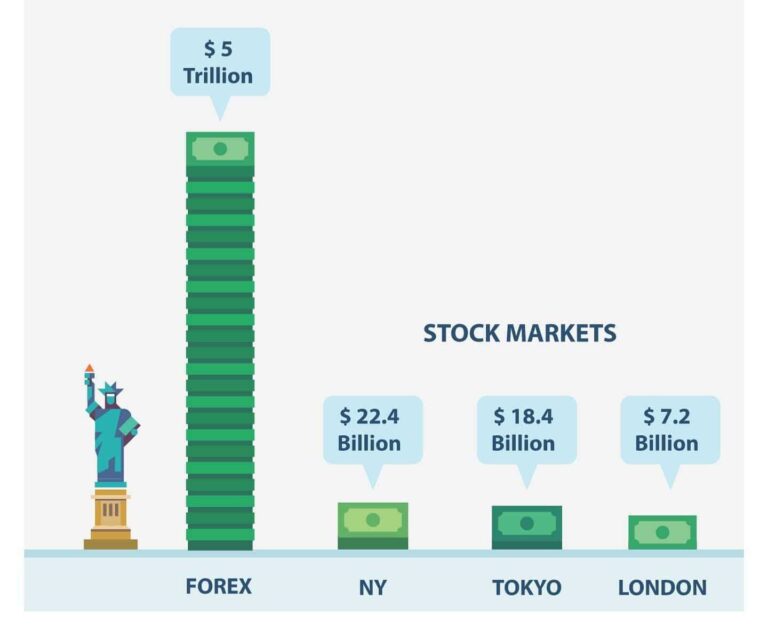

The Foreign Exchange market, commonly known as Forex or FX, is the world’s largest financial market, with trillions of dollars traded daily. It plays a critical role in global finance, allowing currencies to be traded freely across borders, facilitating international trade and investment. But the modern Forex market, with its sophisticated electronic platforms and round-the-clock trading, has evolved over centuries. To fully appreciate how the Forex market functions today, it’s essential to understand its history and development.

Ancient Beginnings: The Origins of Currency Exchange

Currency exchange dates back to ancient times when humans began to transition from a barter-based economy to one using standardized forms of currency. Before the invention of money, trade was conducted via barter, which was inefficient and highly dependent on mutual needs. If one person had grain and another had cattle, they could trade only if they both desired what the other had to offer.

This problem gave rise to commodity money. Precious metals like gold and silver, along with items like grain or livestock, were used as early forms of currency. The weight and purity of metals were standardized by ancient empires, making trading more efficient. In ancient Mesopotamia, Egypt, and Greece, gold and silver coins became the standard of exchange, and this marked the early beginnings of a currency system.

The first recorded instance of currency exchange occurred in ancient Egypt, where travelers would exchange their currencies to conduct trade. The Roman Empire further developed the use of coins and created one of the first sophisticated financial systems, including money-changing practices.

The Middle Ages: The Rise of Banking and the Gold Standard

The next major evolution in currency exchange came during the Middle Ages, particularly in the 12th and 13th centuries. During this time, Italian merchants in cities such as Venice and Florence began to trade currencies to support international trade. Money changers would facilitate these trades, a practice that laid the groundwork for modern banking.

As trade grew across Europe, different currencies, mostly based on metals like gold and silver, were in use. Banks started emerging to manage currency exchanges, loans, and deposits. One key development was the issuance of “bills of exchange,” which allowed merchants to pay for goods across borders without physically transporting precious metals. These bills of exchange became a forerunner of modern foreign exchange markets.

During this period, the gold standard became popular. Countries would link their currencies to a specific amount of gold. This system was formalized over the next centuries, eventually becoming central to international finance. Under the gold standard, the value of a country’s currency was directly tied to a specific quantity of gold, and exchange rates were fixed.

The Evolution of the Modern Forex Market: Bretton Woods and Aftermath

The real development of the modern Forex market, however, began after World War II with the creation of the Bretton Woods Agreement in 1944. This agreement aimed to bring stability to the global economy after the war. Under this system, the U.S. dollar was pegged to gold at a fixed rate of $35 per ounce, and other major currencies were pegged to the U.S. dollar. This created a system of fixed exchange rates, which provided stability but limited flexibility.

The Bretton Woods system worked relatively well for a few decades, but as economies grew and became more interconnected, the limitations of fixed exchange rates became apparent. In the 1960s and early 1970s, the U.S. economy struggled with inflation and trade deficits, which put pressure on the dollar and, by extension, the entire Bretton Woods system.

In 1971, President Richard Nixon suspended the convertibility of the U.S. dollar into gold, effectively ending the Bretton Woods system. The result was the creation of a floating exchange rate system, where the value of currencies would be determined by supply and demand in the global market. This move marked the birth of the modern Forex market.

The 1970s to 1990s: The Development of Electronic Trading

After the collapse of Bretton Woods, the Forex market entered a period of rapid growth. The 1970s and 1980s saw the establishment of a global network of banks and financial institutions trading currencies on a large scale. Initially, this trading was conducted over the phone or through brokers, but the introduction of computers and telecommunications technology in the 1980s and 1990s revolutionized the market.

With the advent of the internet, the Forex market moved online. Banks, institutional traders, and even individuals could now access Forex trading platforms, allowing for 24-hour trading across different time zones. This period also saw the deregulation of financial markets, which allowed for more open trading and the creation of derivative instruments like futures and options based on currencies.

Electronic trading platforms like Reuters Dealing and EBS (Electronic Broking Services) became the standard for trading in the 1990s, making it easier for traders to execute trades quickly and efficiently. Forex brokers began offering services to individual traders, allowing them to participate in the market from their own homes, which was a massive shift from the traditional model.

The 21st Century: The Age of Algorithmic Trading and Retail Forex

In the 21st century, the Forex market has continued to evolve at an astonishing pace. One of the biggest developments has been the rise of algorithmic and high-frequency trading. Computers can now execute thousands of trades per second based on complex algorithms designed to profit from small price fluctuations. This form of trading has transformed the market, making it more liquid and efficient, but also more volatile at times.

Another major change has been the growth of the retail Forex market. In the past, Forex trading was limited to banks, hedge funds, and large financial institutions. However, with the advent of online platforms and brokers, retail investors can now participate in the market. This has democratized Forex trading, but it has also introduced new risks, as individual traders often lack the resources and information available to institutional traders.

Additionally, regulatory bodies have been established across different regions to ensure transparency and fair practices in the Forex market. For instance, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate Forex trading. In Europe, the European Securities and Markets Authority (ESMA) imposes strict rules on leverage and other aspects of trading.

Conclusion: The Ever-Evolving Market

The history of the Forex market is a reflection of the global economy itself—constantly evolving, growing in complexity, and driven by innovation. From ancient money changers in Egypt and Italy to modern electronic platforms used by millions worldwide, the Forex market has come a long way. As the world becomes more interconnected and technology advances, the Forex market is likely to continue growing, offering both opportunities and challenges for traders and investors alike.

While the core principles of currency exchange remain the same, the methods, participants, and scale of trading have changed dramatically over time. Understanding this history gives us insight into the future of the Forex market, where innovation and globalization will continue to drive its growth and transformation.