Forex trading, or foreign exchange trading, is the act of buying and selling currencies in a decentralized market. It offers unique opportunities for profit, but it also comes with significant risks, especially for those starting with a small amount of capital. In this article, we will explore the fundamentals of Forex trading, strategies for maximizing small investments, risk management techniques, and the importance of discipline and education.

Understanding Forex Trading

What is Forex Trading?

The Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, which are centralized, the Forex market operates 24/5 (Monday to Friday) and allows traders to buy or sell currencies against one another. For instance, you might trade the euro against the US dollar (EUR/USD) or the British pound against the Japanese yen (GBP/JPY).

Currency Pairs

In Forex, currencies are traded in pairs. The first currency is the base currency, and the second is the quote currency. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. If the price of EUR/USD rises from 1.10 to 1.11, it means the euro has strengthened against the dollar.

Leverage in Forex Trading

Leverage is one of the key features of Forex trading. It allows traders to control larger positions with a smaller amount of capital. For example, if your broker offers a leverage of 100:1, you can control $1,000 worth of currency with just $10. While leverage can amplify profits, it can also amplify losses, making it crucial to understand how it works.

Starting with $10

Finding the Right Broker

The first step to turning $10 into $10,000 is to find a broker that allows you to trade with a small deposit. Many brokers offer micro accounts, where you can trade with tiny lot sizes. Look for brokers that offer:

- Low minimum deposit requirements

- High leverage options

- Demo accounts for practice

- Competitive spreads

Understanding the Risks

With a starting capital of just $10, the journey to $10,000 is incredibly risky. The majority of retail Forex traders lose money, so it’s vital to approach this venture with caution. Ensure that you are prepared for the potential to lose your initial investment.

Developing a Trading Strategy

Technical Analysis

Technical analysis involves studying price charts and indicators to make trading decisions. Here are some key concepts to focus on:

- Candlestick Patterns: Learn to read candlestick patterns to identify potential reversals or continuations in the market.

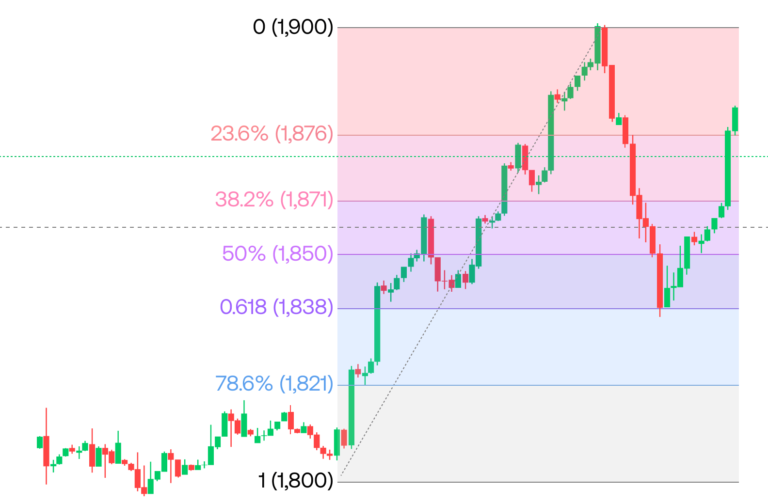

- Support and Resistance: Identify key levels where the price tends to bounce or break. These levels can help you decide entry and exit points.

- Indicators: Use indicators like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to assist in your decision-making.

Fundamental Analysis

Fundamental analysis looks at economic indicators and news events that can impact currency values. Key indicators to watch include:

- Interest Rates: Central banks’ interest rate decisions can significantly influence currency values.

- Economic Reports: Reports like GDP, employment data, and inflation can provide insights into a country’s economic health.

- Geopolitical Events: Events such as elections, trade agreements, or conflicts can lead to volatility in the Forex market.

Scalping vs. Swing Trading

With only $10, you might consider short-term strategies like scalping, where you make multiple trades throughout the day to capture small price movements. Alternatively, swing trading involves holding positions for several days or weeks to capitalize on larger price moves. Assess your risk tolerance and time commitment to determine which strategy fits you best.

Risk Management Techniques

Setting Stop-Loss and Take-Profit Levels

When trading with high leverage and a small account, setting stop-loss and take-profit orders is crucial. A stop-loss order automatically closes your position at a predetermined loss, while a take-profit order does the same at a predetermined profit. This helps manage risk and ensures that emotions don’t dictate your trading decisions.

Position Sizing

Proper position sizing is essential to protect your capital. A common rule is to risk only 1-2% of your total capital on any single trade. With a $10 account, this means risking just $0.10 to $0.20 per trade. This conservative approach allows you to withstand multiple losses without wiping out your account.

Avoiding Overleveraging

While leverage can amplify profits, overleveraging can lead to significant losses. It’s crucial to strike a balance. Consider using lower leverage initially, especially when trading with a small account.

The Psychological Aspect of Trading

Maintaining Discipline

Discipline is perhaps the most important trait a trader can possess. The allure of quickly turning $10 into $10,000 can lead to impulsive decisions. Stick to your trading plan, and avoid the temptation to deviate from it, even after a string of wins or losses.

Managing Emotions

Trading can be emotionally taxing. Fear and greed can cloud judgment, leading to poor decision-making. Developing a trading routine and sticking to it can help manage these emotions. Consider keeping a trading journal to reflect on your decisions and emotional state during trades.

The Importance of Education

Continuous Learning

The Forex market is dynamic, and what works today may not work tomorrow. Stay updated on market trends, economic events, and new trading strategies. Online courses, webinars, and trading communities can provide valuable insights and knowledge.

Using a Demo Account

Before risking real money, practice your trading strategies on a demo account. This allows you to gain experience and test your strategies without financial risk. Many brokers offer demo accounts with virtual currency, making it an excellent way to build confidence.

Realistic Expectations

The Probability of Success

Turning $10 into $10,000 is an extremely ambitious goal, and the probability of achieving it is low. Many traders face challenges, including emotional discipline, market volatility, and unforeseen economic events. Set realistic expectations and be prepared for the possibility of losing your initial investment.

The Path to Success

Instead of focusing solely on turning $10 into $10,000, consider a more gradual approach. Aim to grow your account steadily over time. Compounding profits can lead to significant growth, even if you don’t reach your initial goal immediately.

Conclusion

While turning $10 into $10,000 through Forex trading is a tantalizing prospect, it is fraught with risks and challenges. Success in Forex trading requires a combination of education, discipline, and effective risk management. Start with a solid understanding of the market, develop a trading strategy, and approach your trading with realistic expectations.

Remember, Forex trading is not a get-rich-quick scheme. It takes time, effort, and patience to become a successful trader. With the right mindset and preparation, you can navigate the complexities of the Forex market and work towards your financial goals.