Forex trading is one of the most liquid and dynamic markets in the world, attracting millions of traders worldwide. For those new to this field, grasping key concepts such as leverage, margin, and pip is essential. These three terms significantly affect your risk, rewards, and overall trading strategy. This article will guide you through understanding leverage, margin, and pip, and explain how they function together in the forex market.

Table of Contents:

- What is Leverage in Forex Trading?

- How Leverage Works in Forex

- Risks and Benefits of Using Leverage

- What is Margin in Forex Trading?

- How to Calculate Margin

- Understanding Free Margin and Margin Call

- What is a Pip in Forex Trading?

- Calculating Pip Value Across Different Currency Pairs

- How Leverage, Margin, and Pip Work Together

- Conclusion

1. What is Leverage in Forex Trading?

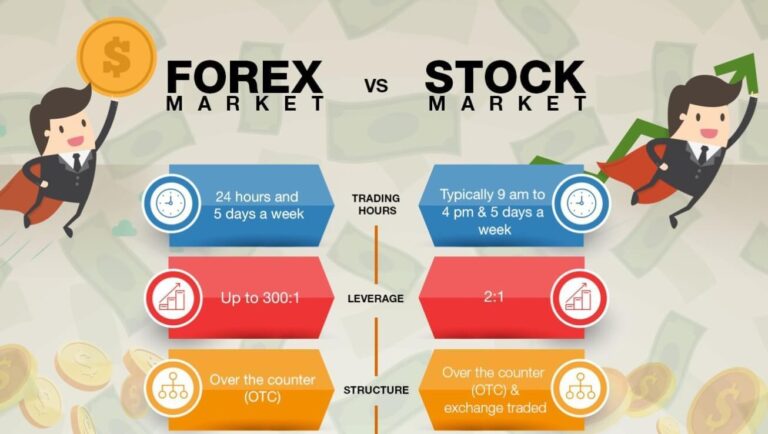

Leverage in forex trading allows you to control a large position in the market with a relatively small amount of capital. Essentially, it enables you to “borrow” funds from your broker to increase the size of your trade beyond what your actual account balance would allow.

Leverage is expressed as a ratio. For example, 50:1 leverage means that for every $1 in your trading account, you can control a $50 position. Other common leverage ratios include 100:1, 200:1, and even up to 500:1 depending on the broker and region you are trading from.

Example:

Let’s say you have $1,000 in your trading account and your broker offers you leverage of 100:1. This means you can open a position worth $100,000. In other words, you are controlling $100,000 in the forex market with just $1,000 of your own money. The broker is essentially lending you the rest of the money needed for the trade.

While leverage can magnify your potential profits, it also amplifies your losses. This is why understanding how leverage works and managing your risk is crucial for long-term success in forex trading.

2. How Leverage Works in Forex

To fully understand leverage, let’s break down a real-world example.

Example:

Suppose you have $2,000 in your trading account, and your broker offers leverage of 50:1. You decide to trade the EUR/USD currency pair. Without leverage, your maximum position size would be $2,000, meaning you can only buy or sell a small amount of euros against the U.S. dollar.

However, with 50:1 leverage, you can now open a position of $100,000. Here’s how it works:

- Your equity: $2,000

- Leverage: 50:1

- Position size: $2,000 x 50 = $100,000

In this scenario, if the EUR/USD exchange rate moves 1%, you could either gain or lose $1,000—half of your entire account—based on the direction of the movement. This demonstrates both the power and the risk of using leverage in forex trading.

3. Risks and Benefits of Using Leverage

Benefits:

- Increased Potential Profits: Leverage allows traders to control larger positions, potentially increasing profits from relatively small market movements. For example, with 100:1 leverage, even a small movement in the currency pair can result in significant gains.

- Access to Bigger Opportunities: Leverage makes it possible for traders with smaller amounts of capital to access the forex market and take advantage of opportunities that would otherwise be out of reach.

Risks:

- Increased Losses: Just as leverage can magnify profits, it also amplifies losses. A highly leveraged trade that goes against you can wipe out your account balance very quickly.

- Margin Calls: When the market moves against a leveraged position, the trader may receive a margin call from the broker, asking them to deposit more funds or close the position. Failing to act on a margin call can result in the broker automatically closing the trade, potentially locking in significant losses.

It’s important to use leverage responsibly. Many traders apply risk management techniques such as stop-loss orders to minimize their downside risk when using leverage.

4. What is Margin in Forex Trading?

Margin refers to the amount of money you need to deposit with your broker in order to open a leveraged position. In forex trading, margin is essentially the “good faith” deposit required to maintain a position in the market. While it is not a cost of the trade, it is an amount of money set aside by your broker to ensure that you can cover potential losses.

Margin is usually expressed as a percentage of the full position size. Common margin requirements are 1%, 2%, 5%, or 10% depending on the broker and the leverage ratio.

Example:

If your broker requires a 1% margin and you want to open a position worth $100,000, you will need to deposit $1,000 (1% of $100,000) as margin.

5. How to Calculate Margin

The amount of margin required to open a trade can be calculated using the following formula:

Margin Required = (Position Size x Margin Requirement) / 100

Example:

Let’s assume you want to open a $50,000 position on the GBP/USD pair, and your broker has a margin requirement of 2%. The margin you need would be calculated as follows:

Margin Required = ($50,000 x 2) / 100 = $1,000

This means you would need $1,000 in your trading account to open this $50,000 position.

6. Understanding Free Margin and Margin Call

There are two key concepts traders need to be aware of when dealing with margin: free margin and margin call.

- Free Margin: This is the amount of money in your trading account that is available to open new positions or cover potential losses. Free margin is the difference between your equity (the total value of your account) and the used margin (the margin that is currently tied up in your open trades).Free Margin = Equity – Used Margin

- Margin Call: A margin call occurs when your account equity falls below the required margin level to maintain your open positions. If the market moves against your position and your account balance falls below a certain threshold, your broker will ask you to either deposit more money or close some of your positions to free up margin.

To avoid margin calls, it is essential to monitor your account balance and ensure that you have enough free margin to support your open trades.

7. What is a Pip in Forex Trading?

A pip (percentage in point) is the smallest unit of price movement in the forex market. It is used to measure changes in the exchange rate of a currency pair. For most currency pairs, a pip is equal to the fourth decimal place (0.0001).

For currency pairs involving the Japanese yen, such as USD/JPY, a pip is typically equal to the second decimal place (0.01).

Example:

If the EUR/USD pair moves from 1.2000 to 1.2001, it has moved by 1 pip. If the USD/JPY pair moves from 110.00 to 110.01, it has moved by 1 pip.

Pips are critical in forex trading as they allow traders to quantify the change in price and calculate profit or loss.

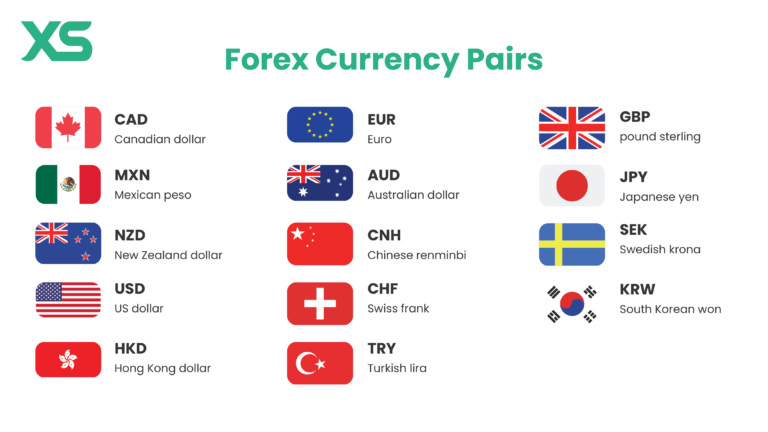

8. Calculating Pip Value Across Different Currency Pairs

The value of a pip depends on the currency pair being traded, the size of the trade, and the exchange rate of the currencies involved. For most currency pairs where the U.S. dollar is the quote currency, the pip value is calculated as follows:

Pip Value = (1 Pip / Exchange Rate) x Lot Size

Example:

Let’s assume you are trading 1 standard lot (100,000 units) of the EUR/USD pair, and the current exchange rate is 1.2000. The pip value would be calculated as follows:

Pip Value = (0.0001 / 1.2000) x 100,000 = $8.33 per pip

This means that for every 1-pip movement in the EUR/USD pair, your profit or loss would be $8.33.

For currency pairs where the U.S. dollar is not the quote currency, the pip value will need to be converted into U.S. dollars using the current exchange rate.

9. How Leverage, Margin, and Pip Work Together

Leverage, margin, and pip are interconnected in forex trading, and understanding how they work together is crucial for managing your risk and maximizing potential profits.

- Leverage: Allows you to control a large position with a small amount of capital. However, it also increases the potential for both gains and losses.

- Margin: Acts as a deposit to open and maintain a leveraged position. It ensures that you can cover potential losses.

- Pip: Measures the smallest price movement in a currency pair. It helps you calculate the profit or loss on a trade.

When you open a leveraged position, you are using a portion of your account balance as margin. As the price of the currency pair fluctuates in pips, your profit or loss will be magnified by the amount of leverage you are using. This is why it is crucial to carefully manage your leverage and margin levels, as a small price movement can have a significant impact on your trading account.

10. Conclusion

Leverage, margin, and pip are fundamental concepts that every forex trader must understand. Leverage allows traders to control large positions with small amounts of capital, while margin is the deposit required to open those positions. Pip, on the other hand, measures price movements and is used to calculate profits and losses.

By understanding how these concepts work together, traders can make more informed decisions and better manage their risk in the forex market. However, it is important to remember that while leverage can amplify profits, it can also magnify losses. As such, responsible use of leverage, careful margin management, and understanding pip movements are critical for long-term success in forex trading.