Forex Trading: Understanding the World’s Largest Financial Market

Foreign exchange, or Forex (FX) trading, is one of the most popular financial markets in the world. It involves the buying and selling of currencies to profit from changes in their exchange rates. With a daily trading volume of over $6 trillion, the Forex market is the largest and most liquid financial market globally. In this article, we’ll explore what Forex trading is, how it works, its benefits and risks, and how beginners can start trading in the Forex market.

What is Forex Trading?

At its core, Forex trading involves exchanging one currency for another at a determined price. Forex transactions occur in currency pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). When you trade Forex, you are simultaneously buying one currency and selling another.

For example, in the EUR/USD pair, if you believe the Euro will strengthen against the US Dollar, you would buy the EUR/USD pair. If you think the Euro will weaken against the US Dollar, you would sell the EUR/USD pair. The goal of Forex trading is to profit from changes in the exchange rate between the two currencies in a currency pair.

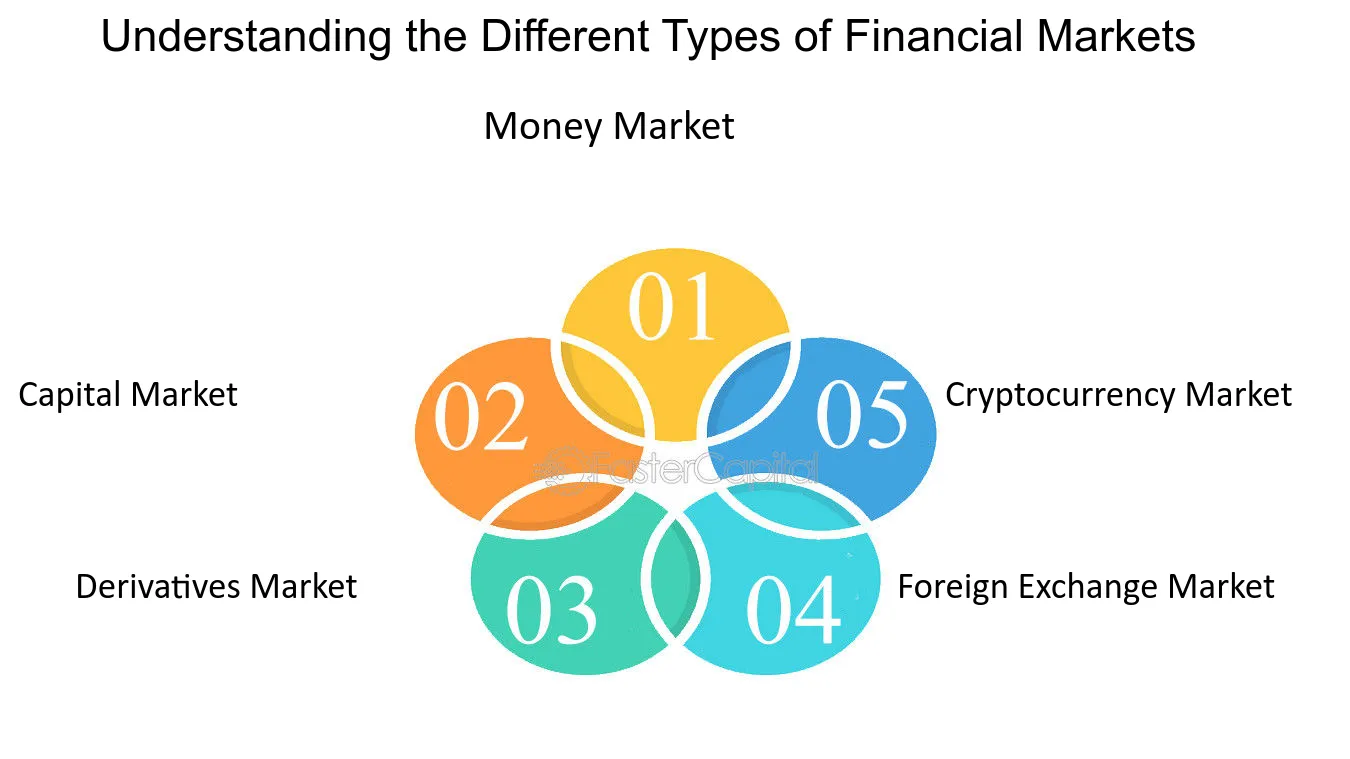

The Structure of the Forex Market

The Forex market operates differently from other financial markets, like the stock market. It is decentralized, meaning it doesn’t have a physical exchange or central marketplace. Instead, Forex trading is conducted electronically over-the-counter (OTC), meaning trades are executed directly between participants through computer networks.

The Forex market operates 24 hours a day, five days a week, across major financial centers in London, New York, Tokyo, and Sydney. This global structure allows Forex traders to participate in the market at any time, making it an attractive option for those seeking flexibility.

There are three primary types of Forex markets:

- Spot Market: This is the immediate exchange of currencies at the current market price. It is the most popular Forex market and forms the basis for the futures and forward markets.

- Futures Market: Traders buy and sell currency contracts at a future date with set conditions. This market is often used for hedging purposes.

- Forward Market: Similar to futures, forward contracts are private agreements between two parties to exchange currencies at a future date and at a specific price.

How Forex Trading Works

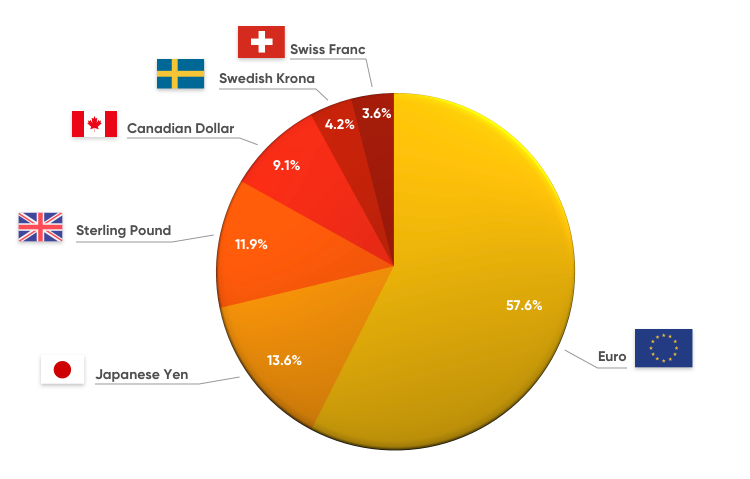

Forex trading revolves around currency pairs, which are divided into three categories:

- Major Pairs: These include the most traded currencies, such as EUR/USD, GBP/USD, and USD/JPY.

- Minor Pairs: These pairs don’t include the US Dollar but involve other major currencies like EUR/GBP or AUD/JPY.

- Exotic Pairs: Exotic pairs consist of one major currency paired with a currency from an emerging or smaller economy, such as USD/TRY (US Dollar/Turkish Lira).

Each currency pair is quoted in terms of the base currency (the first currency in the pair) and the quote currency (the second currency). The exchange rate tells you how much of the quote currency you need to buy one unit of the base currency. For example, if the EUR/USD pair is quoted at 1.1800, it means that 1 Euro can be exchanged for 1.18 US Dollars.

Forex traders speculate on the movement of these exchange rates, either buying or selling currency pairs based on their expectations of future price movements. To make trading more efficient, brokers offer leveraged trading, allowing traders to control large positions with smaller amounts of capital. Leverage amplifies both potential profits and potential losses, making risk management crucial.

The Participants in the Forex Market

Several key players participate in the Forex market:

- Banks and Financial Institutions: These are the biggest players, as they facilitate large currency transactions for clients and trade for their accounts.

- Corporations: Large companies engage in Forex trading to hedge against currency risks arising from international trade.

- Governments and Central Banks: Governments and central banks participate in the Forex market to stabilize their economies by adjusting exchange rates.

- Retail Traders: Individual traders who participate in the Forex market through online brokers are growing in numbers, thanks to advances in technology and online platforms.

Benefits of Forex Trading

There are several reasons why Forex trading has become popular among retail traders:

- High Liquidity: The Forex market’s large daily trading volume ensures that there is ample liquidity, meaning you can enter and exit positions with ease.

- 24-Hour Market: Unlike stock markets, the Forex market operates 24 hours a day during the week, offering flexibility to traders across different time zones.

- Low Transaction Costs: Forex brokers typically offer tight spreads (the difference between the bid and ask price), meaning transaction costs are lower compared to other markets.

- Leverage: Forex trading offers access to leverage, allowing traders to control larger positions with a smaller initial investment. For example, a 1:100 leverage means that with $1,000, you can control a $100,000 position.

- Diverse Trading Opportunities: The Forex market is influenced by various factors, such as economic data, geopolitical events, and interest rates, providing multiple trading opportunities across different currency pairs.

- Potential for Profit in Rising and Falling Markets: In Forex, you can profit from both rising and falling markets. You can go long (buy) when you expect the base currency to appreciate or go short (sell) when you anticipate the base currency will depreciate.

Risks of Forex Trading

While Forex trading offers potential rewards, it also comes with significant risks:

- Market Volatility: The Forex market is highly volatile, with prices fluctuating rapidly in response to economic data, geopolitical events, and market sentiment. While volatility can create profit opportunities, it can also lead to significant losses if not managed carefully.

- Leverage Risk: While leverage can magnify profits, it also amplifies losses. If the market moves against your position, you could lose more than your initial investment.

- Lack of Regulation: The decentralized nature of the Forex market means that it is less regulated than other financial markets. Traders should choose reputable brokers to ensure they are trading in a secure environment.

- Emotional Trading: Traders can make irrational decisions driven by emotions like fear or greed, leading to poor trade execution and financial losses. Developing a trading plan and sticking to it is essential for success.

How to Start Forex Trading

For beginners looking to enter the Forex market, the following steps can help guide you:

- Learn the Basics: Before trading, familiarize yourself with Forex market terminology, currency pairs, and basic trading strategies. Many online resources and courses can help build your foundational knowledge.

- Choose a Reliable Broker: Selecting a trustworthy broker is crucial. Look for brokers that are regulated by financial authorities and offer transparent pricing, a user-friendly platform, and excellent customer service.

- Use a Demo Account: Most brokers offer demo accounts that allow you to practice trading with virtual money. This lets you become comfortable with the trading platform, test strategies, and gain experience without risking real capital.

- Develop a Trading Plan: A solid trading plan outlines your goals, risk tolerance, trading strategy, and money management rules. It helps keep emotions in check and provides a structured approach to trading.

- Start Small: When you begin trading live, start with a small account and use minimal leverage. This helps limit your losses while you refine your trading skills.

- Continuous Learning: The Forex market is dynamic, and ongoing education is crucial for success. Keep up with market news, economic indicators, and emerging trading strategies to stay informed.

Conclusion

Forex trading offers significant profit potential due to its liquidity, flexibility, and global nature. However, it is not without risks, and success requires a solid understanding of the market, effective risk management, and emotional discipline. For beginners, the key to becoming a successful Forex trader lies in gaining the necessary knowledge, choosing the right broker, and practicing with a demo account before transitioning to live trading.

Whether you are a seasoned investor or a beginner, the Forex market provides opportunities for everyone willing to put in the time to learn and master its intricacies. With the right mindset, strategy, and discipline, Forex trading can be a profitable venture in the long run.