and JustMarkets could be a good fit. For traders seeking low spreads and strong regulation, IC Markets, Admiral Markets, and FP Markets stand out. If you’re interested in high leverage, Exness and IUX Markets offer flexible conditions but require careful risk management. Always ensure that the broker you choose aligns with your trading goals, risk tolerance, and preferred trading style.