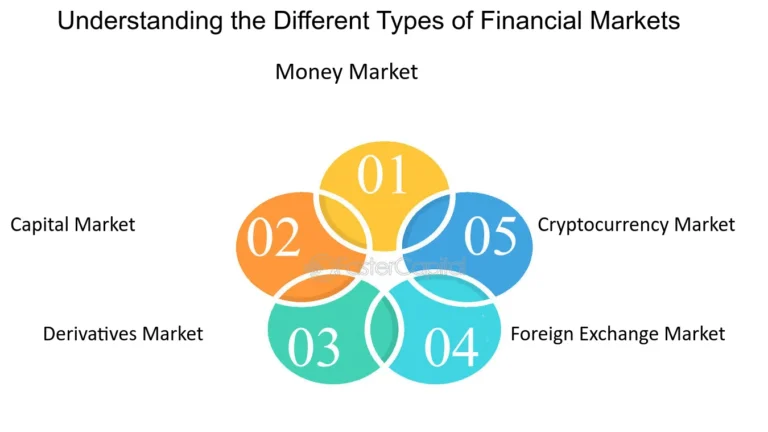

Navigating the world of forex trading can be complex, especially for newcomers. Forex, or foreign exchange, is the largest financial market in the world, where currencies are bought and sold. To succeed in this market, it is essential to familiarize yourself with the terminology that traders use daily. In this article, we’ll explore the top forex terms every trader should know, providing you with a solid foundation to start your trading journey.

Table of Contents:

- Currency Pair

- Base Currency

- Quote Currency

- Pip

- Leverage

- Margin

- Bid Price

- Ask Price

- Spread

- Lot Size

- Long Position

- Short Position

- Stop-Loss Order

- Take-Profit Order

- Margin Call

- Slippage

- Liquidity

- Volatility

- Broker

- Swap

- Hedging

- Technical Analysis

- Fundamental Analysis

1. Currency Pair

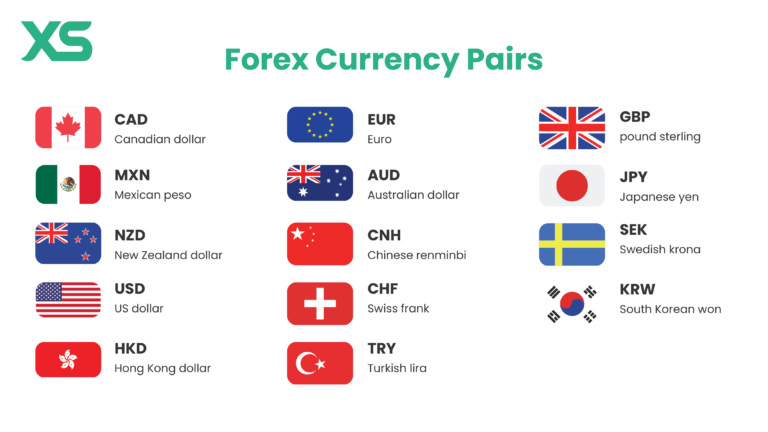

A currency pair is the quotation of two currencies traded against each other in the forex market. When trading forex, you are simultaneously buying one currency and selling another. Each currency pair consists of a base currency (the first currency) and a quote currency (the second currency). Some popular currency pairs include:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

The price of a currency pair reflects how much of the quote currency is required to buy one unit of the base currency.

2. Base Currency

The base currency is the first currency listed in a currency pair. It represents the currency you are buying when you place a trade. In the EUR/USD currency pair, EUR (euro) is the base currency. If the EUR/USD rate is 1.2000, it means that 1 euro is equal to 1.20 U.S. dollars.

When you buy a currency pair, you are purchasing the base currency while selling the quote currency.

3. Quote Currency

The quote currency is the second currency in the currency pair. It is the currency you are selling when you buy the base currency. In the EUR/USD currency pair, USD (U.S. dollar) is the quote currency. The exchange rate shows how much of the quote currency is needed to buy one unit of the base currency.

4. Pip

A pip (percentage in point) is the smallest price movement in the forex market and represents a standardized unit. For most currency pairs, a pip is equal to 0.0001. In currency pairs involving the Japanese yen, a pip is equal to 0.01.

Example:

If the EUR/USD exchange rate moves from 1.2000 to 1.2001, that is a movement of 1 pip.

Pips are essential in measuring price changes and calculating profit or loss in trades.

5. Leverage

Leverage allows traders to control larger positions in the forex market with a relatively small amount of capital. It essentially enables you to “borrow” money from your broker to increase your position size. Leverage is typically expressed as a ratio, such as 50:1, 100:1, or 200:1.

Example:

If you have $1,000 in your account and your broker offers 100:1 leverage, you can control a position of $100,000.

Leverage amplifies both potential profits and losses, so it should be used carefully.

6. Margin

Margin is the amount of money required to open and maintain a leveraged position. In forex trading, margin is a portion of your account balance set aside by your broker to cover potential losses. It is not a fee but a form of collateral.

Example:

If your broker requires a 1% margin to open a $100,000 trade, you will need $1,000 in your account as the margin.

7. Bid Price

The bid price is the price at which a broker or the market is willing to buy a currency pair. This is the price at which traders can sell the base currency.

Example:

If the EUR/USD pair is quoted as 1.2000/1.2005, the bid price is 1.2000, meaning you can sell euros at 1.2000 U.S. dollars.

8. Ask Price

The ask price is the price at which a broker or the market is willing to sell a currency pair. This is the price at which traders can buy the base currency.

Example:

In the quote 1.2000/1.2005 for EUR/USD, the ask price is 1.2005, meaning you can buy euros at 1.2005 U.S. dollars.

9. Spread

The spread is the difference between the bid price and the ask price of a currency pair. It represents the broker’s fee or the cost of making a trade.

Example:

If the EUR/USD pair is quoted as 1.2000/1.2005, the spread is 5 pips (1.2005 – 1.2000 = 0.0005 or 5 pips).

Tighter spreads are generally better for traders as they lower the cost of trading.

10. Lot Size

Lot size refers to the volume of a trade in forex. In forex trading, currency is traded in standardized units called lots:

- Standard lot: 100,000 units of the base currency

- Mini lot: 10,000 units

- Micro lot: 1,000 units

The size of the lot directly affects the value of each pip.

11. Long Position

A long position refers to buying a currency pair in the forex market with the expectation that its value will rise. In other words, you are betting that the base currency will appreciate against the quote currency.

Example:

If you go long on EUR/USD, you are buying euros and selling U.S. dollars, hoping the euro will strengthen against the dollar.

12. Short Position

A short position involves selling a currency pair in the forex market with the expectation that its value will fall. When you go short, you are selling the base currency while buying the quote currency.

Example:

If you go short on GBP/USD, you are selling British pounds and buying U.S. dollars, expecting the pound to weaken against the dollar.

13. Stop-Loss Order

A stop-loss order is a risk management tool used to limit potential losses on a trade. It automatically closes a trade when the market reaches a specific price level, preventing further losses if the market moves against your position.

Example:

If you go long on EUR/USD at 1.2000 and place a stop-loss at 1.1950, your trade will automatically close if the price falls to 1.1950.

14. Take-Profit Order

A take-profit order is a type of order used to lock in profits on a trade. It automatically closes the position when the price reaches a specified level, securing the profit without needing to monitor the market continuously.

Example:

If you go long on USD/JPY at 110.00 and place a take-profit at 111.00, your position will close automatically when the price reaches 111.00.

15. Margin Call

A margin call occurs when your account equity falls below the required margin to keep your positions open. When this happens, your broker will request that you deposit more funds or close some positions. Failing to meet a margin call can result in the broker automatically closing your trades to prevent further losses.

16. Slippage

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. This typically occurs during periods of high market volatility or when there is a lack of liquidity.

Example:

If you place a buy order for EUR/USD at 1.2000, but the order is executed at 1.2002, you have experienced 2 pips of slippage.

17. Liquidity

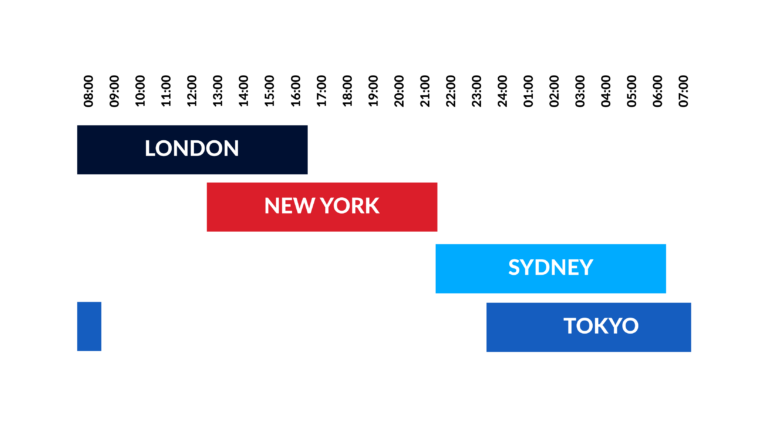

Liquidity in forex refers to the ease with which a currency pair can be bought or sold without causing significant price movements. A highly liquid market means there are many buyers and sellers, and trades can be executed quickly at stable prices.

Major currency pairs like EUR/USD and GBP/USD are considered highly liquid due to their high trading volumes.

18. Volatility

Volatility refers to the degree of price fluctuations in the forex market. A volatile market experiences rapid and significant changes in price, while a less volatile market is more stable.

High volatility presents more trading opportunities but also increases risk.

19. Broker

A forex broker is a financial services company that provides traders with access to the forex market. Brokers act as intermediaries, executing trades on behalf of traders. They may offer various services, including trading platforms, leverage, and analytical tools.

20. Swap

A swap is the interest fee that traders pay or earn for holding a position overnight. The swap rate depends on the interest rate differential between the two currencies in the pair.

If you hold a trade overnight, you may either receive or pay a small interest rate, depending on the currency pair and direction of your trade.

21. Hedging

Hedging is a risk management strategy that involves opening multiple positions to offset potential losses. Traders may hedge by taking opposing positions in the same or correlated currency pairs to reduce exposure to market movements.

22. Technical Analysis

Technical analysis involves studying historical price charts and using various indicators to predict future market movements. Traders use tools such as moving averages, trend lines, and oscillators to identify patterns and trends.

23. Fundamental Analysis

Fundamental analysis focuses on analyzing economic data, news, and geopolitical events to forecast currency price movements. Factors such as interest rates, inflation, and political stability are considered to evaluate the strength of a currency.

Conclusion

Understanding key forex terms is crucial for anyone looking to succeed in the forex market. By familiarizing yourself with terms like pips, leverage, margin, and more, you’ll be able to navigate the trading environment with greater confidence. Each of these terms plays a vital role in shaping your trading decisions, helping you better manage risk and seize opportunities in the dynamic world of forex trading.